AMD 'Exceptionally Positioned' Ahead Of Q3: Chipmaker Is Just Getting Started In AI Supercycle That Could Run Through 2030, Says BofA's Vivek Arya

Several prominent analysts are weighing in on Advanced Micro Devices Inc. (NASDAQ:AMD) ahead of the company’s third-quarter results on Tuesday.

‘Exceptionally Positioned’ For The AI Supercycle

According to Bank of America analyst Vivek Arya, AMD is among the top beneficiaries of the multiyear AI infrastructure buildout, pointing to a decade-long cycle fueled by hyperscaler capex and productivity gains across the real economy.

Arya said the AI-driven semiconductor expansion is still in its early innings, potentially lasting "another year to two years and perhaps even till 2030." He emphasized that most infrastructure cycles, such as 3G and 4G, tend to span a decade or more during his recent appearance on CNBC’s ‘Closing Bell Overtime’ last week.

See Also: Uber, AMD And 3 Stocks To Watch Heading Into Tuesday

He also referred to the company as being “exceptionally positioned,” alongside peers such as NVIDIA Corp. (NASDAQ:NVDA) to ride this multi-year tailwind.

Could Hit $300 ‘Relatively Quickly’

Analyst and investor Keith Fitz-Gerald, of the Fitz-Gerald Group, has a bullish outlook on AMD’s shares ahead of its third-quarter print.

He said, “I’m expecting this one to go to 300 relatively quickly,” while appearing on Fox Business’ “Varney & Co,” on Monday, which represents an upside of nearly 16% from the stock’s Monday close at $259.65.

According to Fitz-Gerald, AMD’s prospects don’t rely on the chips, but rather on its full-stack data center strategy, which he believes will be key in the company’s efforts to catch up with NVIDIA. “It’s all going to be in the note steward in the guidance,” he said, signaling that investors should look closely at its roadmap and competitive positioning.

AMD’s Chips Are ‘Catching Fire’

Analysts remain focused on the company’s data center performance, amid its push to secure the No. 2 position in the AI GPU market. Besides this, Ed Carson, a news editor at Investor’s Business Daily, sees a potential lift from a PC refresh cycle, especially after Microsoft officially ended support for Windows 10 last month.

On IBD’s YouTube channel last week, Carson said that AMD’s “chips are really catching fire,” noting that hyperscaler spending from companies like Meta Platforms Inc. (NASDAQ:META), Alphabet Inc. (NASDAQ:GOOG), and Microsoft Corp. (NASDAQ:MSFT) remains “gargantuan.”

According to Carson, AMD shares are now trading nearly 40% above the 50-day moving average. “This is one you want to talk about, a stock that’s extended,” he said, while noting that “it's basically quadrupled since April.”

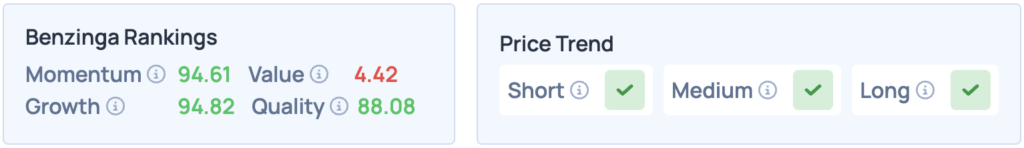

AMD shares were up 1.38% on Monday, closing at $259.65, and are currently down 2.08% overnight, ahead of its third-quarter results. The stock scores high on Momentum, Growth and Quality in Benzinga’s Edge Stock Rankings, with a favorable price trend in the short, medium and long terms. Click here for deeper insights on the stock.

Read More:

Photo courtesy: Shutterstock

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal