What Morningstar (MORN)'s $1 Billion Buyback and Asia Expansion Mean for Shareholders

- Morningstar, Inc. recently announced a new US$1 billion share repurchase program, reported third quarter 2025 earnings with continued revenue growth, and detailed its expansion of the Morningstar DBRS credit ratings business into the Asia Pacific region with an Australia-based hub and new executive appointments.

- These moves showcase Morningstar’s focus on shareholder returns, operational expansion, and deepening presence in global financial services markets.

- We'll explore how Morningstar's fresh share repurchase plan reflects its confidence in future growth and supports its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Morningstar's Investment Narrative?

For those considering Morningstar as part of their portfolio, the core belief is in its ability to keep scaling recurring revenue streams, benefit from brand loyalty, and maintain a disciplined approach to capital allocation, all within an evolving global financial services sector. The recent authorization of a new US$1 billion share repurchase plan and a sizable US$1.5 billion credit facility signal confidence in both balance sheet strength and future cash flow. Expansion into Asia Pacific, particularly establishing Morningstar DBRS in Australia, fits the narrative of operational growth and global diversification, potentially widening addressable markets. However, with recent softening in share price and net income coming in below last year’s third quarter, near-term optimism may be tempered by margin pressure and higher financing costs tied to new debt. While these recent moves reinforce Morningstar’s long-term goals, they do little to change the biggest catalyst and risk: the balancing act between revenue growth, profitability, and how new investments translate into shareholder returns.

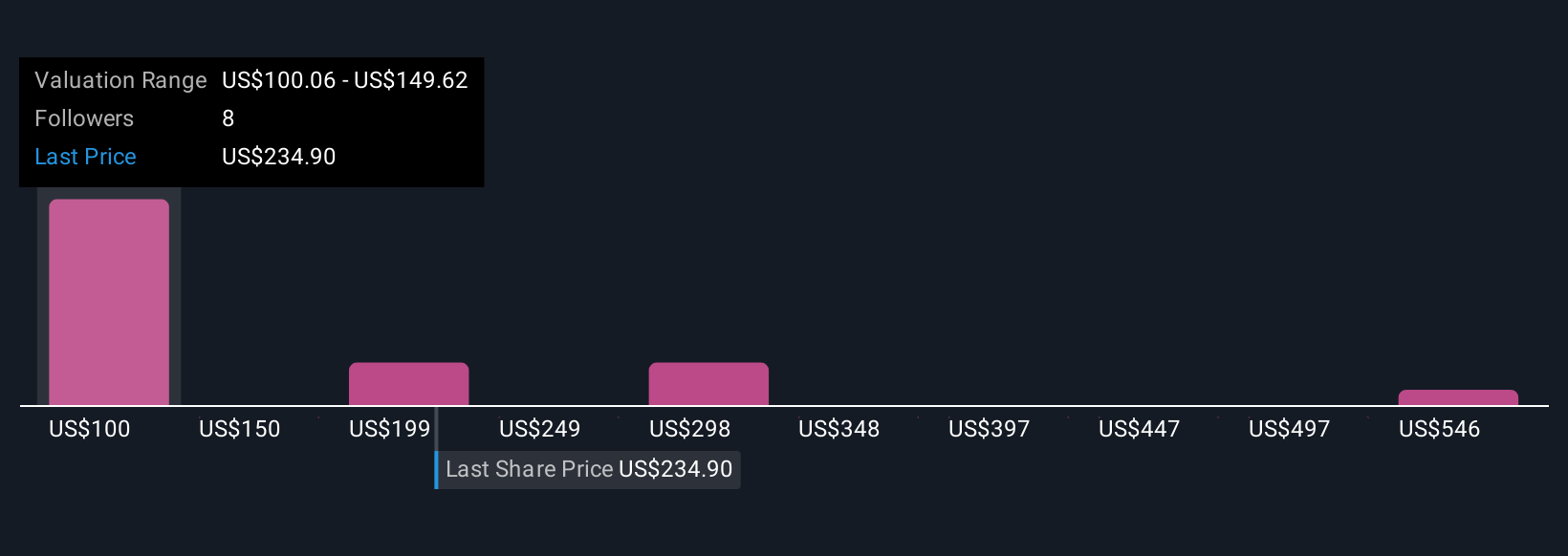

On the flip side, the cost of new debt and execution risk in APAC shouldn’t be overlooked. Morningstar's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 8 other fair value estimates on Morningstar - why the stock might be worth over 2x more than the current price!

Build Your Own Morningstar Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Morningstar research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Morningstar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Morningstar's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal