Fair Isaac (FICO) Valuation in Focus Following New Mortgage Simulator Launch with Industry Partners

Fair Isaac (FICO) has rolled out its Score Mortgage Simulator across prominent platforms Credit Interlink and SharperLending Solutions, making this mortgage analysis tool more accessible to industry professionals and lenders. This move underscores FICO's push to expand the simulator's visibility in mortgage lending.

See our latest analysis for Fair Isaac.

FICO’s rollout of its Score Mortgage Simulator with major partners lands as the stock comes off a challenging stretch. While a recent 4.68% pop hints at shifting sentiment, the share price is still down over 16% year-to-date, and the total shareholder return remains negative over the past year, despite impressive long-term gains of nearly 280% over three years. Recent product partnerships and conference appearances could help revive momentum if they translate to more industry adoption, but for now, investors are waiting to see if optimism sticks.

If you’re curious what other innovators are making waves right now, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With strong revenue growth and new business momentum, but a share price that has yet to rebound from its decline, investors are left to consider whether FICO is an undervalued growth play or if the market already anticipates future gains.

Most Popular Narrative: 17.7% Undervalued

The most followed narrative currently values Fair Isaac at $2,017, which is notably higher than the stock’s last close at $1,659. This viewpoint sets a higher expectation for the stock as investors weigh strong growth drivers against current price levels.

The ongoing transition to SaaS and cloud-based delivery, evidenced by double-digit growth in FICO Platform ARR and emphasis on conversion to next-generation AI-driven decisioning solutions, is increasing recurring revenues, supporting margin expansion and greater earnings predictability. Sustained investment in explainable AI and machine learning, as showcased by new FICO-focused foundation models and decisioning innovations, is enhancing competitive differentiation and supporting premium product offerings, increasing average selling prices and net margins.

Curious what makes this narrative tick? Analysts are betting on future profit expansion and bold recurring revenue growth to deliver the goods. There is a big swing in the outlook and a focus on premium margins. Want to see how their forecast shapes the story? Dive in for the key numbers and surprising assumptions that drive this fair value call.

Result: Fair Value of $2,017 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory changes or increased competition from alternative scoring models could challenge FICO's market dominance and future profitability. These factors may influence how the current story unfolds.

Find out about the key risks to this Fair Isaac narrative.

Another View: High Price, Higher Hurdles?

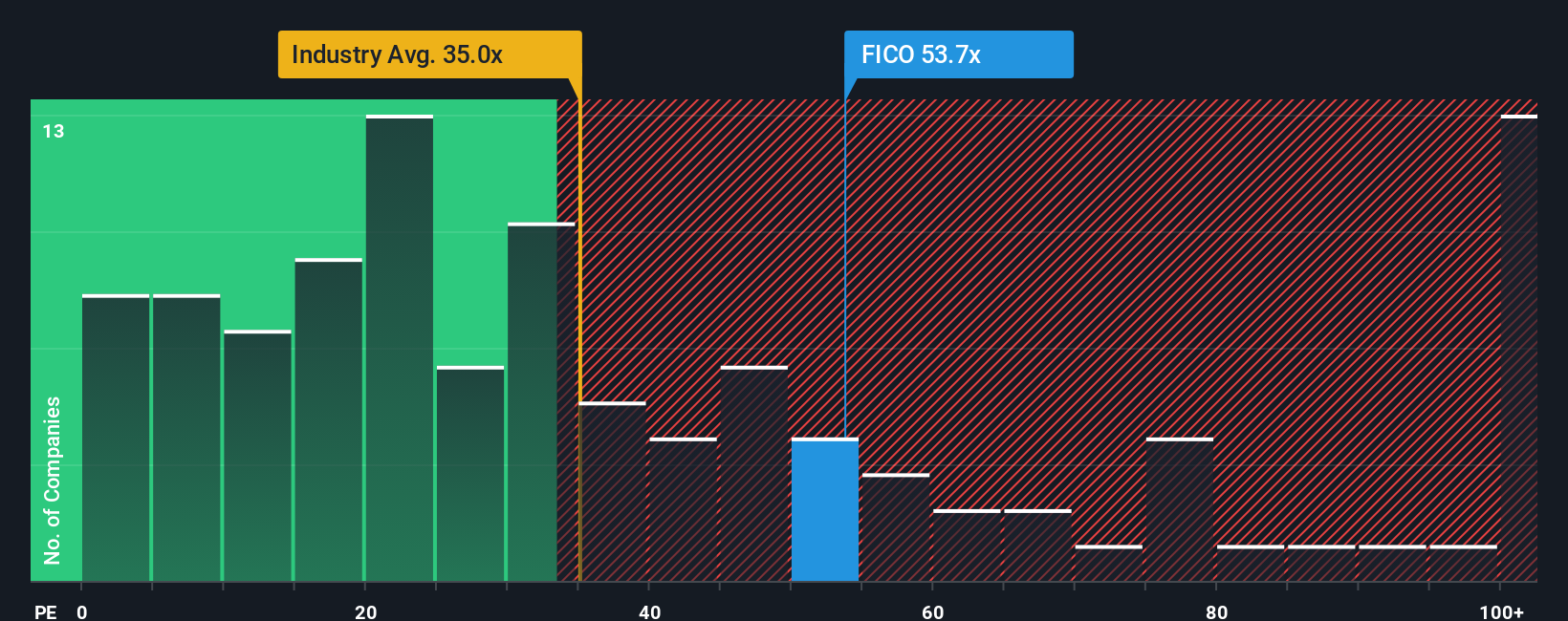

Taking a multiples approach, FICO trades at a price-to-earnings ratio of 63x. This exceeds the US Software sector average of 34.9x, the peer group average of 62.1x, and is well above a fair ratio of 42.3x. As a result, investors are paying a sizable premium for growth, which can create extra risk if those growth expectations are not met. Could the market reward FICO’s strong business, or is the bar set too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fair Isaac Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly shape your own view using our tools: Do it your way

A great starting point for your Fair Isaac research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don't let opportunity slip by, especially when you can target your search with tailored stock ideas that suit your unique investing goals and strategies.

- Capture income and stability with these 20 dividend stocks with yields > 3%, featuring companies offering yields above 3% for those focused on reliable returns in turbulent markets.

- Get ahead of the curve by accessing these 27 AI penny stocks, giving you an edge in the booming artificial intelligence sector, where innovation drives rapid growth.

- Take advantage of value opportunities by scanning these 843 undervalued stocks based on cash flows, identified as trading below their intrinsic cash flow value and revealing hidden gems the market has yet to recognize.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal