3 Leading Tech Stocks to Buy in November

Key Points

Nvidia has huge sales growth on the books for next year.

Alphabet displayed excellent resilience in 2025.

TSMC is launching a new chip technology.

Despite many investors proclaiming the market as overvalued heading into the end of the year (which it probably is from a historical standpoint), the market continues to roar higher. This isn't an easy task to juggle for investors, as there are some real investment opportunities combined with FOMO (the fear of missing out).

The risk is that you buy now and overpay for a stock that's worth 20% less months from now, which is a scenario no investor wants. On the flip side, if you buy the right stocks, there is plenty of upside from today's levels.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

I think some tech stock leaders look like excellent buys now, as they are actually far cheaper than they appear due to impressive growth coming down the pipeline.

Image source: Getty Images.

1. Nvidia

Nvidia (NASDAQ: NVDA) may be the first company someone lists when you ask them to name an overvalued stock. With the stock trading for nearly 60 times trailing earnings, they'd be right. However, that's a poor way to analyze a growth stock, especially one that's growing as quickly as Nvidia is.

Nvida makes graphics processing units (GPUs), which are the computing backbone behind the artificial intelligence boom. There is a massive and growing demand for these computing units, and Nvidia can't get them out the door fast enough. Recently, Nvidia announced that it has $500 billion in orders for its leading Blackwell and Rubin chips over the next five quarters. For reference, Nvidia generated $165 billion in revenue over the past 12 months.

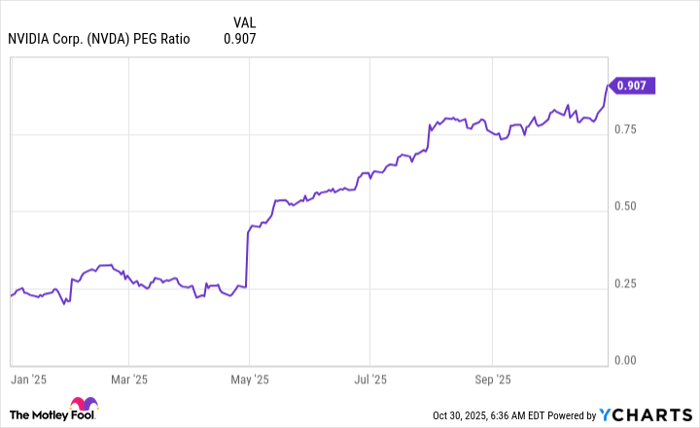

That showcases massive growth, and if we consider Nvidia's price-to-earnings-growth ratio (PEG ratio), it's clear the stock is undervalued.

NVDA PEG Ratio data by YCharts

This metric factors in earnings growth and valuation, and a stock with a PEG ratio under 1 is usually considered undervalued. This gives me a clear sign that Nvidia is still a buy at current prices, and if its growth accelerates (like management is forecasting), the stock could be even cheaper than it appears.

2. Alphabet

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) wasn't supposed to be one of the winners of the AI trend. Everyone assumed that its generative AI offerings would flop and that the Google Search engine wouldn't be used as much, causing the business to struggle. None of that has happened, as Alphabet's Gemini model is seen as one of the best in the industry, and Google Search has seamlessly integrated generative AI summaries into each result, which has kept Google Search as the top option in the space.

This led to an amazing Q3, where revenue rose 16% year over year to $102 billion, eclipsing the $100 billion mark for the first time in company history. Strength came from all around, but with Google Search's revenue rising 15% year over year, it's clear that Alphabet is still the leader in this space.

Despite strong growth, Alphabet is in the same boat as Nvidia, valued at a PEG ratio of 0.85. This indicates there could be plenty more room for the stock to run, making it a great stock to buy now.

3. Taiwan Semiconductor

Last is Taiwan Semiconductor (NYSE: TSM). Taiwan Semiconductor is the world's largest chip manufacturer by revenue, and has gotten that way by providing chips to all of the leading AI computing providers. Taiwan Semiconductor has also launched several new innovative technologies, including one that could alleviate the AI energy crisis.

TSMC's 2 nanometer (nm) chips are entering production, which can reduce energy consumption by 25% to 30% when configured to run at the same processing speed as previous 3nm chips. That's a huge gain, and it showcases that there are still plenty of advancements to come from already-impressive chips.

Similar to Nvidia, Taiwan Semiconductor is growing rapidly, with revenue rising 41% during Q3. TSMC's growth showcases massive chip demand, which isn't slated to slow down anytime soon due to massive AI infrastructure spending.

Taiwan Semiconductor is the cheapest of them all, trading at a PEG ratio of 0.56. This indicates that TSMC could be another excellent stock to buy now, as it's far undervalued for the growth that it's putting up.

All three of these companies may be called overvalued by some investors, but the math doesn't back it up. As a result, they all appear to be excellent buys right now.

Keithen Drury has positions in Alphabet, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Alphabet, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal