Undiscovered Gems in the US Market for November 2025

As the U.S. stock market wraps up October 2025 with impressive gains across major indices, including a notable rise in the Nasdaq driven by strong tech performances, investors are turning their attention to small-cap stocks that might have been overlooked amidst the broader rally. In such a dynamic environment, identifying potential gems requires looking beyond headline-grabbing giants and focusing on companies with robust fundamentals and unique growth opportunities that align well with current economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Greenfire Resources | 35.48% | -1.31% | -25.79% | ★★★★☆☆ |

| Solesence | 91.26% | 23.30% | 4.70% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Timberland Bancorp (TSBK)

Simply Wall St Value Rating: ★★★★★★

Overview: Timberland Bancorp, Inc. is the bank holding company for Timberland Bank, offering a range of community banking services in Washington with a market cap of $253.41 million.

Operations: Timberland Bancorp generates revenue primarily from its community banking services, amounting to $81.62 million.

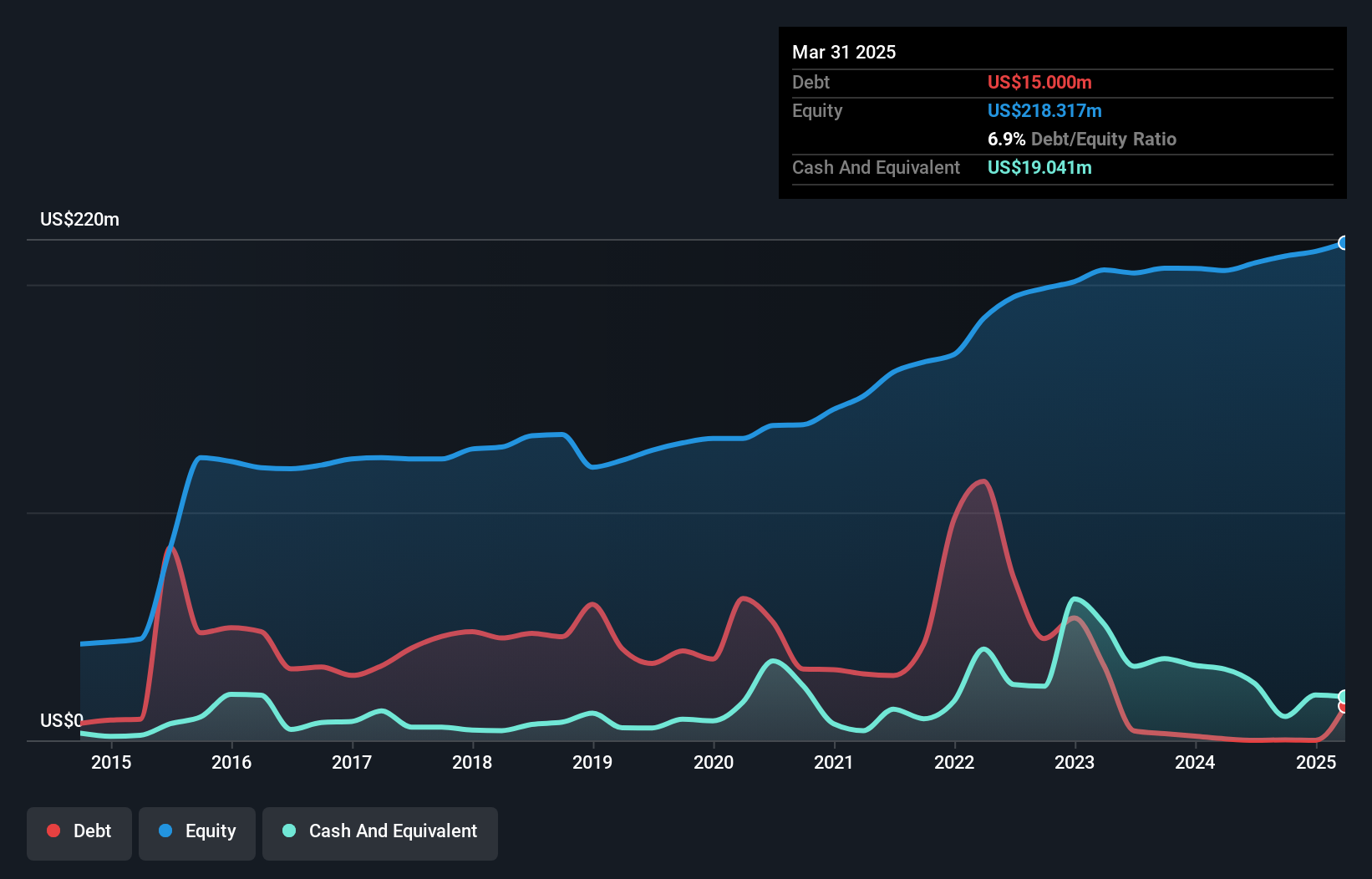

Timberland Bancorp, with assets totaling US$2 billion and equity of US$262.6 million, is an intriguing player in the banking sector. It boasts a robust allowance for bad loans at 411%, ensuring stability against potential defaults. The bank's earnings growth of 20.1% surpasses the industry average, highlighting its competitive edge. With deposits reaching US$1.7 billion and loans at US$1.5 billion, Timberland maintains a solid footing in its operations. Recent announcements reveal net income rose to US$29.16 million from last year's US$24.28 million, reflecting strong financial health and an appealing valuation trading below estimated fair value by nearly half.

- Delve into the full analysis health report here for a deeper understanding of Timberland Bancorp.

Gain insights into Timberland Bancorp's past trends and performance with our Past report.

Radiant Logistics (RLGT)

Simply Wall St Value Rating: ★★★★★★

Overview: Radiant Logistics, Inc. is a third-party logistics company offering technology-enabled global transportation and value-added logistics services across the United States and Canada, with a market cap of $285.76 million.

Operations: Radiant Logistics generates revenue primarily from its transportation segment, with air freight contributing $902.70 million. The company focuses on technology-enabled logistics services across North America.

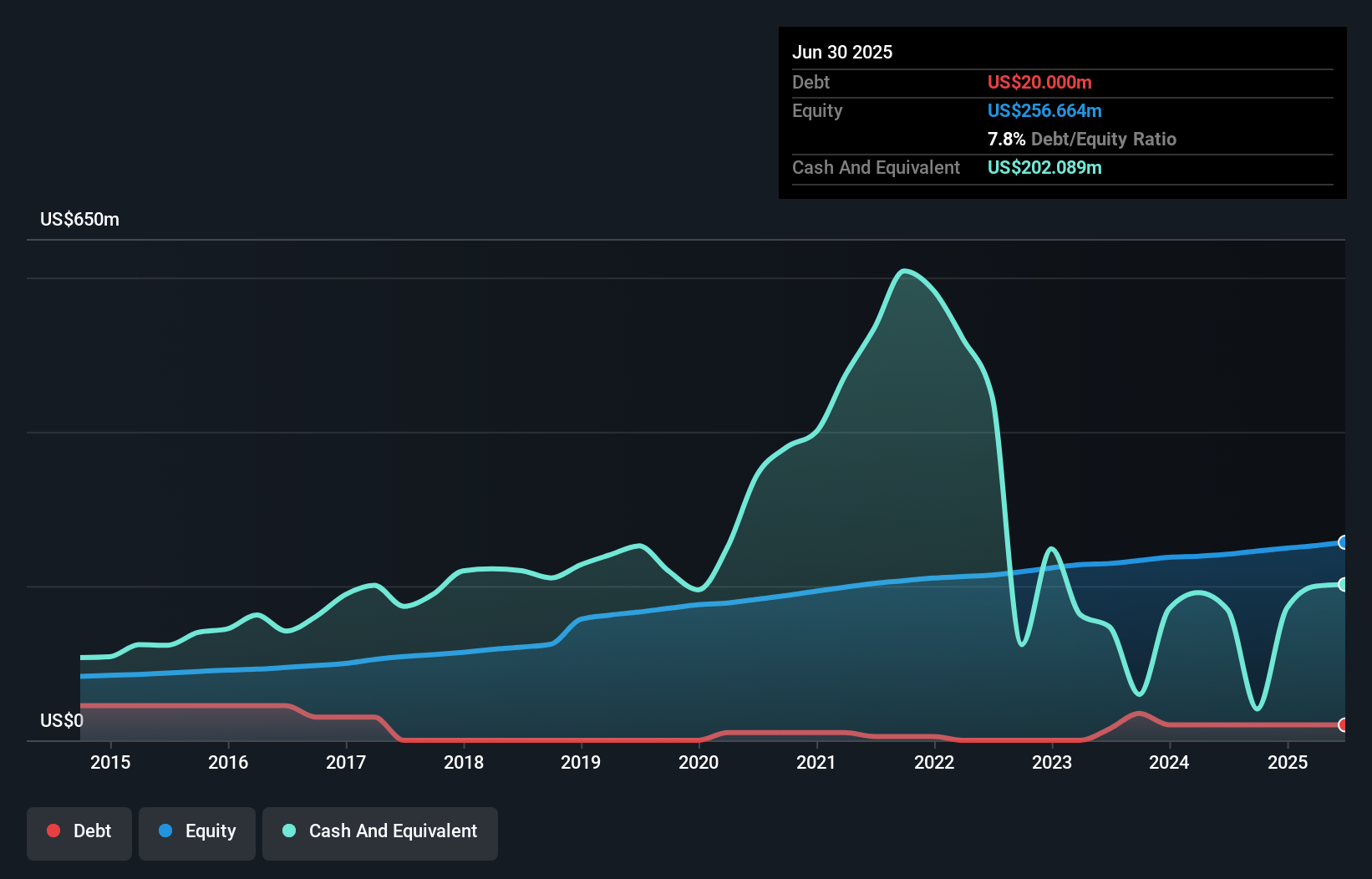

Radiant Logistics, operating in the U.S. and Canada, showcases a robust financial profile with cash exceeding total debt and an impressive EBIT coverage of interest payments at 17.3 times. Over the past year, earnings surged by 125%, outpacing the logistics industry growth rate of 1.9%. The company's strategic acquisitions like Foundation and Focus Logistics aim to enhance service offerings while reducing commission expenses through converting agency stations into company-owned locations. Despite a debt-to-equity ratio drop from 37.6% to 8.8% over five years, Radiant faces challenges such as pricing pressures and reliance on project-based revenues which may impact consistent earnings growth.

Exzeo Group (XZO)

Simply Wall St Value Rating: ★★★★★★

Overview: Exzeo Group, Inc. offers comprehensive insurance technology and operational solutions to carriers and agents, with a market capitalization of approximately $1.91 billion.

Operations: Exzeo Group generates revenue primarily from its insurance technology and operations solutions, with the Property & Casualty segment contributing $183.71 million. The company's market capitalization stands at approximately $1.91 billion.

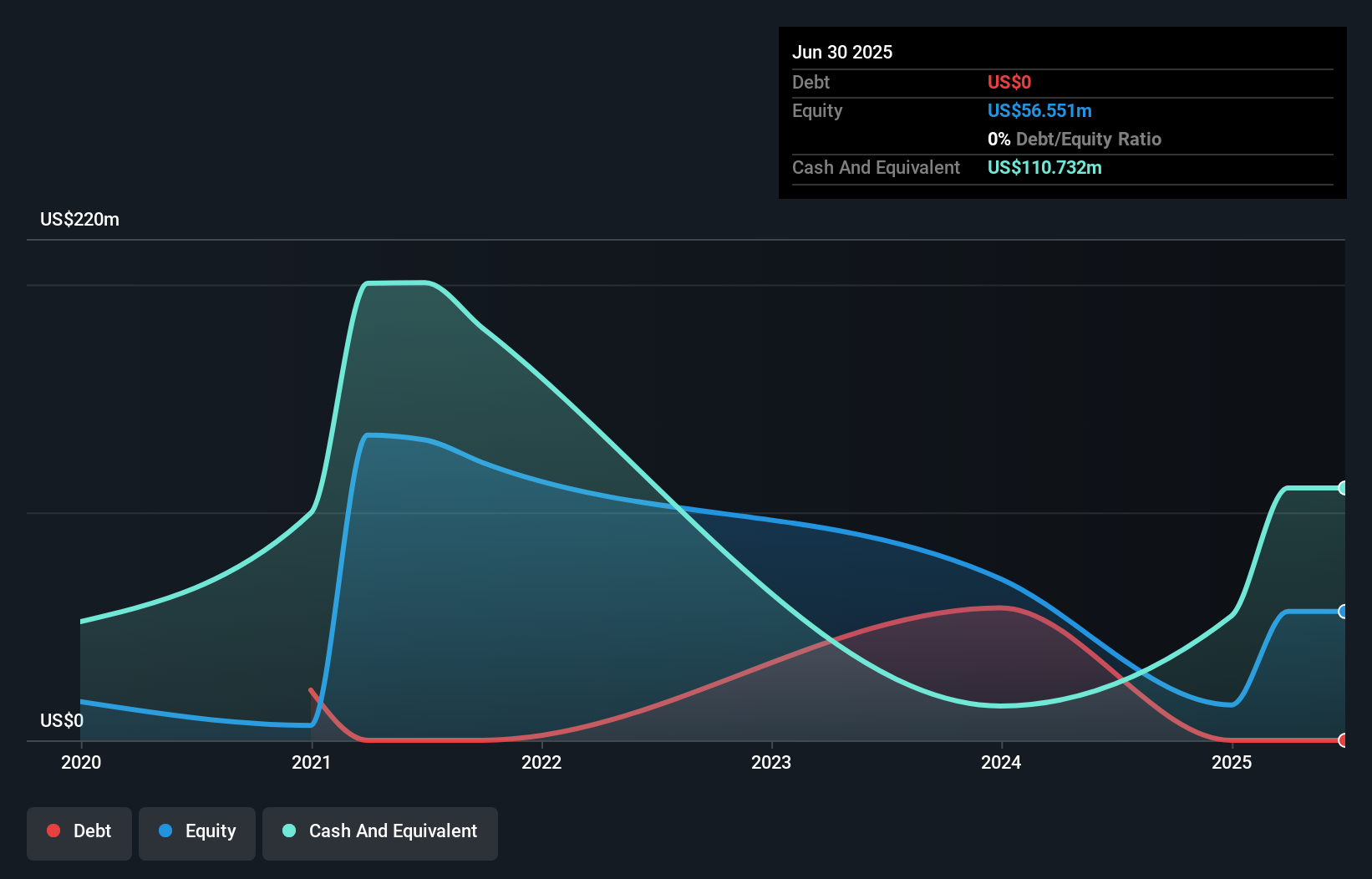

Exzeo Group, a nimble player in the software sector, has shown remarkable earnings growth of 521.9% over the past year, significantly outpacing the industry average of 18.4%. Trading at 80.2% below its estimated fair value, it appears undervalued with high-quality earnings and no debt burden after reducing its debt from a ratio of 94.2% five years ago. The company's free cash flow is positive at US$213.89 million as of June 2025, indicating strong financial health despite highly illiquid shares. Recently filing for an IPO worth US$176 million suggests potential expansion and increased market presence ahead.

- Take a closer look at Exzeo Group's potential here in our health report.

Review our historical performance report to gain insights into Exzeo Group's's past performance.

Summing It All Up

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 304 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal