Is Bristol-Myers Squibb’s Recent Rally a Sign the Stock Is Mispriced in 2025?

- Wondering if Bristol-Myers Squibb is a bargain in today's market? Let's dig in together and break down whether its recent price reflects its true long-term value.

- The stock has recently bounced 6.2% over the past week and gained a modest 1.4% in the past month, despite still being down nearly 19% so far this year.

- Investors have kept a close eye on Bristol-Myers Squibb following news of regulatory approvals for new therapies and speculative activity around potential asset sales. This has added some excitement despite its challenging long-term performance. These events have provided a burst of optimism and may explain the recent uptick after a long period of share price decline.

- When it comes to value, Bristol-Myers Squibb earns a solid 5 out of 6 on our valuation checklist, showing strength across most metrics. We will explore a few ways to gauge a fair price for the stock, and at the end, share a smarter, more comprehensive way to weigh up its true value.

Find out why Bristol-Myers Squibb's -12.8% return over the last year is lagging behind its peers.

Approach 1: Bristol-Myers Squibb Discounted Cash Flow (DCF) Analysis

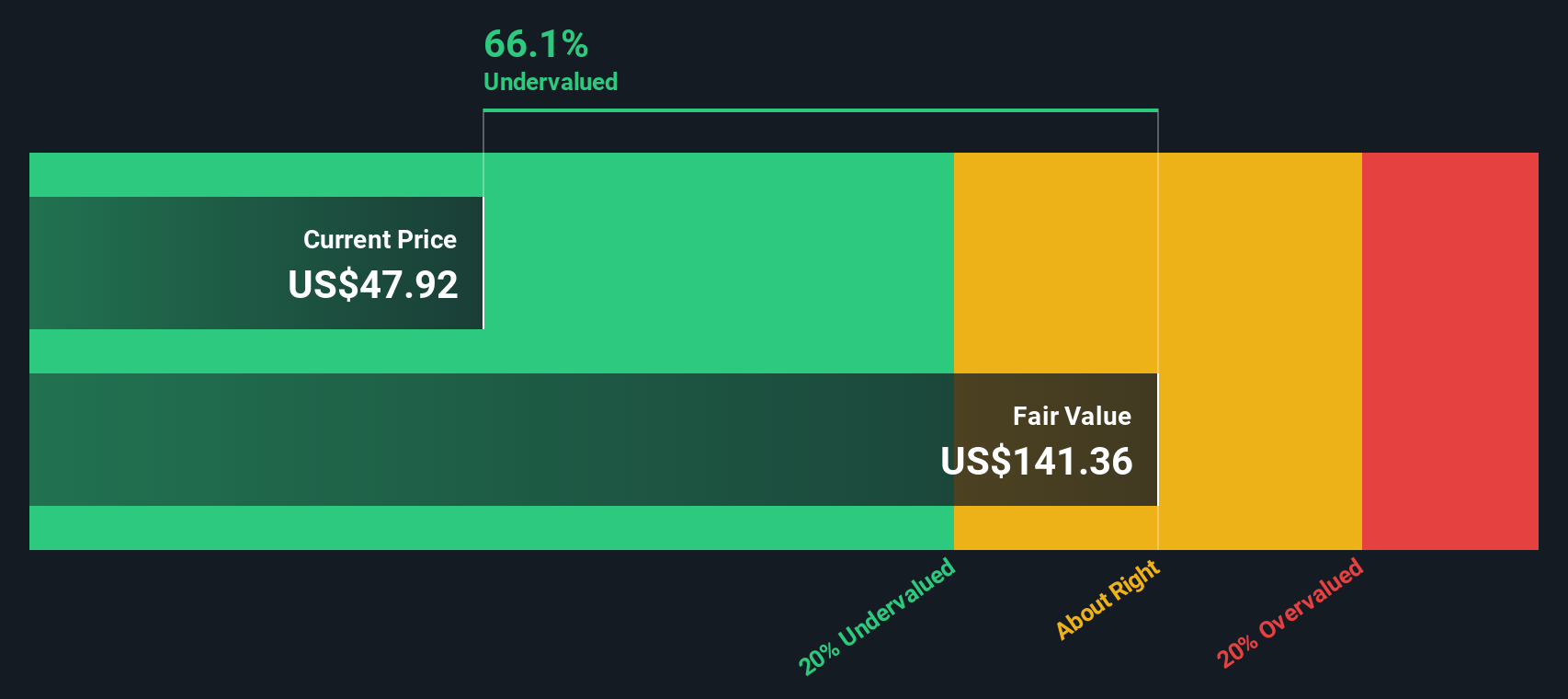

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting those forecasts back to today's value. In simple terms, this approach tries to capture the future earning power of Bristol-Myers Squibb and reflect what that is worth if you received all those cash flows right now.

For Bristol-Myers Squibb, the most recent Free Cash Flow (FCF) stands at $15.34 billion. Analyst forecasts predict annual FCF to remain robust, with projections around $13.63 billion in 2026 and $11.76 billion by 2029. Beyond 2029, further estimates are extrapolated based on industry trends and company performance, bringing projected FCF to approximately $12.07 billion by 2035, all in USD. These steady cash flows underpin the company’s financial strength.

Based on these projections, the DCF model calculates an estimated intrinsic value of $128.39 per share for Bristol-Myers Squibb. This represents a meaningful 64.1% discount to its current share price, indicating the stock appears significantly undervalued according to this approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bristol-Myers Squibb is undervalued by 64.1%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

Approach 2: Bristol-Myers Squibb Price vs Earnings

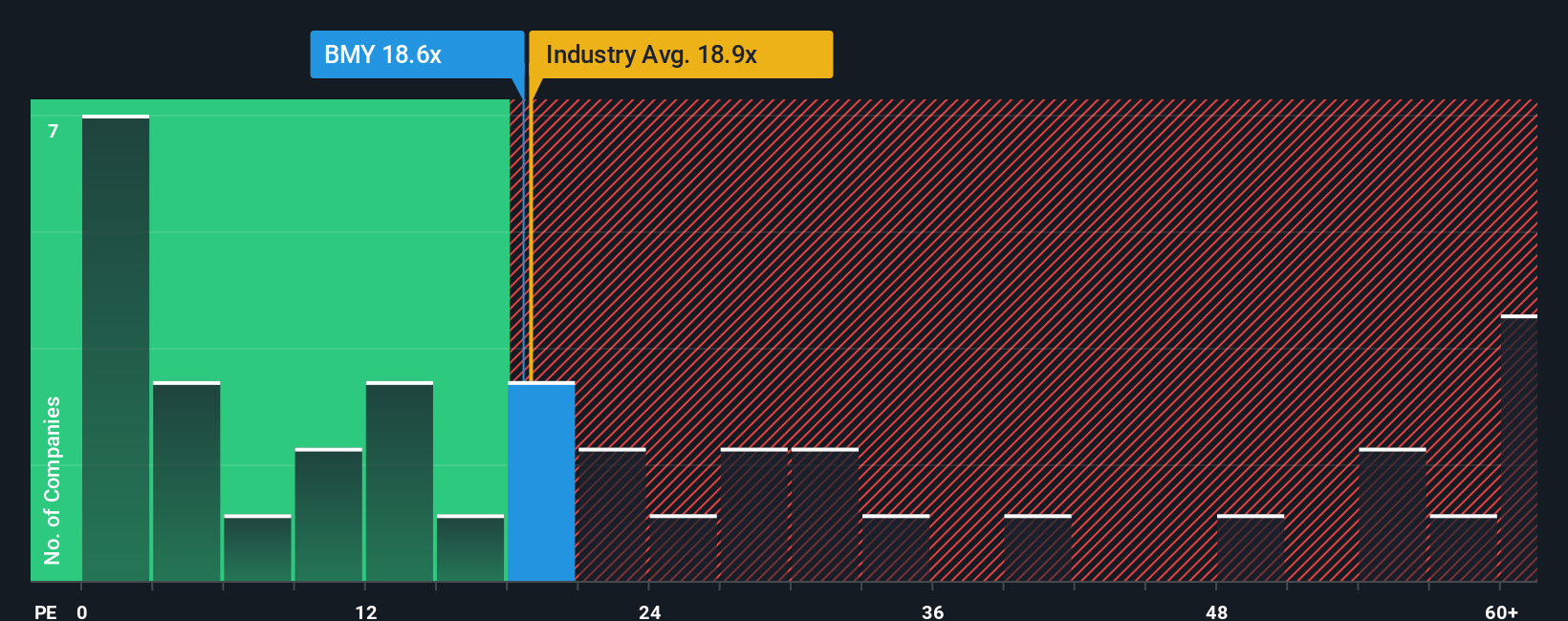

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies because it captures how much investors are willing to pay for each dollar of current earnings. It is especially useful for established firms like Bristol-Myers Squibb, where profits are relatively stable. The PE ratio provides a quick way to compare value across similar businesses.

What makes a “normal” or “fair” PE ratio can vary depending on factors such as a company's expected earnings growth and the risks it faces. Companies with faster growth prospects or lower risks usually command a higher multiple, while those facing challenges or uncertainties tend to trade at a discounted ratio.

Currently, Bristol-Myers Squibb trades at a PE ratio of 15.5x. This is a bit below the average for pharmaceutical industry peers, which stands at 16.2x. It is even lower when compared with the broader industry average of 18.1x. On the surface, this might suggest that the stock is trading at a discount relative to its competition.

Simply Wall St’s proprietary “Fair Ratio” provides a more tailored benchmark by accounting for Bristol-Myers Squibb’s earnings growth outlook, profit margins, market capitalization, industry setting, and unique risk profile. Unlike a simple peer or industry comparison, the Fair Ratio of 24.2x reflects not just averages but what investors should reasonably expect for a business with Bristol-Myers Squibb's specific attributes.

With the Fair Ratio well above both the actual PE and the industry and peer benchmarks, Bristol-Myers Squibb appears to be meaningfully undervalued according to this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bristol-Myers Squibb Narrative

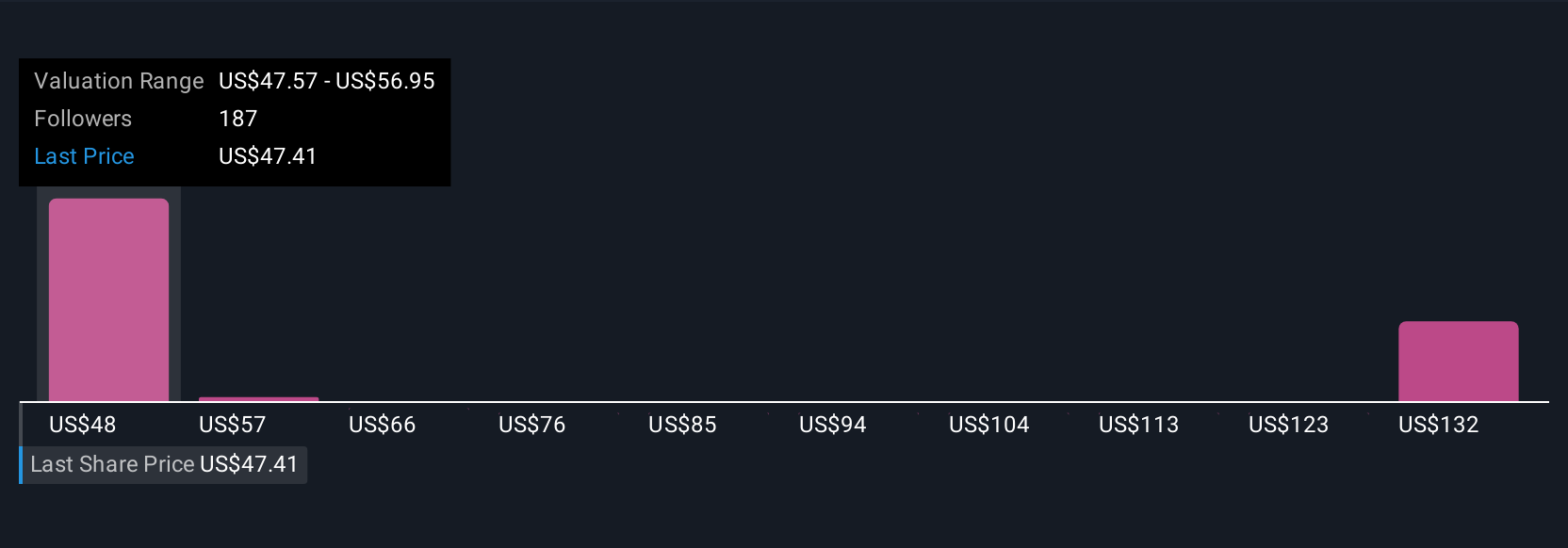

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful tool that lets you express the “story” you believe about Bristol-Myers Squibb by connecting your own forecasts about its future growth, earnings, margins, and fair value to the key events or drivers you think matter most.

Unlike traditional valuation methods that focus only on the numbers, Narratives help you tie together how and why those numbers might play out, making your investment thesis more personal and actionable. When you use a Narrative on Simply Wall St's Community page, you build a forecast—your story for the company—that is then instantly linked to a fair value calculation and compared to today’s share price, so you can easily see if your story points to a buy, hold, or sell decision.

Narratives are kept up to date automatically as new company results, news, or analyst updates arrive, so your view always reflects the latest information. For example, one investor might build a bullish Narrative for Bristol-Myers Squibb with a fair value as high as $68 based on successful new drug approvals and cost savings. Another might be more cautious, with a Narrative and fair value closer to $34 due to patent expiries and pipeline risk.

Do you think there's more to the story for Bristol-Myers Squibb? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal