Will Leadership Integration at CDW (CDW) Strengthen Its Innovation and Customer Engagement Strategy?

- CDW Corporation recently announced that Sona Chawla, Chief Growth and Innovation Officer and Executive Vice President, will retire on December 31, 2025, with Mukesh Kumar, Chief Services and Solutions Officer, assuming an expanded and integrated leadership role focused on unifying the company’s technology, services, and product teams.

- This leadership realignment is expected to enhance CDW’s customer and partner engagement by bringing together AI, digital transformation, and operational agility efforts under one cohesive team.

- We’ll examine how Mukesh Kumar’s expanded role and the integration of growth functions could shape CDW’s long-term investment case.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

CDW Investment Narrative Recap

To be a CDW shareholder, you need to believe the company can drive growth through digital transformation, AI, and an expanded services portfolio, offsetting pressure from shifting end-market funding and margin compression risks. The recent executive transition, with Mukesh Kumar assuming broader responsibilities, does not materially impact the company’s immediate earnings catalyst, accelerating demand for AI and managed services, nor the primary risk from slowing profit growth amid operational headwinds.

Of CDW’s recent announcements, the July 2025 partnership with Asato Corporation stands out against this leadership news. By integrating AI-powered IT asset intelligence into its offerings, CDW underscores its commitment to technology-driven growth, which remains central to its current revenue and margin catalysts, even as organizational changes take place.

However, unlike the leadership update, investors should be aware that gross margin pressures from large enterprise mix continue to affect near-term earnings, especially if...

Read the full narrative on CDW (it's free!)

CDW's narrative projects $24.3 billion in revenue and $1.3 billion in earnings by 2028. This requires 3.5% yearly revenue growth and a $0.2 billion earnings increase from current earnings of $1.1 billion.

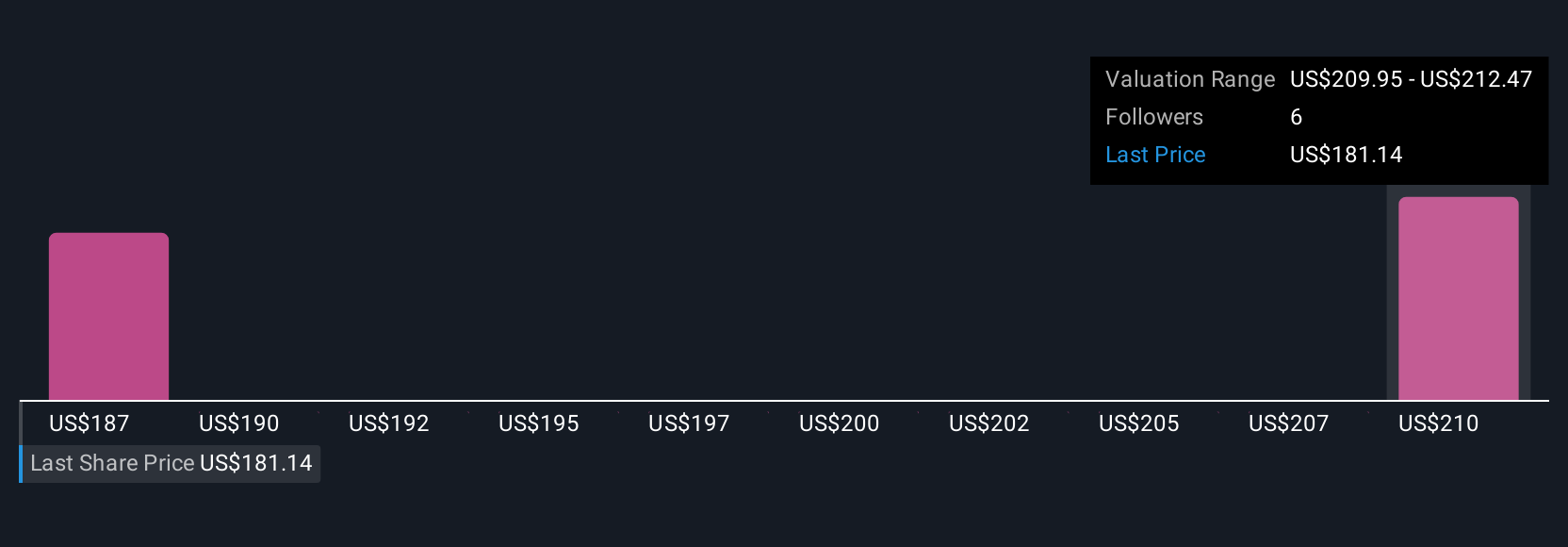

Uncover how CDW's forecasts yield a $203.40 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Three recent fair value estimates from the Simply Wall St Community range from US$180.03 to US$234.14 per share, reflecting varied outlooks on CDW’s future. As analyst consensus continues to highlight the importance of expanding recurring software and services, opinions can differ markedly, explore these viewpoints to understand what could drive or limit CDW’s broader performance.

Explore 3 other fair value estimates on CDW - why the stock might be worth as much as 47% more than the current price!

Build Your Own CDW Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CDW research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CDW research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CDW's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal