Should Rogers' (ROG) Cautious Q4 Outlook and Share Buybacks Signal a Shift in Long-Term Strategy?

- Rogers Corporation recently reported its third quarter 2025 results, issued fourth quarter guidance that points to flat-to-higher sales year-over-year, and announced progress on its multi-year share repurchase program, including the completion of repurchasing over 1.94 million shares since 2015.

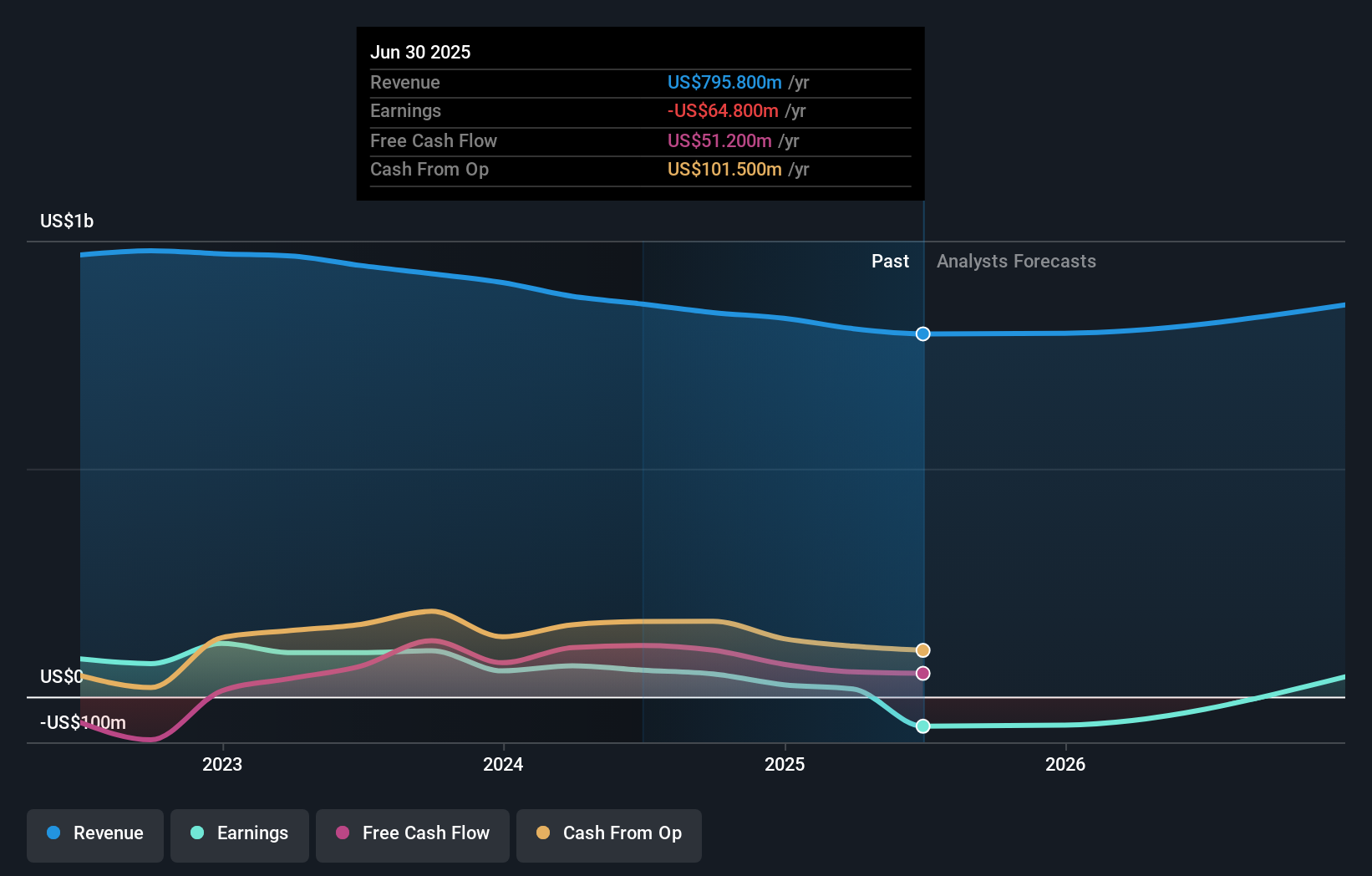

- An interesting detail is that despite modest quarterly sales growth, the company continues to face profitability challenges, with guidance indicating only breakeven to modest earnings for the coming quarter and a net loss for the year-to-date period.

- Next, we'll examine how Rogers' cautious earnings guidance for the fourth quarter shapes its overall investment narrative and future prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Rogers Investment Narrative Recap

To be a shareholder in Rogers today, you need to believe in the company’s ability to turn exposure to long-term electrification and advanced materials demand into consistent, profitable growth, despite competitive and execution headwinds. The latest earnings and cautious guidance, with Q4 sales barely expected to rise year-over-year and profits remaining weak, does little to change the key short-term catalyst: signs of recovery in the EV and power electronics markets; nor does it mitigate the biggest risk, which is ongoing pressure from Asian competition and potential further customer losses.

Among recent developments, Rogers’ continued share repurchase activity stands out, with nearly 2 million shares bought back since 2015, including $10 million in Q3 2025 alone. While this signals a commitment to shareholder returns, it may have a limited impact on the underlying earnings trajectory given current market and operational challenges.

On the other hand, investors should be aware that continued exposure to aggressive pricing and market share losses in Asia could...

Read the full narrative on Rogers (it's free!)

Rogers' narrative projects $921.6 million revenue and $83.3 million earnings by 2028. This requires 5.0% yearly revenue growth and a $148.1 million increase in earnings from the current $-64.8 million.

Uncover how Rogers' forecasts yield a $85.67 fair value, in line with its current price.

Exploring Other Perspectives

The Simply Wall St Community supplied 2 fair value estimates for Rogers, ranging from US$16.14 to US$85.67 per share. With competitive threats looming and operational execution under scrutiny, these differing perspectives highlight the importance of considering several viewpoints before forming an outlook on the company’s performance.

Explore 2 other fair value estimates on Rogers - why the stock might be worth as much as $85.67!

Build Your Own Rogers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rogers research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Rogers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rogers' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal