Morningstar (MORN): Evaluating Valuation After $1 Billion Buyback and Mixed Q3 Earnings

Morningstar (MORN) announced a new $1 billion share repurchase plan and completed a sizable buyback round. The company also released third-quarter results that showed higher revenue but a dip in net income from the previous year.

See our latest analysis for Morningstar.

Despite launching another large buyback and expanding into new markets, Morningstar’s share price has struggled in 2025, posting a year-to-date return of -36.13%. While revenue has grown and the company continues to invest, recent financial updates and ongoing market caution have weighed on sentiment. Total shareholder return for the past twelve months stands at -34.94%, and it has been barely positive over five years. Momentum is clearly fading for now. However, the latest buyback and expansion moves could set the stage for long-term opportunity if trends reverse.

If you’re following how companies adapt in changing markets, now’s a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With sentiment this low and buybacks signaling internal confidence, the question facing investors is whether Morningstar is now undervalued or if the market is already accounting for potential future growth and risks.

Price-to-Earnings of 23.2x: Is it justified?

Morningstar’s shares trade at a price-to-earnings (P/E) ratio of 23.2x, making the stock less expensive than most direct peers but still at a premium to what valuation models suggest is fair.

The price-to-earnings ratio reveals how much investors are willing to pay per dollar of the company’s earnings. This offers a window into expectations for profitability and growth in the capital markets sector. For a diversified financials company like Morningstar, this multiple gauges whether the market sees it as a growth story or just another industry player.

Right now, the 23.2x P/E is lower than the US capital markets sector average of 25.1x and also below the peer average of 26.4x, signaling a modest discount. However, it is still substantially above the company’s estimated fair P/E ratio of 14x. This indicates investors may be pricing in stronger performance or resilience than fundamentals alone justify. If the market's view shifts, this premium could shrink quickly.

Explore the SWS fair ratio for Morningstar

Result: Price-to-Earnings of 23.2x (ABOUT RIGHT)

However, continued sluggish share performance and a significant discount to analyst price targets may signal persistent concerns over future growth or profitability.

Find out about the key risks to this Morningstar narrative.

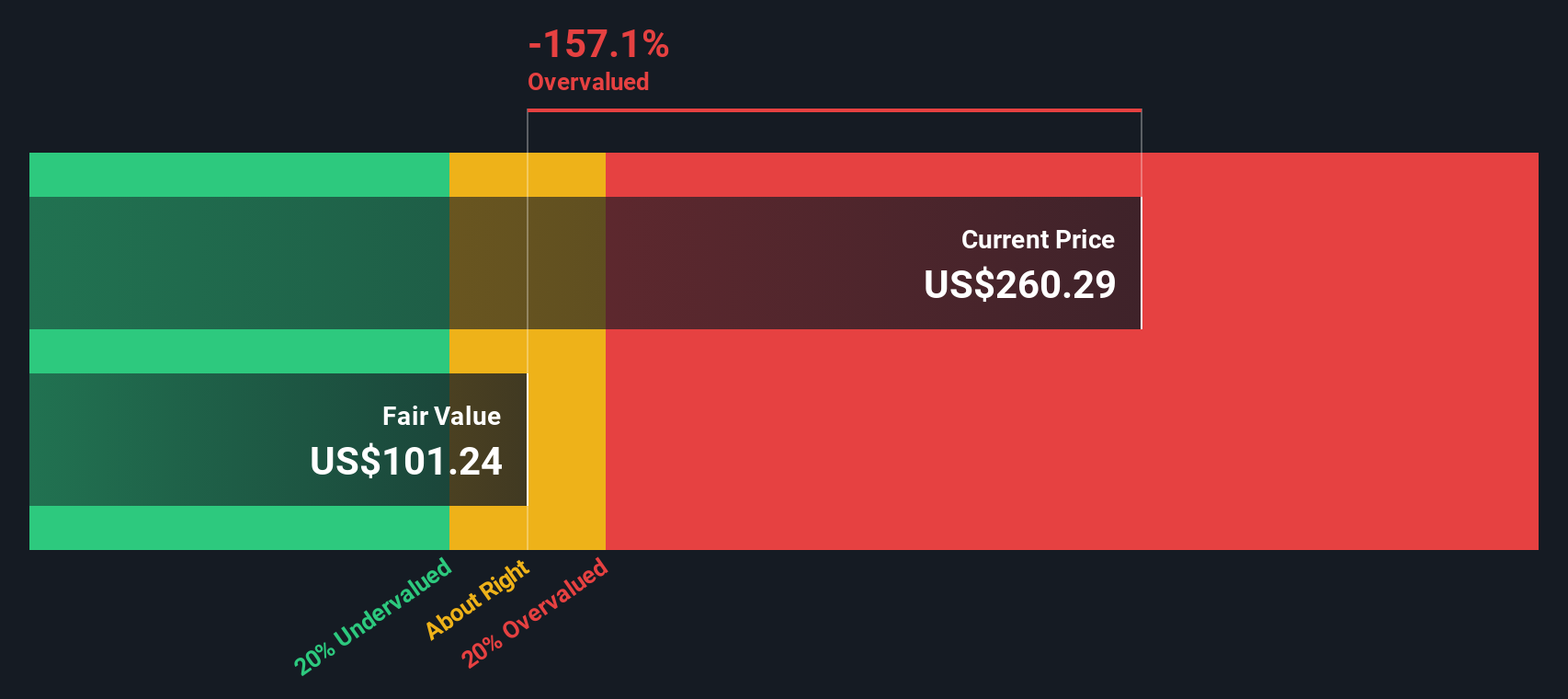

Another View: SWS DCF Model Shows Overvaluation Risk

While the price-to-earnings ratio suggests Morningstar trades at a discount to peers, our SWS DCF model presents a very different picture. According to this approach, the share price is well above estimated fair value, which raises big questions about the sustainability of its current valuation. Could momentum or sentiment alone be holding up the stock?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Morningstar for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Morningstar Narrative

If you'd like to dig deeper into the numbers or would rather draw your own conclusions, it only takes a few minutes to create your personal view. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Morningstar.

Looking for more investment ideas?

Strong opportunities are waiting if you know where to look, so don’t let them pass by. Here are three fresh ways to broaden your horizons today:

- Accelerate your portfolio with these 840 undervalued stocks based on cash flows, which unlocks hidden gems based on robust cash flow potential and smart valuation checks.

- Capitalize on future healthcare breakthroughs by checking out these 33 healthcare AI stocks to target companies advancing medical innovation using artificial intelligence.

- Capture steady income streams and dependable returns by starting with these 22 dividend stocks with yields > 3%, featuring stocks that deliver attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal