Keysight Technologies (KEYS) Is Up 8.0% After Unveiling Quantum System Analysis Tool for Engineers

- In October 2025, Keysight Technologies introduced Quantum System Analysis, a new Electronic Design Automation solution that enables quantum engineers to simulate and optimize quantum systems at the system level, expanding their quantum EDA portfolio.

- This launch directly addresses industry-wide challenges in system-level quantum design and comes shortly after the Nobel Prize recognized advances in superconducting quantum circuits, an area targeted by Keysight's latest platform.

- We'll examine how the introduction of system-level quantum simulation capabilities shapes Keysight's investment thesis and growth trajectory.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Keysight Technologies Investment Narrative Recap

For investors considering Keysight Technologies, the core thesis rests on sustained demand for advanced test and measurement solutions driven by accelerating AI adoption, government R&D priorities, and growth in quantum and semiconductor markets. The recent launch of Quantum System Analysis expands Keysight’s position in quantum design and simulation, but does not directly alter the biggest near-term catalyst, AI infrastructure investment, or the current headwind from new tariffs that could pressure margins if cost mitigation falls short.

Of recent announcements, the Quantum System Analysis release is most pertinent, as it showcases Keysight’s investment in innovative quantum EDA tools that serve high-growth R&D sectors. This supports the catalyst of capturing long-term value in emerging quantum computing and advanced semiconductor fields, further diversifying revenue streams beyond traditional hardware and software.

Conversely, investors should be aware that if mitigation measures for rising tariffs are less effective than planned, this could...

Read the full narrative on Keysight Technologies (it's free!)

Keysight Technologies is projected to reach $6.3 billion in revenue and $1.2 billion in earnings by 2028. This is based on analysts' assumptions of 6.5% annual revenue growth and a $656 million increase in earnings from the current $544 million.

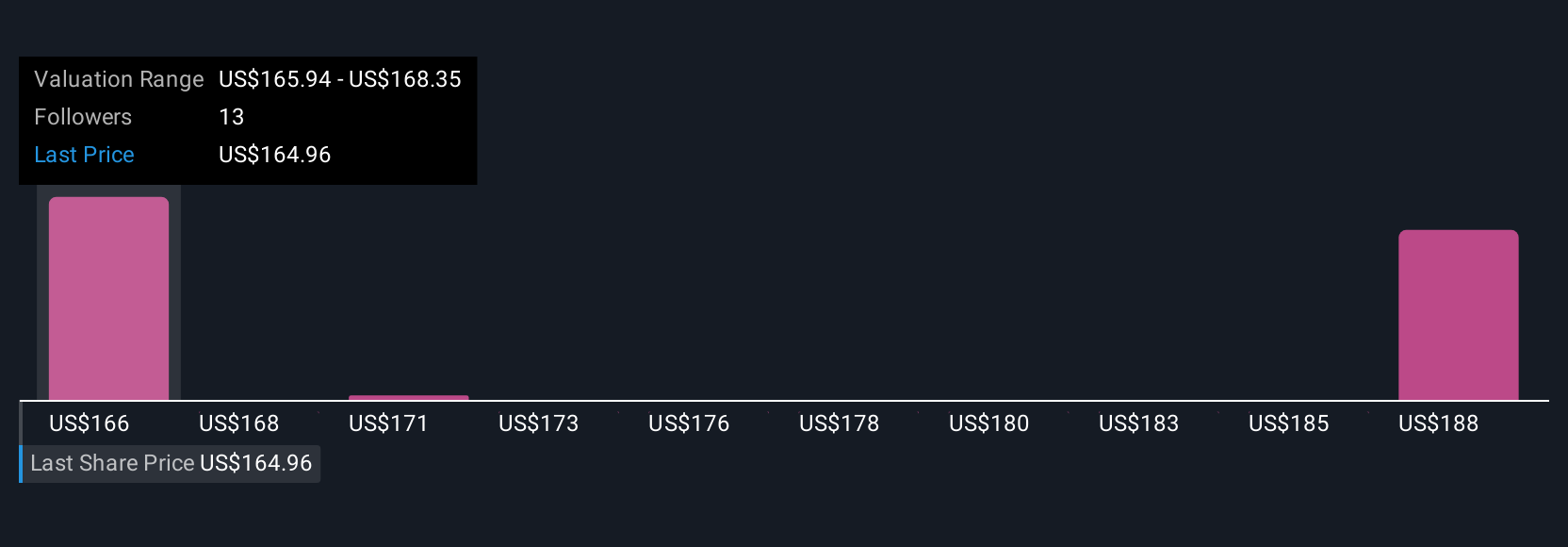

Uncover how Keysight Technologies' forecasts yield a $187.60 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted five fair value estimates for Keysight, ranging from US$141.32 to US$190.01 per share. While views differ, many point to the current tariff-driven cost risk potentially affecting near-term earnings and the company’s profit profile, encouraging you to compare multiple opinions before taking a position.

Explore 5 other fair value estimates on Keysight Technologies - why the stock might be worth as much as $190.01!

Build Your Own Keysight Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Keysight Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Keysight Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Keysight Technologies' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal