Krystal Partnership Could Be a Game Changer for PAR Technology (PAR)

- Krystal Restaurants LLC recently announced it has selected PAR Technology's Punchh® platform to power its new Club Krystal loyalty program as part of its national brand expansion and focus on personalized guest engagement.

- This partnership highlights the increasing industry demand for integrated technology solutions that unify guest data, deliver personalized experiences, and drive repeat visits across multiple restaurant locations and channels.

- We'll explore how this new enterprise win supports PAR Technology's growth narrative amid recent rollout delays and evolving customer needs.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

PAR Technology Investment Narrative Recap

Shareholders in PAR Technology need to believe in the long-term potential of its unified software suite to drive recurring revenue growth, even amid rollout delays and ongoing losses. The Krystal Restaurants partnership validates enterprise demand but is not likely to materially alter the key near-term catalyst, which remains the execution of delayed multi-year rollouts and conversion of the significant sales pipeline; the biggest risk is continued implementation slowdowns, which could extend the path to profitability.

Among recent announcements, the multiproduct win with Taco Bueno best underscores PAR’s current momentum in selling integrated solutions across restaurant chains, a positive sign given that cross-sell acceleration is a core driver for revenue retention and margin improvement. These deals reinforce why execution on pipeline rollouts is so important to overall performance.

However, while headline wins are encouraging, investors should be aware that execution risk from ongoing rollout delays remains a...

Read the full narrative on PAR Technology (it's free!)

PAR Technology's narrative projects $608.8 million revenue and $55.1 million earnings by 2028. This requires 13.4% yearly revenue growth and a $146.6 million increase in earnings from current earnings of -$91.5 million.

Uncover how PAR Technology's forecasts yield a $71.33 fair value, a 102% upside to its current price.

Exploring Other Perspectives

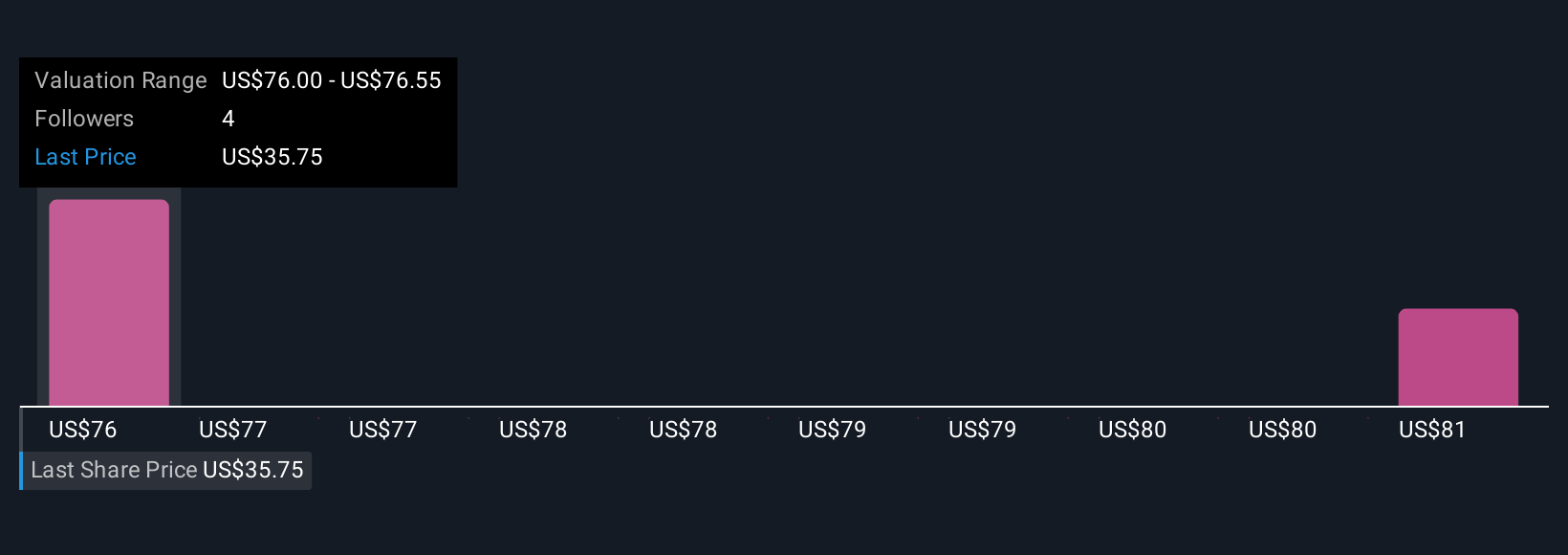

The Simply Wall St Community includes 3 unique fair value estimates, ranging from US$60.97 to US$71.33, all well above the current share price. While opinions vary, recent news highlights how sustained rollout delays could weigh on revenue timing and impact future expectations, consider the variety of market views before drawing a conclusion.

Explore 3 other fair value estimates on PAR Technology - why the stock might be worth just $60.97!

Build Your Own PAR Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PAR Technology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PAR Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PAR Technology's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal