Dividend and Buyback Authorization Could Be a Game Changer for New Oriental Education & Technology Group (EDU)

- New Oriental Education & Technology Group reported a rise in first-quarter sales to US$1.52 billion and announced a cash dividend, a US$300 million share buyback authorization, and positive earnings guidance for fiscal 2026.

- The simultaneous rollout of a dividend and share repurchase program highlights management's commitment to returning capital to shareholders while signaling confidence in future performance.

- We’ll explore how the newly announced buyback program could influence New Oriental’s outlook within its evolving investment narrative.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

New Oriental Education & Technology Group Investment Narrative Recap

To be a shareholder in New Oriental Education & Technology Group, you need to believe in its ability to balance steady revenue growth with profitability despite macroeconomic headwinds, regulatory risks, and increased competition in non-academic and adjacent business segments. While recent results affirm guidance for higher revenues in fiscal 2026, they do not materially reduce the significance of ongoing risks such as intensifying sector competition, which remains a key factor for short-term performance.

Among recent announcements, the new US$300 million share repurchase program stands out, as it signals the company’s commitment to shareholder returns even as earnings growth has moderated and margin expansion faces constraints from rising operating costs. This buyback is particularly relevant in supporting catalysts like EPS growth and value creation, reinforcing a focus on capital allocation and investor confidence amid evolving market dynamics.

By contrast, investors should be aware that persistent margin pressures in core and new business lines could limit...

Read the full narrative on New Oriental Education & Technology Group (it's free!)

New Oriental Education & Technology Group's outlook anticipates $6.5 billion in revenue and $628.5 million in earnings by 2028. This is based on an expected 9.7% annual revenue growth rate and a $256.8 million increase in earnings from the current $371.7 million.

Uncover how New Oriental Education & Technology Group's forecasts yield a $58.31 fair value, in line with its current price.

Exploring Other Perspectives

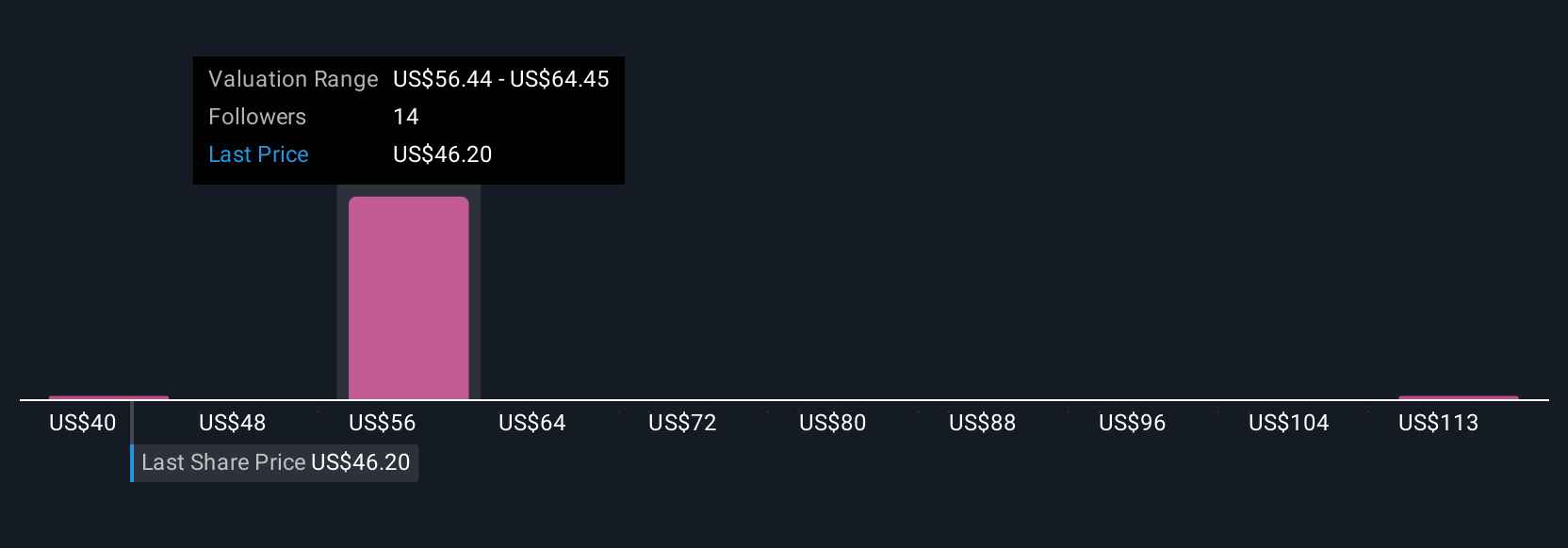

Four fair value estimates from the Simply Wall St Community span from US$38.90 to US$139.80 per share, highlighting broad disagreement on future prospects. With competition and margin pressure cited as ongoing risks, your outlook may depend on which business segment’s growth or challenges you view as most important.

Explore 4 other fair value estimates on New Oriental Education & Technology Group - why the stock might be worth over 2x more than the current price!

Build Your Own New Oriental Education & Technology Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New Oriental Education & Technology Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free New Oriental Education & Technology Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New Oriental Education & Technology Group's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal