Is Modine Manufacturing Still Attractive After 628.9% Surge and Data Center Expansion News?

- Curious if Modine Manufacturing is still a bargain after such a massive run-up? Let’s dig into whether the current price leaves room for future gains.

- While the share price is up an astonishing 628.9% over the past three years, the stock has also risen 31.9% since the start of 2024, despite a modest 5% dip this past week.

- Recent headlines about new partnerships and expansion into advanced cooling technologies have reignited investor interest. The buzz has brought more attention to Modine’s growth prospects, making it an intriguing name to watch.

- Modine’s valuation score stands at 3 out of 6, suggesting there is a mixed view on whether it is undervalued or not. Let’s explore the standard valuation approaches first, and stick around for a unique perspective at the end of this article.

Approach 1: Modine Manufacturing Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by forecasting all future cash flows and discounting them back to their present value. For Modine Manufacturing, this approach helps investors look beyond current profits to assess the true worth of the business as a function of its potential to generate cash in the years ahead.

Currently, Modine Manufacturing reports Free Cash Flow of $53.0 million. Analyst estimates show significant anticipated growth, with projections reaching $362.4 million by 2028. Beyond analyst estimates, Simply Wall St extrapolates that annual Free Cash Flow could climb even further, reaching about $902.3 million by 2035. All figures are in US dollars and rounded to the nearest tenth for clarity.

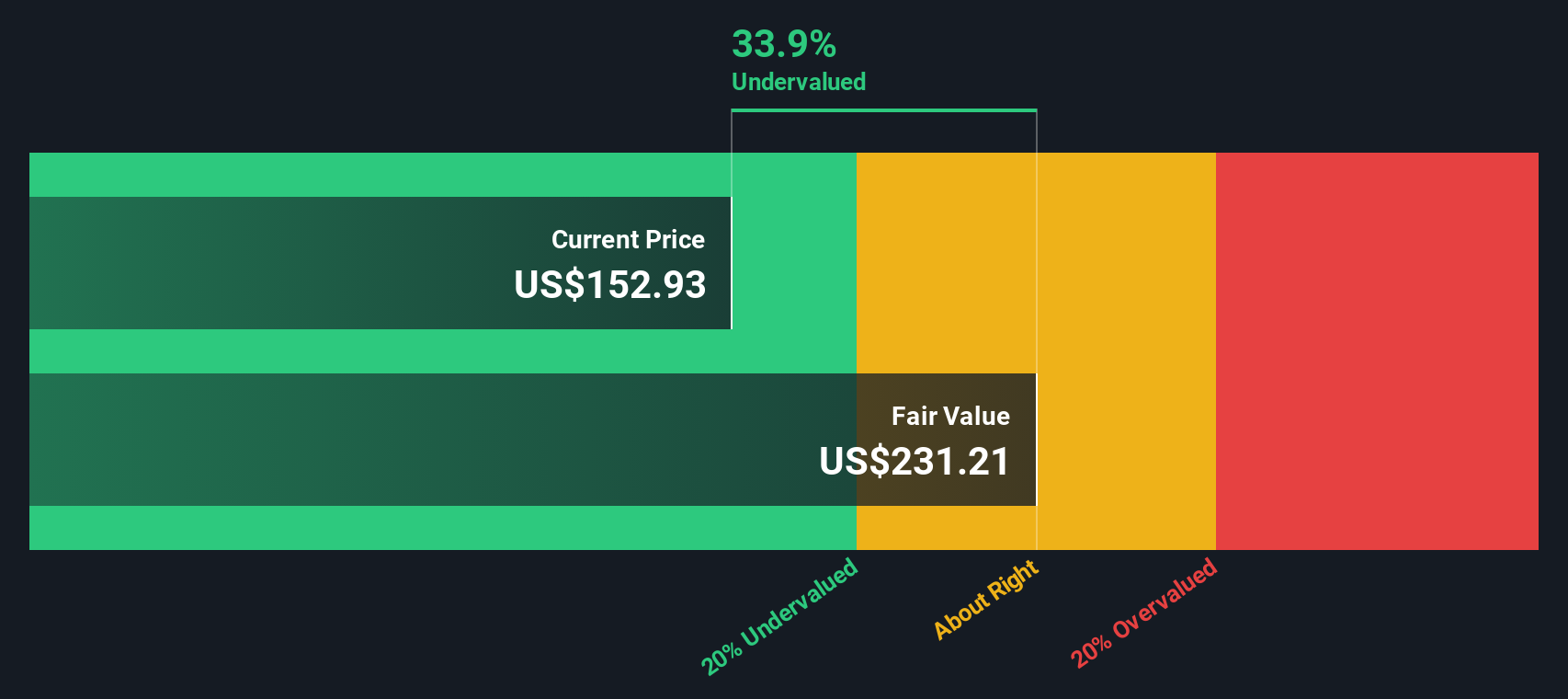

Based on these projections and the 2 Stage Free Cash Flow to Equity method, Modine’s intrinsic value is calculated at $231.25 per share. This represents a discount of 33.7% compared to the current market price, suggesting the stock trades well below what its future cash flows might warrant.

In summary, the DCF model signals a strong undervaluation, driven by robust expected cash flow growth in the coming years.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Modine Manufacturing is undervalued by 33.7%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Modine Manufacturing Price vs Earnings (P/E)

The Price-to-Earnings ratio, or P/E, is a widely used valuation metric for profitable companies like Modine Manufacturing because it connects a company’s market price directly to its actual earnings. Investors often use the P/E ratio to gauge how much the market is willing to pay today for a dollar of future earnings. This makes it particularly effective for analyzing established businesses in the Auto Components sector.

Growth expectations and perceived risk play a major role in determining what a “normal” or “fair” P/E ratio should be. Companies with strong growth prospects or lower risk profiles usually warrant higher P/E multiples, while those facing uncertainty or slower growth trade at lower ones.

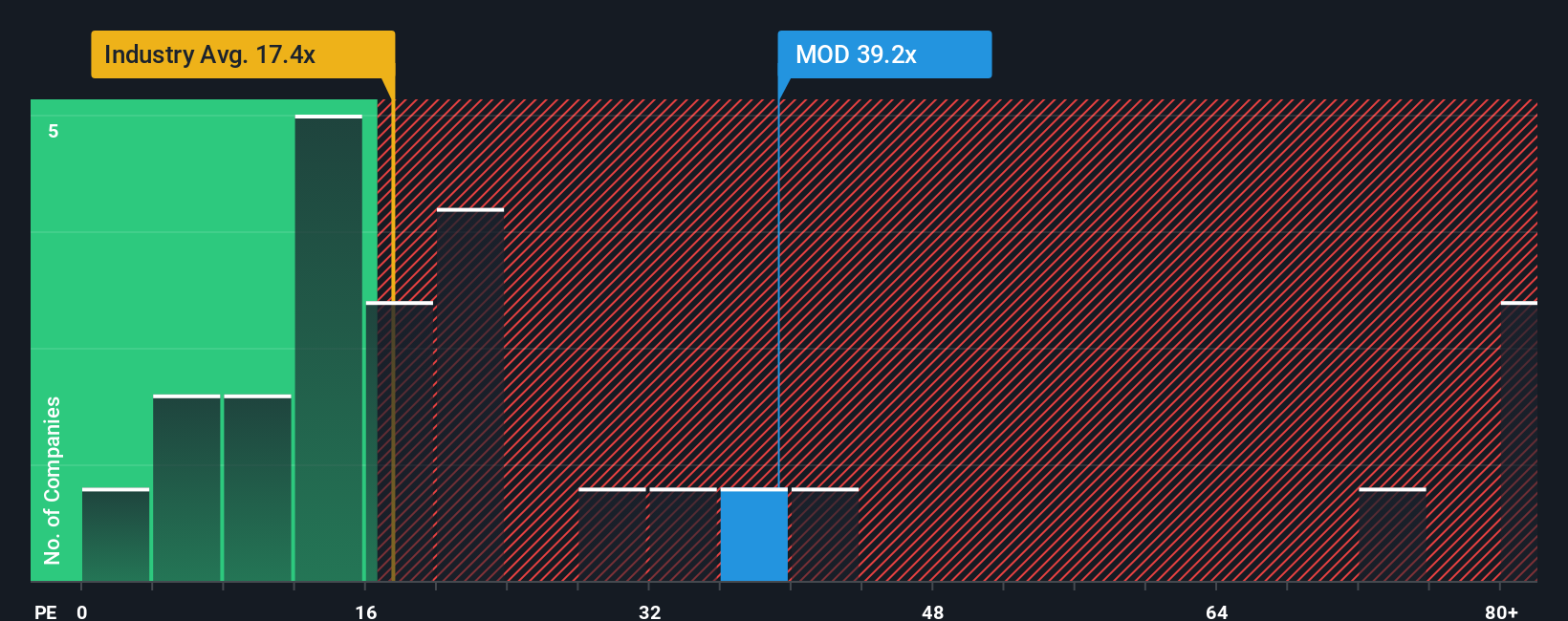

Right now, Modine Manufacturing trades at a P/E ratio of 43.3x. This stands well above the industry average of 18.7x and the peer average of 26.4x, reflecting investors’ optimism about Modine’s future. However, relying solely on industry or peer comparisons can be misleading because they do not take the company’s unique characteristics into account.

That is where Simply Wall St's “Fair Ratio” comes in. The Fair Ratio is a proprietary benchmark that considers not just industry norms, but also factors such as Modine’s profit margins, future earnings growth, market cap, and specific risks. In Modine’s case, the Fair Ratio is calculated at 30.1x, reflecting what would be reasonable for the business given its profile.

Given Modine’s current P/E multiple of 43.3x versus its Fair Ratio of 30.1x, the stock appears overvalued on this metric. The difference suggests the market may be pricing in expectations that are even more optimistic than justified by the company’s fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1414 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Modine Manufacturing Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company, an informed, personal perspective that sits behind the numbers, including your assumed fair value and your estimates of future revenue, earnings, and margins.

Narratives connect the dots between what you believe is driving a company’s future, your forecasts, and a calculated fair value for its shares. These stories are not just for experts, as any investor can create, browse, and adjust Narratives in the Community page on Simply Wall St, used by millions of investors globally.

With Narratives, your investment decisions become more dynamic; you can see how your fair value compares to the current share price, helping you decide when to buy or sell. Because Narratives are updated live as news or earnings reports come in, they always reflect the latest facts and expectations.

For example, some investors believe Modine's expansion into data center cooling will drive revenues above $4.0 billion with high margins, supporting a fair value as high as $185 per share. More cautious investors, wary of execution risks, set their Narrative-based fair value at just $145 per share.

Do you think there's more to the story for Modine Manufacturing? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal