Mobileye (MBLY): Assessing Valuation After India ADAS Deal and Improved Q3 Results

Mobileye Global (MBLY) made headlines with two key updates: the company signed a Memorandum of Understanding with VVDN Technologies to develop ADAS tech for Indian automakers, and released quarterly earnings showing sales growth and a slimmer net loss.

See our latest analysis for Mobileye Global.

Mobileye’s push into India and signs of narrowing losses have yet to reignite the stock’s momentum, with the share price down over 34% year-to-date and the one-year total shareholder return at negative 15.5%. While deal news and improving financials point to longer-term growth potential, near-term share price performance has remained muted amid shifting industry sentiment.

If Mobileye’s global moves have you watching the sector, it might be time to explore other auto innovators. See the full list via See the full list for free.

With shares trading well below analyst price targets, improved financials, and new international partnerships, is Mobileye a bargain poised for a rebound, or is the market already factoring in its next wave of growth?

Most Popular Narrative: 31.8% Undervalued

Analyst consensus points to a fair value comfortably above Mobileye's last close price. Major growth assumptions drive a substantial upside case, setting the stage for a debate on whether these expectations can become reality.

The partnership with leading platforms like Uber and Lyft for the integration of Mobileye Drive is positioned to significantly enhance Mobileye’s revenue streams through upfront sales and recurring license fees tied to utilization rates.

Want to know the narrative behind this bold price target? Long-term revenue levers and a profit turnaround are just the start. The real surprise lies in the ambitious assumptions about future margins and market expansion that underpin this fair value. Discover what’s fueling the high stakes optimism and see if the numbers match the hype.

Result: Fair Value of $19.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing trade tensions and slower than expected adoption by automakers could quickly reshape Mobileye’s growth outlook and weigh on future earnings potential.

Find out about the key risks to this Mobileye Global narrative.

Another View: Multiples Paint a More Cautious Picture

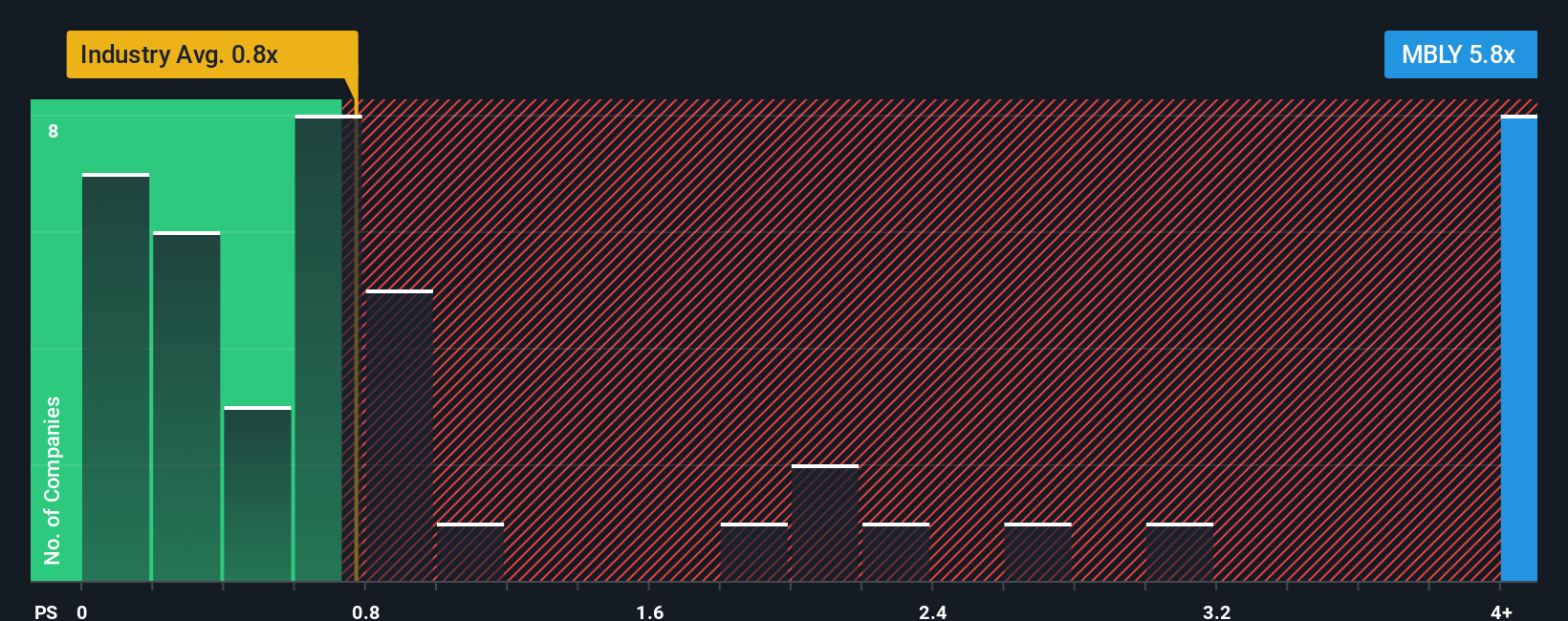

Looking beyond analyst forecasts, comparing Mobileye’s price-to-sales ratio of 5.5x to the US Auto Components industry average of 0.7x and a peer group average of 1.3x highlights just how expensive the shares look on this measure. The fair ratio, suggested at 4.3x, also sits well below today’s valuation. Does this multiples-based risk signal a longer road to a real bargain?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mobileye Global Narrative

If you want to challenge these viewpoints or dig deeper into the numbers yourself, shaping your own perspective takes just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Mobileye Global.

Looking for More Investment Ideas?

Smart investors know where the real opportunities hide. Expand your horizon and get ahead of the crowd with these unique angles before everyone else catches on:

- Tap into strong income potential by targeting stability and market-beating yields with these 22 dividend stocks with yields > 3%.

- Spot undervalued gems that may be flying below Wall Street’s radar by taking a closer look at these 840 undervalued stocks based on cash flows.

- Ride the hottest wave in tech by backing visionaries powering tomorrow’s breakthroughs with these 26 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal