Atlas Energy Solutions (AESI): Evaluating Valuation Ahead of Q3 Earnings and Recent Leadership Changes

Atlas Energy Solutions (AESI) heads into its Q3 2025 earnings report just days after the departure of its EVP & President, Sand and Logistics. This has sparked fresh discussion on leadership stability and business direction.

See our latest analysis for Atlas Energy Solutions.

Atlas Energy Solutions has caught renewed attention following the executive change, coming off a sharp 17.8% share price return over the past week yet still down more than 46% year-to-date. Momentum has built up quickly in the short term, but its 1-year total shareholder return is a disappointing -31.2%, which highlights lingering concerns even amid the recent rally.

If the swift shift in leadership at Atlas has you wondering what else is on the move, it might be the perfect moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares still trading at a notable discount to analyst price targets and uncertainties surrounding recent leadership changes, the key question remains: is Atlas Energy Solutions now undervalued, or is the market already factoring in its growth prospects?

Most Popular Narrative: 9.5% Undervalued

Atlas Energy Solutions is trading at $12.38, while the most widely followed narrative places its fair value at $13.68. This suggests room for upside, especially as analysts focus on sector shifts and business diversification as pivotal factors.

The launch of Atlas' Power business (following the Moser Energy Systems acquisition) offers a new, diversifying growth engine with exposure to fast-growing commercial, industrial, and technology sectors that are signing multi-year contracts beyond traditional oil and gas. This reduces revenue cyclicality and supports long-term earnings stability.

Curious what really powers this price target? The narrative hints at breakthrough profit margins and expansion plans well beyond just oil and gas. Think future cash flow, operational leverage, and unexpected earnings upgrades. Only the full narrative reveals how it all adds up.

Result: Fair Value of $13.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, prolonged weakness in completions activity or further declines in Permian sand prices could quickly undermine the current valuation case for Atlas Energy Solutions.

Find out about the key risks to this Atlas Energy Solutions narrative.

Another View: Multiples Raise Questions

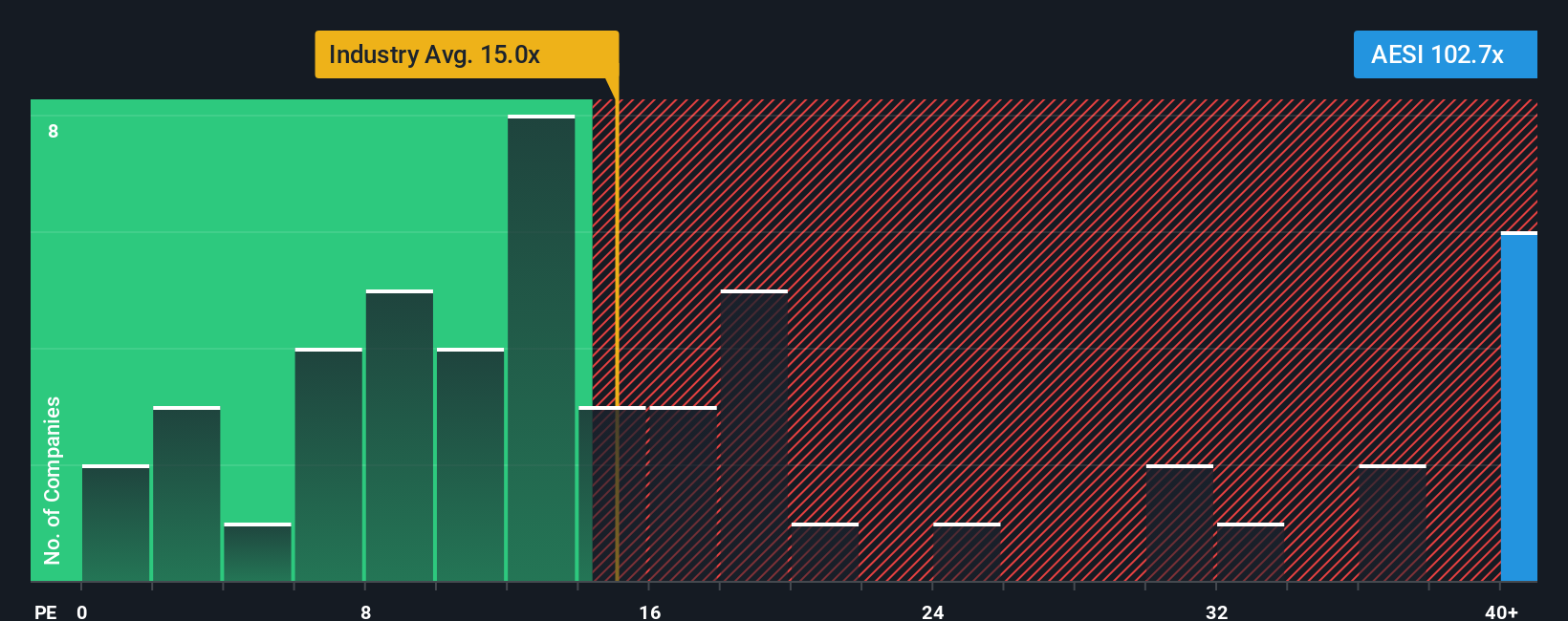

Taking a different approach, Atlas Energy Solutions trades at a price-to-earnings ratio of 109.6x. This is considerably higher than both the industry average of 16.7x and the fair ratio of 37.1x. This signals that the shares are expensive by this measure and may carry higher valuation risk. Does this premium suggest resilience, or could the share price be vulnerable?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Atlas Energy Solutions Narrative

If you want to dig into the numbers yourself or see things from a different angle, you can build your own perspective in just a few minutes. Do it your way

A great starting point for your Atlas Energy Solutions research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead by choosing investment opportunities that match your strategy and fit your risk-reward comfort zone. Don’t let another opportunity slip away.

- Grow your portfolio with dependable income by checking out these 22 dividend stocks with yields > 3% with strong yields above 3%.

- Tap into the next wave of artificial intelligence progress with these 26 AI penny stocks to gain exposure to innovative AI businesses shaping tomorrow’s economy.

- Take advantage of overlooked value opportunities and find your edge among these 840 undervalued stocks based on cash flows, based on solid projected cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal