What Halozyme Therapeutics (HALO)'s Insider Sales and Diverging Institutional Moves Mean For Shareholders

- Halozyme Therapeutics announced the upcoming release of its quarterly earnings report on Monday, November 3rd, following recent insider sales of over 300,000 shares and significant trading activity by institutional investors.

- An interesting development is the divergence among hedge funds and asset managers, with key players such as BlackRock and JPMorgan reducing their positions while others like Arrowstreet Capital and UBS Group have increased their holdings.

- With the quarterly results pending and insider sales at the forefront, we’ll explore how shifting institutional sentiment could influence Halozyme’s investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Halozyme Therapeutics Investment Narrative Recap

If you’re considering Halozyme Therapeutics as an investment, the big picture centers on the continued uptake of subcutaneous drug delivery enabled by the ENHANZE platform, which promises recurring royalties as more pharmaceutical partners gain regulatory approvals for these therapies. The upcoming quarterly earnings release and reports of significant insider selling may influence short-term sentiment, but unless earnings disappoint or major partner revenues decline, they are unlikely to alter the stock’s most important near-term catalyst: broader adoption and indication expansion by key partners. However, persistent insider sales paired with shifting institutional positioning remain a potential flag for investors, particularly as concentrated revenue from a handful of partners continues to expose Halozyme to top-line volatility risk.

Among recent announcements, Halozyme’s EC approval for VYVGART® in CIDP highlights continued growth opportunities for the ENHANZE platform and directly supports the company’s key catalyst of expanding royalty streams through new partner drug launches. As these product approvals accumulate, they reinforce the investment case, but also underline how dependent results are on the ongoing commercial success of a select roster of therapies.

By contrast, investors should be mindful of the impact that any negative shift in commercial momentum among Halozyme’s largest partners could have on revenue visibility…

Read the full narrative on Halozyme Therapeutics (it's free!)

Halozyme Therapeutics is projected to reach $2.0 billion in revenue and $1.1 billion in earnings by 2028. This outlook assumes annual revenue growth of 18.7% and represents an earnings increase of $542.7 million from current earnings of $557.3 million.

Uncover how Halozyme Therapeutics' forecasts yield a $75.44 fair value, a 16% upside to its current price.

Exploring Other Perspectives

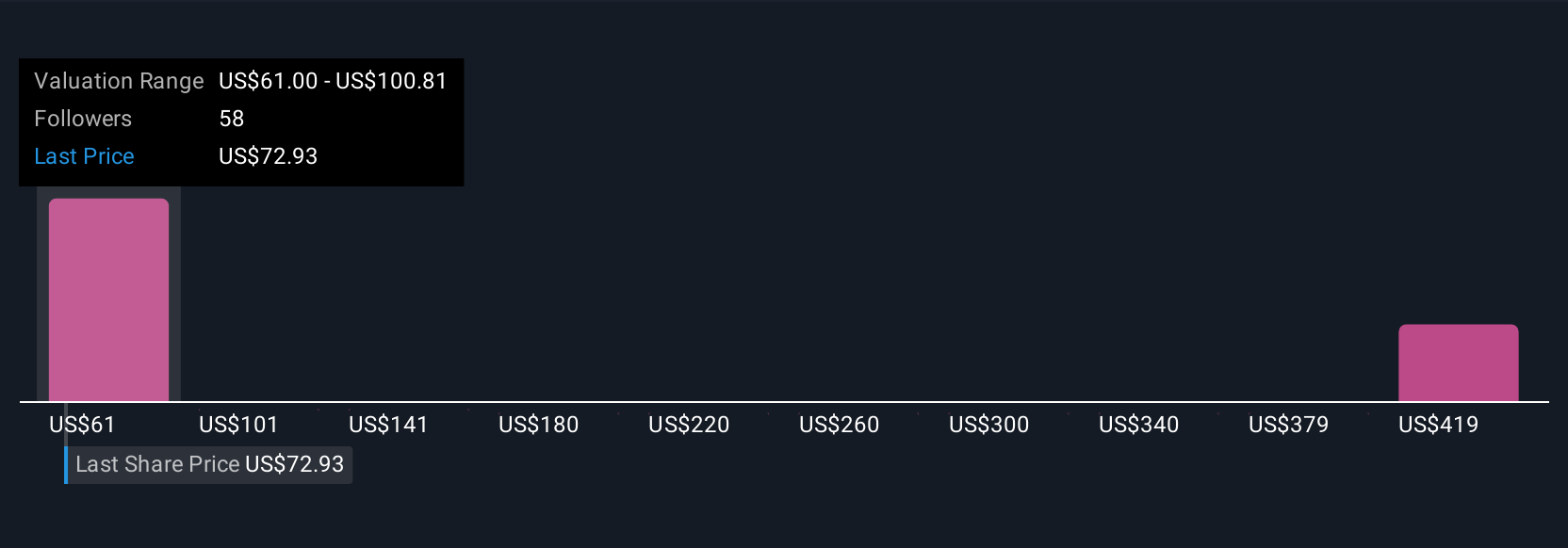

Simply Wall St Community members produced eight individual fair value estimates for Halozyme, ranging from US$70.33 to US$420.35 per share. With such diversity of opinion, keep in mind that the company’s ongoing reliance on major partner performance remains a key consideration shaping future outcomes, explore multiple viewpoints before making your own assessment.

Explore 8 other fair value estimates on Halozyme Therapeutics - why the stock might be worth just $70.33!

Build Your Own Halozyme Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Halozyme Therapeutics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Halozyme Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Halozyme Therapeutics' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal