Gentherm (THRM) Valuation in Focus After Raised Full-Year Earnings Guidance and Q3 Results

Gentherm (THRM) just released its third quarter results and raised its full-year earnings outlook, signaling a more optimistic business outlook from management even as net income saw a modest year-over-year decline.

See our latest analysis for Gentherm.

Gentherm’s raised earnings outlook has sparked renewed interest, with its share price gaining 13.7% over the last 90 days. However, the 1-year total shareholder return remains negative at -14.95%, reflecting challenges the company continues to face despite recent momentum.

If Gentherm’s improving outlook has you watching the auto industry, consider checking out See the full list for free. for other companies showing signs of acceleration.

The question now is whether Gentherm’s recent surge and raised guidance signal an undervalued opportunity for long-term investors, or if the market has already priced in the company’s future growth potential.

Most Popular Narrative: 18.6% Undervalued

Gentherm's widely followed narrative puts fair value at $45.20, well above the last close price of $36.80. That gap sets the stage for a deeper dive into what could fuel a re-rating in the stock.

Accelerating adoption of comfort and wellness features (like pneumatic lumbar, massage, and climate-controlled seating) by mainstream, high-volume vehicle platforms, demonstrated by new multi-year awards from Ford, GM, Hyundai, and multiple Chinese OEMs, suggests higher content-per-vehicle and robust revenue growth ahead as these features become industry standard rather than luxury-only.

Wondering what powers such an optimistic thesis? The bold assumptions behind this price target include rising global automotive content, margin expansion, and a long-term profit runway that few investors see coming. Want the full breakdown of these drivers? The details behind this valuation might just surprise you.

Result: Fair Value of $45.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressure and Gentherm’s limited market share in Asia could disrupt these bullish forecasts if not addressed in the coming quarters.

Find out about the key risks to this Gentherm narrative.

Another View: Is Gentherm Overpriced on Earnings?

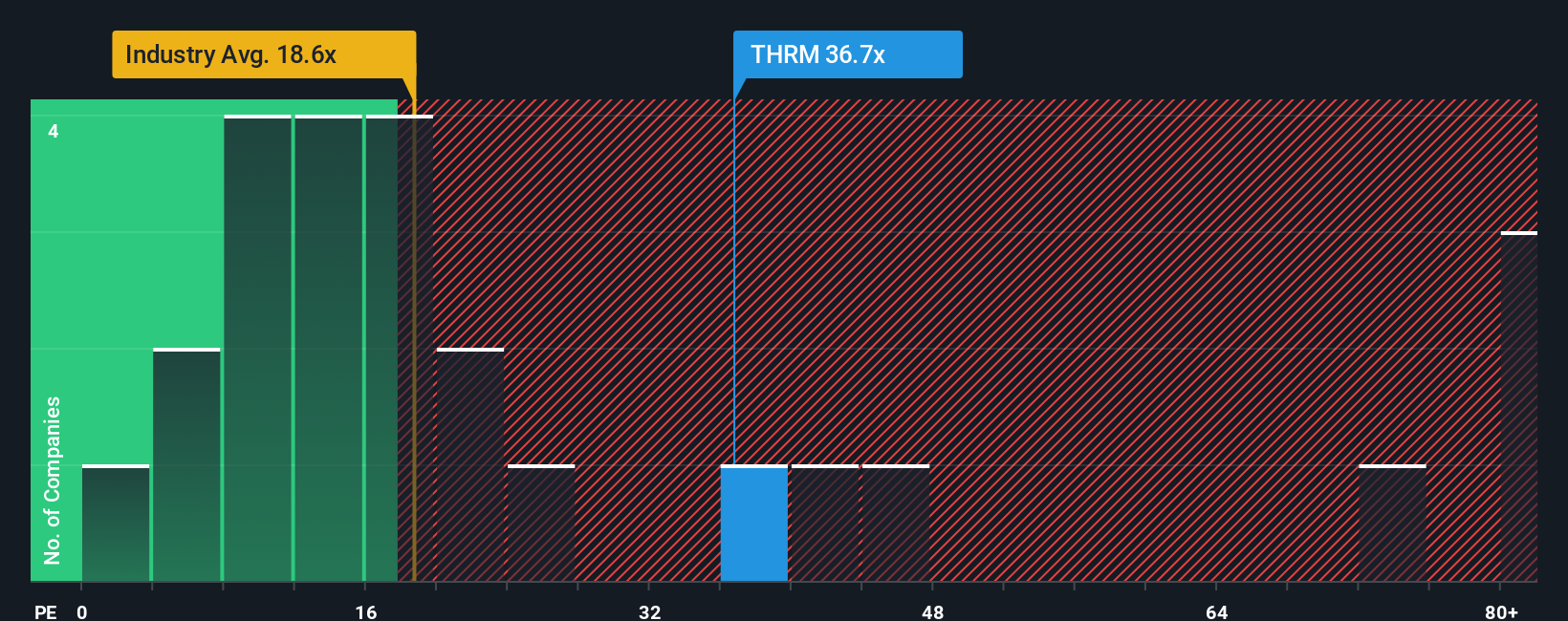

While analyst fair value and growth narratives look positive, Gentherm's current price-to-earnings ratio (36.7x) stands out as high compared to both the industry average (18.7x) and similar peers (17.8x). Even compared to its fair ratio of 26.2x, Gentherm appears expensive, raising questions about valuation risk if earnings forecasts stumble. Could these elevated multiples make the stock vulnerable if growth disappoints?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Gentherm Narrative

If you see Gentherm’s story differently or want to run your own analysis, you can craft a personalized narrative in just a few minutes, too. Do it your way.

A great starting point for your Gentherm research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never limit themselves to one opportunity when so many promising stocks are within reach. Don’t let the next big winner slip by you. Check out these unique angles for your portfolio today:

- Boost your passive income potential and tap into steady yields by reviewing these 22 dividend stocks with yields > 3% showing reliable payouts above 3%.

- Ride the wave of artificial intelligence and uncover exciting up-and-comers transforming tomorrow’s tech with these 26 AI penny stocks.

- Capitalize on attractive valuations and seek winning opportunities among these 840 undervalued stocks based on cash flows that our models flag for their growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal