Johnson & Johnson (JNJ): Is There More Value Ahead After a Steady Climb?

Johnson & Johnson (JNJ) shares have held steady over the past month, showing a slight uptick amid muted headlines for the healthcare giant. Investors may be watching closely for catalysts that could shape the next move in the stock’s trajectory.

See our latest analysis for Johnson & Johnson.

While Johnson & Johnson has seen a modest lift in its share price over the last quarter, the real story is the company’s impressive 31.14% year-to-date share price return. This has built notable momentum for investors who stuck with it. Over the past five years, total shareholder returns of 53.13% highlight how the stock has delivered steady value through different market cycles. This suggests resilient fundamentals instead of just market hype.

If you’re looking to see how the wider healthcare sector is performing, discover more movers and innovators with our See the full list for free.

With Johnson & Johnson’s strong returns clear for all to see, the key question now is whether current prices still offer upside for investors or if the market has already factored in the company’s future growth potential.

Most Popular Narrative: 4.6% Undervalued

Compared to the recent close of $188.87, the popular narrative's fair value estimate of $198.03 suggests the stock has room to run. This sets the stage for a closer look at the forces shaping analyst expectations and price targets.

There is consensus that the upcoming separation of the orthopedics division is transforming Johnson & Johnson into a higher-margin, faster-growing enterprise. This move is seen as having potential for notable revenue and margin improvement.

Want the full story? This narrative hinges on breakthrough strategic shifts, ambitious projections, and a key assumption about where margins are going next. If you crave the behind-the-scenes financial logic that explains this value call, you need to see the numbers for yourself. Dive in and uncover the bold expectations fueling the narrative's fair value.

Result: Fair Value of $198.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing litigation and potential biosimilar competition could quickly change investor sentiment and present challenges, even for the most optimistic forecasts for Johnson & Johnson.

Find out about the key risks to this Johnson & Johnson narrative.

Another View: What Does the SWS DCF Model Say?

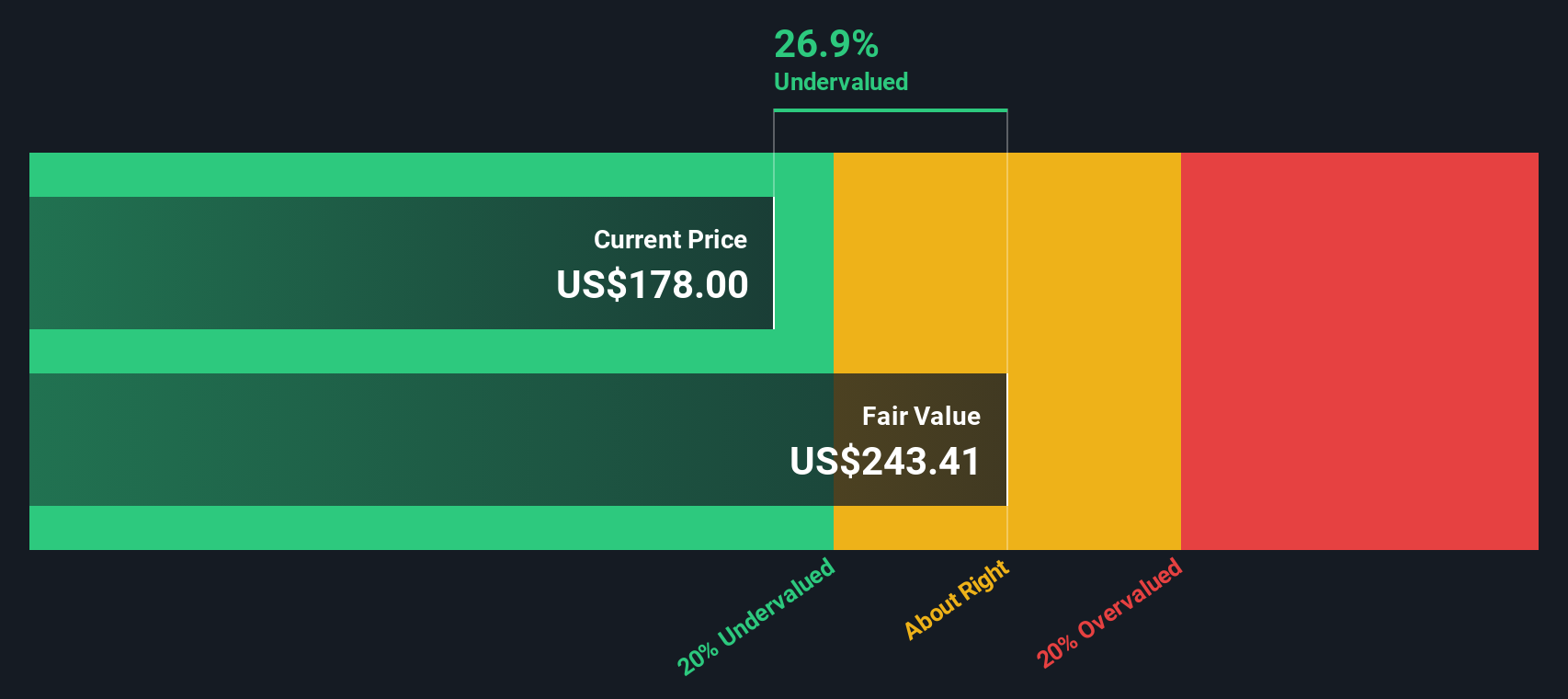

While the favored narrative leans on analyst target prices and earnings multiples, our SWS DCF model tells a different story. It implies Johnson & Johnson is trading significantly below its estimated fair value, which suggests much more upside than current analyst consensus. Which view offers the clearer signal for investors?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Johnson & Johnson Narrative

If you want to dig into the details and shape your own view of Johnson & Johnson, building a custom narrative only takes a few minutes. The story is truly yours – Do it your way

A great starting point for your Johnson & Johnson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t just follow the crowd when opportunities are all around you. Smart investors use the power of Simply Wall Street’s screeners to stay ahead. Missing out means leaving growth on the table.

- Spot exceptional growth stories by checking out these 26 AI penny stocks gaining traction thanks to advances in artificial intelligence and industry-disrupting innovation.

- Maximize your income with these 22 dividend stocks with yields > 3% that offers yields above 3 percent from resilient, cash-generating businesses.

- Stay ahead of the curve by tracking these 81 cryptocurrency and blockchain stocks poised to benefit from the accelerating adoption of digital assets and blockchain-based solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal