Wayfair (W): Assessing Valuation After Strong Q3 Results and Raised Outlook

Wayfair (W) delivered accelerated revenue growth, expanding margins, and strong free cash flow in its third quarter. This drove the stock to a new 52-week high as investors responded to upbeat guidance and confidence in ongoing momentum.

See our latest analysis for Wayfair.

Wayfair’s stock has been on a tear, climbing over 120% so far this year and setting new highs as upbeat earnings and confident guidance suggest a turnaround gaining significant momentum. While the five-year total shareholder return remains deep in the red, the 157% total return for the past year highlights how rapidly sentiment has shifted as the company regains market share and investors take interest in the new growth narrative.

If you want to spot other stocks showing major momentum shifts, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

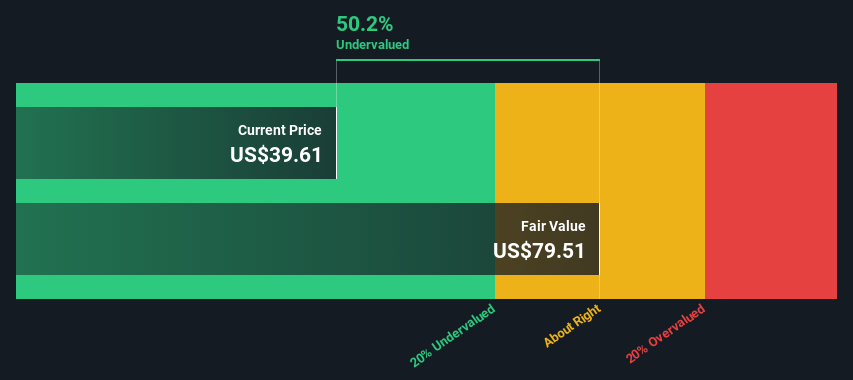

Yet with shares up more than 120% this year and trading near all-time highs, it raises a critical question for investors: is Wayfair still undervalued, or is the market already pricing in all of its future growth?

Most Popular Narrative: 21.9% Overvalued

Wayfair’s most widely followed fair value estimate is $84.90, noticeably below the latest closing price of $103.51. This raises doubts about whether recent gains are sustainable at current levels.

Wayfair’s proprietary logistics network, CastleGate, is expected to provide a meaningful growth unlock by improving efficiency and customer experience. This can positively impact revenue growth through higher conversion rates and potentially improved net margins.

Curious which financial assumptions power this call? The analyst narrative counts on faster margin improvements and higher customer engagement. Want inside access to the projections supporting that number? Discover the growth levers and profit targets woven into this valuation outlook.

Result: Fair Value of $84.90 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in the housing market and intensifying international competition could quickly challenge the bullish expectations for Wayfair’s future earnings growth.

Find out about the key risks to this Wayfair narrative.

Another View: Discounted Cash Flow Says Undervalued

Looking at Wayfair through the lens of the SWS DCF model tells a different story. This method suggests the stock is actually undervalued, with its current price of $103.51 sitting well below a fair value estimate of $202.74. That is a significant gap. So what is the market missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Wayfair Narrative

If these conclusions do not align with your perspective, you can dive into the data and test your own thesis in just a few minutes. Do it your way

A great starting point for your Wayfair research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Put yourself ahead of the crowd by tapping into forward-looking investment opportunities. These spotlights could lead you to your next winning trade, but only if you take action now.

- Uncover high-yield potential by reviewing these 22 dividend stocks with yields > 3%, which offer reliable income streams, solid fundamentals, and stable cash flows.

- Target tomorrow’s breakthroughs by reviewing these 26 AI penny stocks, which are poised to benefit from artificial intelligence innovations and digital transformation.

- Capitalize on the next financial revolution by examining these 81 cryptocurrency and blockchain stocks, which are harnessing the power of cryptocurrencies and blockchain technology for dynamic growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal