Is Baidu a Hidden Bargain After Its 14.9% Dip and AI Investments in 2025?

- Curious whether Baidu's stock is a hidden bargain or priced for perfection? You're not alone, and a closer look at its valuation might surprise you.

- After a strong run so far this year with a 46.2% rise year-to-date, Baidu cooled off recently, dipping 14.9% over the last month. This could signal shifting sentiment or new risks emerging.

- Recent headlines highlight the company's ongoing investments in artificial intelligence and cloud services, which continue to attract both buzz and speculation about future growth. These developments have sparked fresh debates, with analysts discussing how Baidu's innovation push could set it apart from both domestic and international rivals.

- On our simple 6-point valuation check, Baidu earns a score of 5 out of 6, suggesting it passes most key value tests. Next, I’ll break down how different valuation approaches stack up for Baidu, and at the end we will dig into the method that could matter most for long-term investors.

Find out why Baidu's 34.3% return over the last year is lagging behind its peers.

Approach 1: Baidu Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) valuation estimates what a company’s shares are really worth by projecting its future cash flows and discounting them back to today’s value. This approach aims to capture both near-term analyst forecasts and longer-term growth projections, giving a holistic view of potential intrinsic worth.

Baidu’s latest twelve months (LTM) Free Cash Flow came in at negative CN¥10.4 Billion, reflecting heavy reinvestment and volatility in core operations. However, looking forward, analysts expect a turnaround, projecting Free Cash Flow to reach over CN¥27.4 Billion by the end of 2028. Projections extending ten years out show continued strong growth, ending at roughly CN¥36.0 Billion in 2035. These longer-term forecasts rely on automated extrapolation beyond the 5-year consensus.

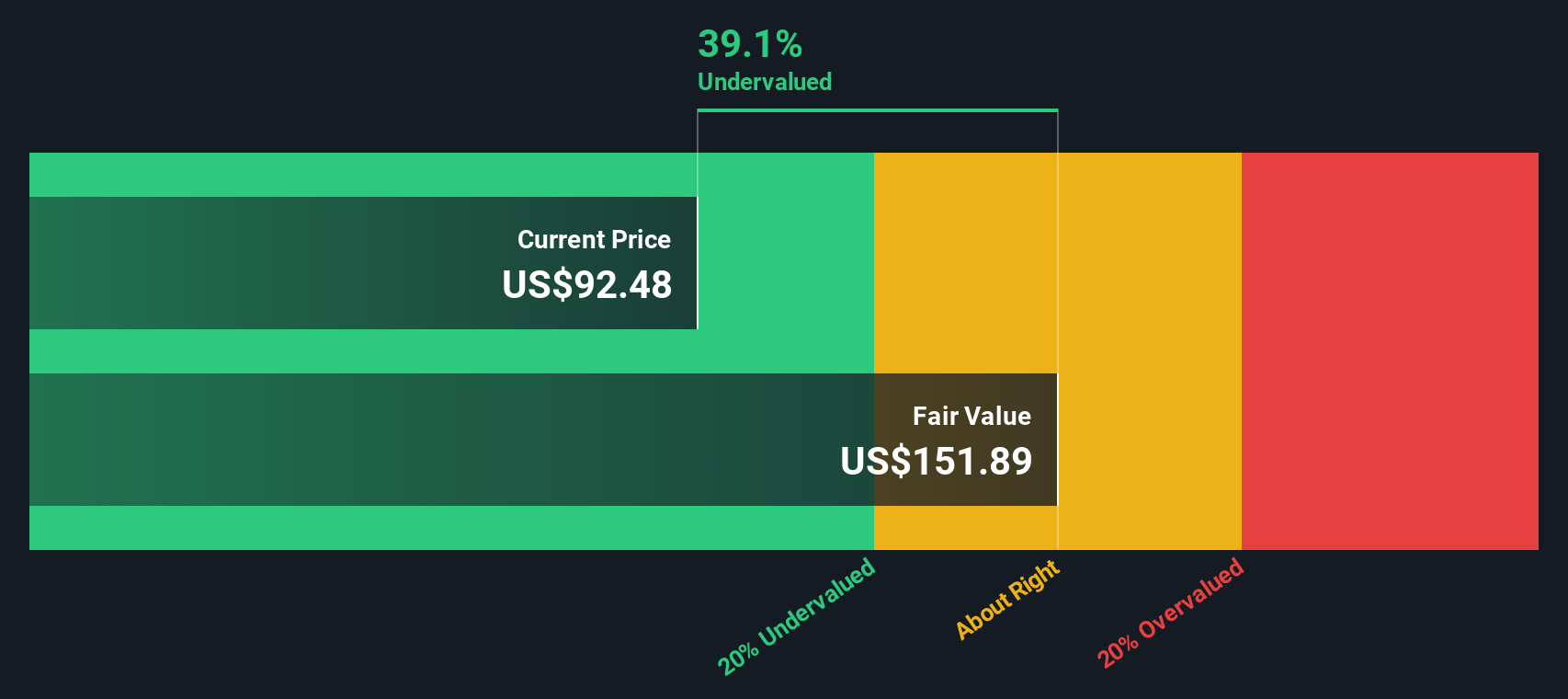

Applying this 2 Stage Free Cash Flow to Equity model, Baidu’s intrinsic value is estimated at $175.16 per share. With the current market price reflecting a 31.0% discount to this intrinsic value, the numbers suggest Baidu stock is attractively undervalued based on projected future cash flows in CN¥.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Baidu is undervalued by 31.0%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Baidu Price vs Earnings

The Price-to-Earnings (PE) ratio is a time-tested valuation tool for profitable companies like Baidu. Since it directly measures what investors are willing to pay today for a dollar of future earnings, it is especially useful when the business has consistent profitability and clear earnings visibility.

A "normal" or "fair" PE ratio varies from company to company. Generally, the PE ratio increases with high growth potential and decreases when risks or uncertainty rise. Stronger expected earnings growth or resilient profit margins often justify a higher PE, while higher perceived risk or industry headwinds tend to limit valuation multiples.

Baidu currently trades at a PE ratio of 10.84x. This is well below both the Interactive Media and Services industry average at 16.49x and the peer average of 44.56x. At first glance, this discount may raise eyebrows; however, headline comparisons can miss important fundamental differences.

That is where Simply Wall St's "Fair Ratio" comes in. This proprietary metric estimates the PE Baidu should trade at, factoring in its unique growth trajectory, profit margins, market cap, industry context, and company-specific risk. By building these variables into a holistic measure, the Fair Ratio of 18.60x offers a more tailored benchmark than relying solely on broad industry or peer averages.

Comparing Baidu's actual PE (10.84x) to its Fair Ratio (18.60x), the stock currently looks undervalued on this basis. This substantial gap suggests that, even after accounting for company-specific fundamentals and risk profile, Baidu's earnings are being valued more conservatively than they likely deserve.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Baidu Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own perspective or “story” about a company, connecting your view of Baidu’s strategy, future growth, and potential risks directly to concrete financial forecasts like revenue, profit margins, and intrinsic value. Narratives move beyond just numbers by letting you link your assumptions and reasoning to the performance you expect, bridging the gap between headlines, forecasts, and what you think the company is really worth.

On Simply Wall St’s Community page, anyone can create or follow Narratives. Millions of investors already use them to map out how fair value compares with the current share price, decide when an opportunity looks attractive, or recognize when it is time to watch and wait. Because they update dynamically whenever new information appears, Narratives keep your research fresh and responsive, whether that news is a quarterly earnings report or a sudden shift in Baidu’s AI strategy.

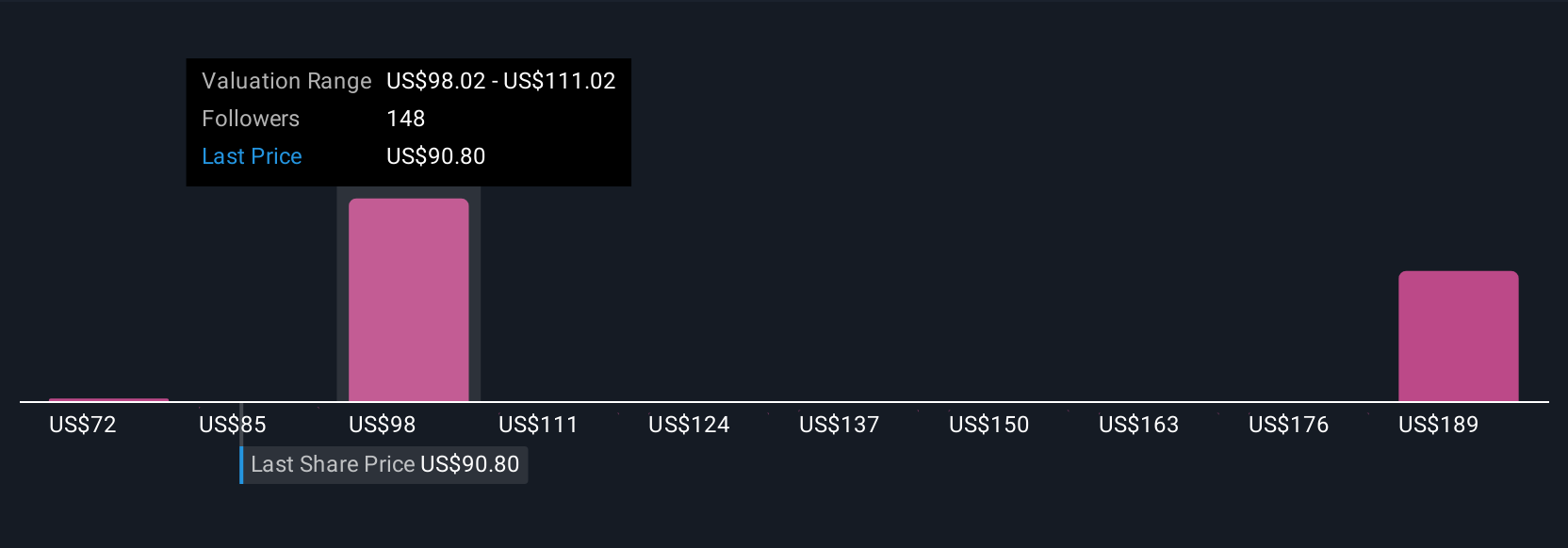

For Baidu, one investor’s Narrative might focus on bullish AI, cloud leadership, and global expansion, leading them to forecast a fair value near $145.76. Another, focused on monetization delays or competition, could set a cautious $71.14 fair value. Narratives give you the tools to build and test your own view, not just follow the crowd.

Do you think there's more to the story for Baidu? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal