A Fresh Look at Materion (MTRN) Valuation After Recent Share Price Pullback

See our latest analysis for Materion.

Materion’s recent share price has pulled back from its highs, dipping 14.7% over the last week after months of solid gains. Even with this short-term setback, the stock still boasts a strong year-to-date share price return of 20.5%. Its total shareholder return over the last three and five years, at 61.4% and 125.6% respectively, shows long-term momentum is clearly intact. Investors seem to be recalibrating expectations, weighing recent growth against the company’s current valuation.

If today’s movements have you rethinking your watchlist, now might be the perfect time to see what’s out there and discover fast growing stocks with high insider ownership

With Materion trading at a significant discount to both its analyst target and estimated intrinsic value, investors face a key question: is there real upside from here, or has the market already factored in the company’s future growth?

Most Popular Narrative: 20.2% Undervalued

With Materion’s narrative fair value sitting well above the recent close, the gap is getting attention, especially as the market digests both upside drivers and emerging risks. Here is one perspective that is fueling the current outlook.

“Accelerating demand in the semiconductor sector, driven by increasing wafer starts, growth in data storage and communication devices, and the recent acquisition of Konasol (expanding footprint in Asia), positions Materion to capture a higher share of a rapidly expanding global market. This supports sustained top line revenue growth over the next several years as new capacity ramps by 2026.”

Want to know the financial engine behind this premium price target? The consensus fair value is powered by surprisingly bold forecasts for growth, margins, and future market position. The hidden catalyst is a chain reaction of profit and revenue expectations most investors will not spot at first glance.

Result: Fair Value of $143.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent uncertainty around demand and exposure to procurement risks, particularly in key Asian markets, could quickly alter this optimistic outlook.

Find out about the key risks to this Materion narrative.

Another View: Are Multiples Telling a Different Story?

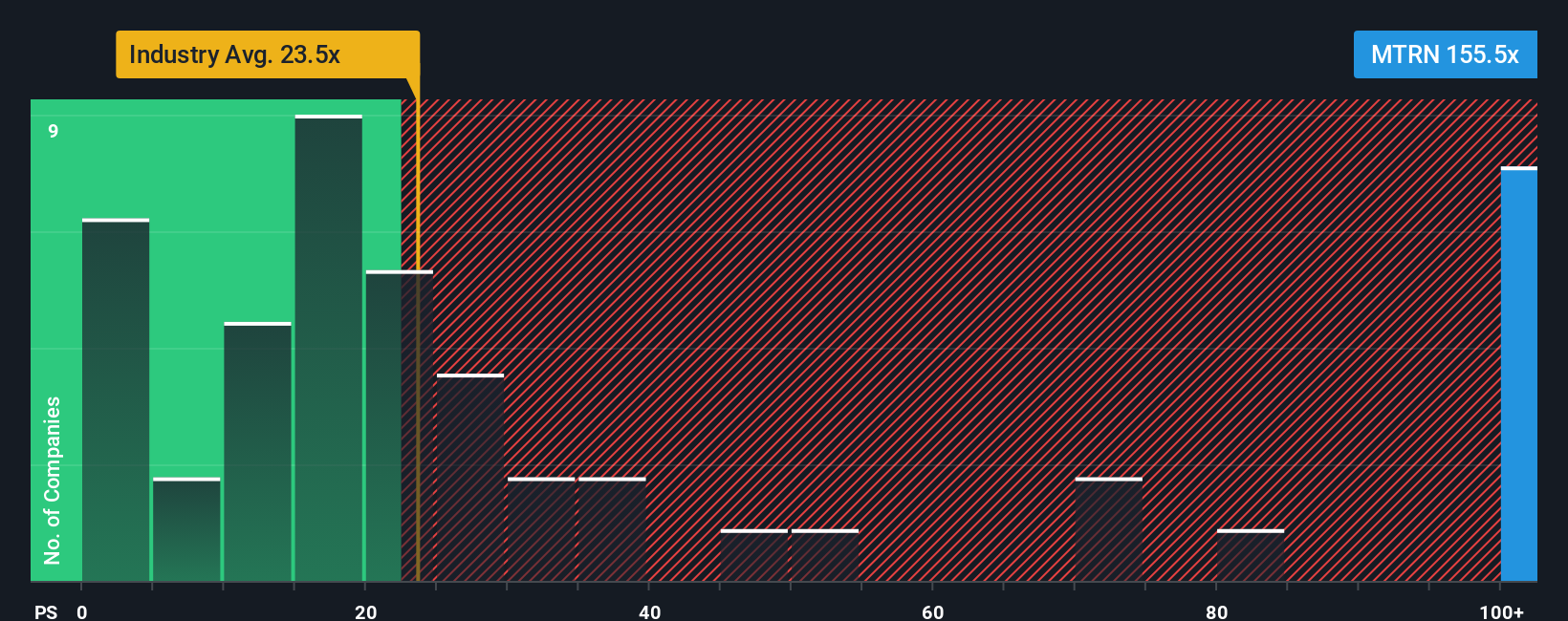

Looking at Materion through the lens of its price-to-earnings ratio raises some doubts. Trading at 122.5x, this is far higher than both the industry average of 24.1x and the peer group average of 73.5x. The fair ratio is just 37x, which suggests that the current valuation could be stretched. Does this signal caution for anyone chasing value here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Materion Narrative

Want to dig deeper or put your own spin on what the numbers reveal? Crafting your own take only takes a few minutes. Do it your way

A great starting point for your Materion research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

The smartest investors cast a wider net. Get ahead of the crowd and uncover exciting opportunities in sectors and trends that could power your portfolio forward.

- Supercharge your search with these 838 undervalued stocks based on cash flows that offer solid fundamentals and attractive prices. This can put you in front of overlooked gems.

- Capitalize on innovation by targeting these 26 AI penny stocks leading breakthroughs in artificial intelligence, automation, and digital transformation.

- Boost your income potential by checking out these 23 dividend stocks with yields > 3% with high, reliable yields that can strengthen your returns through any market cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal