A Fresh Look at Mister Car Wash (MCW) Valuation Following Strong Q3 Earnings and Upbeat Guidance

Mister Car Wash (MCW) delivered third-quarter results that beat analyst expectations for both revenue and earnings. A 6% jump in revenue and record-high adjusted EBITDA margin fueled optimism among investors this week.

See our latest analysis for Mister Car Wash.

The upbeat quarterly results sparked a major rebound in Mister Car Wash’s share price this week, with an 11.1% 7-day share price return as investors welcomed both the revenue beat and optimistic guidance. Still, after a tough stretch earlier this year, total shareholder return over the past 12 months remains down 29.5%, which reminds long-term holders that momentum is just now starting to rebuild.

If this turnaround has you curious about other pockets of growth, now may be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading well below their average analyst price targets and forward earnings growth expected, is Mister Car Wash an undervalued play in recovery, or is the market already pricing in its future upside?

Most Popular Narrative: 25.6% Undervalued

Mister Car Wash’s widely followed narrative places its fair value at $7.52, which is well above the current share price of $5.59. This gap has drawn close attention to whether the market is missing potential upside baked into future financial forecasts.

"Mister Car Wash's resilient and growing membership subscription base (UWC) provides predictable, recurring revenue and demonstrates strong customer retention, particularly as consumers increasingly value convenience and subscription services. Continued price optimization and tier upgrades (for example, growth in Titanium tier) are expected to further lift revenue per member and expand margins over time."

Want to know what powers this bullish valuation? The narrative’s secret sauce lies in sticky memberships, expanding margins, and big financial leaps. Curious which forecasts tip the scales in Mister Car Wash's favor? Unlock the details to see what’s fueling this story.

Result: Fair Value of $7.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent membership declines and softer retail demand could challenge Mister Car Wash’s recovery narrative if these trends do not stabilize soon.

Find out about the key risks to this Mister Car Wash narrative.

Another View: Zooming in on Price-to-Earnings

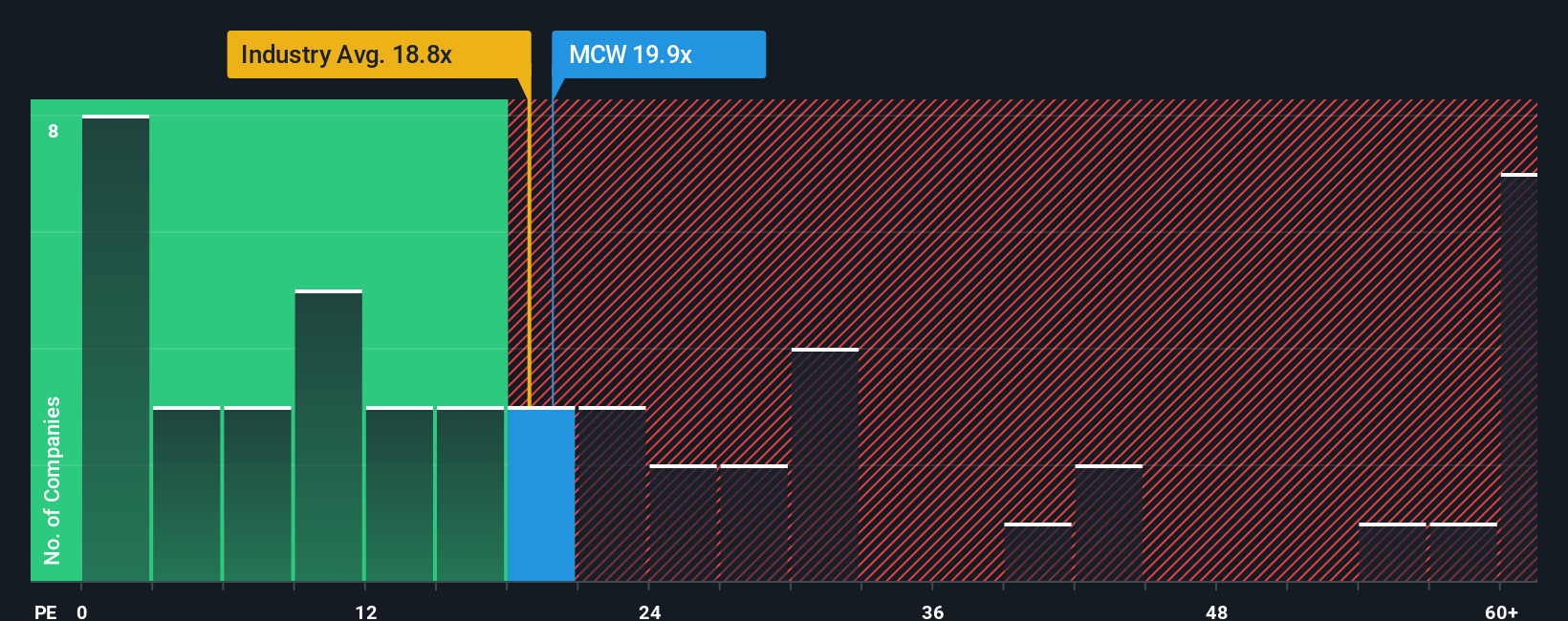

Taking a look through another lens, Mister Car Wash trades at a P/E ratio of 19.9x. That is pricier than both the industry average (18.4x) and its peers (18.7x), yet it remains below its fair ratio of 22.8x. This suggests the stock could get rerated upward if market sentiment shifts, but it also exposes investors to valuation risk should expectations fall short. Could the market be slow to recognize true value, or is this premium a warning sign?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mister Car Wash Narrative

If you see the numbers differently or want to follow your own research trail, crafting your personal thesis is quick and straightforward. Just Do it your way.

A great starting point for your Mister Car Wash research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your strategy to just one stock. Use the Simply Wall Street Screener to spot overlooked gems, future trends, or steady income plays tailored to your goals.

- Seize the potential for high returns by checking out these 3585 penny stocks with strong financials that offer strong financials despite their small-cap status.

- Amplify your portfolio’s innovation factor and get ahead of tech trends with these 26 AI penny stocks shaping tomorrow’s AI breakthroughs.

- Boost your passive income strategy by targeting these 22 dividend stocks with yields > 3% offering yields above 3% for consistent rewards.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal