Savers Value Village (SVV): Widening Losses Undercut Strong Earnings Growth Narrative

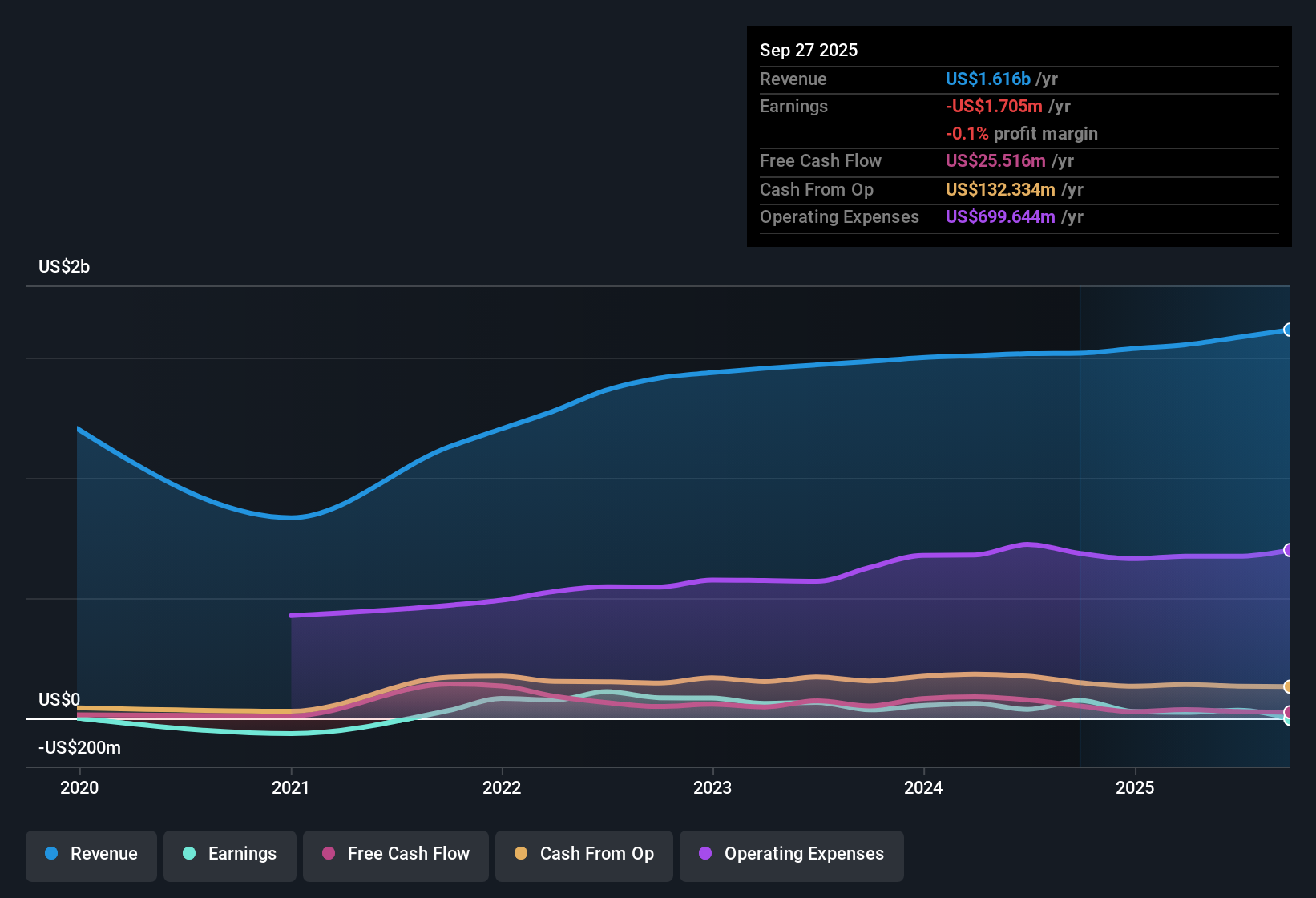

Savers Value Village (SVV) remains unprofitable, with reported losses widening at a pace of 4.1% per year over the past five years. Revenue is projected to grow 7.6% annually, trailing the broader US market's 10.3%, but forecasts call for a striking 100.7% annual increase in earnings, with profitability expected within three years. Currently trading at $9.21, which is below its estimated fair value and industry peers, SVV stands out for its attractive valuation despite ongoing financial challenges.

See our full analysis for Savers Value Village.Next, let’s see how these numbers stack up against the most widely followed narratives to find out which stories are confirmed and which are up for debate.

See what the community is saying about Savers Value Village

Margin Expansion Remains Elusive

- Profit margins currently sit at 2.1%, with analysts projecting an increase to 7.2% within three years if store-level efficiencies rebound as planned.

- Analysts' consensus view emphasizes that although operational investments and store expansions are set to normalize cost structures,

- failure to achieve this could leave margins under persistent pressure from labor costs and donated inventory risks,

- while a successful turnaround would help close SVV’s margin gap compared to broader retail peers.

- Consensus narrative notes expectations of margin rebound are heavily dependent on mature store performance and ongoing cost containment.

Want a deeper dive into how trends like these are shaping the company's outlook? 📊 Read the full Savers Value Village Consensus Narrative.

Analysts Expect Heavy Earnings Acceleration

- Earnings are projected to soar from $34 million to $145.8 million by around September 2028, an aggressive 100.7% annual increase that depends on both margin improvements and steady revenue growth.

- Analysts' consensus view contends that this profit surge will require a meaningful decrease in shares outstanding and ongoing gains in both basket size and customer loyalty,

- but repeated shortfalls in margin or execution could force analysts to revise their growth forecasts or valuation multiples downward,

- hinting at delicate tradeoffs between aggressive expansion and earnings reliability.

Discounted Price Versus Peer Group

- With a current Price-To-Sales Ratio of 0.9x, SVV trades below both its sector average of 1.5x and peer average of 2.5x. Its share price of $9.21 remains under both the DCF fair value benchmark of $11.59 and the analyst target of $14.17.

- Analysts' consensus view sees this valuation gap as a potential opportunity for value-focused investors,

- but they caution that weak financial positioning and limited margin progress could justify the market’s ongoing skepticism unless the company delivers on efficiency and predictable growth,

- making future improvements in profitability key to unlocking upside from current levels.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Savers Value Village on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the numbers? Share your perspective and create a unique narrative in just a few minutes: Do it your way

A great starting point for your Savers Value Village research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Savers Value Village offers potential upside, its challenged profitability and fragile financial footing raise concerns that margin recovery may not materialize as analysts hope.

If you want companies with robust balance sheets and lower financial risk, discover options with solid balance sheet and fundamentals stocks screener (1984 results) to target stronger fundamentals and dependable performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal