Is United Airlines a Bargain After 16.9% Share Price Jump?

- Wondering if United Airlines Holdings stock is a bargain right now? You're not alone, especially with so much buzz about whether its price truly reflects its long-term prospects.

- The stock has seen some notable movement lately, including a 16.9% gain over the last year. Despite some ups and downs such as a 5.3% dip in the past week and a year-to-date slide of 1.5%, the stock remains in focus.

- Part of this recent activity ties back to broader industry developments and travel demand trends, as the aviation sector adapts to shifting consumer habits and changing fuel prices. Headlines about United's strategic route expansions and operational shifts have added another layer of intrigue to its share price story.

- For those focused on the numbers, United Airlines Holdings earns a 5 out of 6 on our valuation check scorecard. This suggests it screens as undervalued in most areas. As we dig into the different ways to calculate value, keep an eye out for a perspective at the end of this article that might offer an even richer understanding.

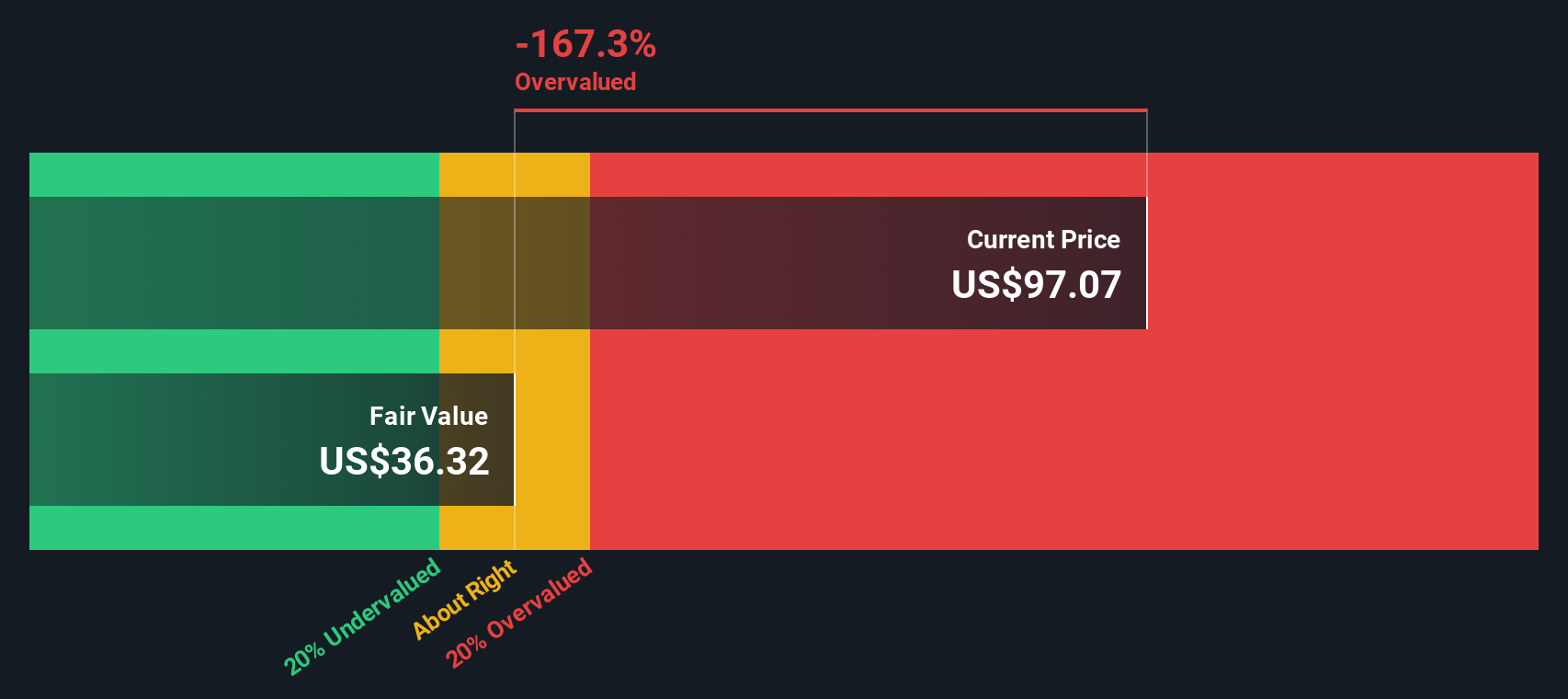

Approach 1: United Airlines Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates United Airlines Holdings' value by projecting its future cash flows and discounting them back to today. The aim is to reflect what those future dollars are worth in present terms. This approach helps investors determine if the current share price is justified by long-term fundamentals.

United Airlines Holdings generated Free Cash Flow (FCF) of $2.61 billion over the last twelve months. According to analyst estimates and Simply Wall St's extrapolated projections, this figure is expected to steadily grow, potentially reaching approximately $7.39 billion in annual FCF by 2035. While analysts offer forecasts for the next five years, the remaining years in this ten-year outlook are estimated using internal models to account for evolving market dynamics.

Based on these projections, the DCF model calculates a fair value of $189.20 per share. This is significantly above the recent share price, implying that United Airlines Holdings trades at a 50.3% discount according to this method. This sizeable gap suggests the stock may offer strong value for long-term investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests United Airlines Holdings is undervalued by 50.3%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

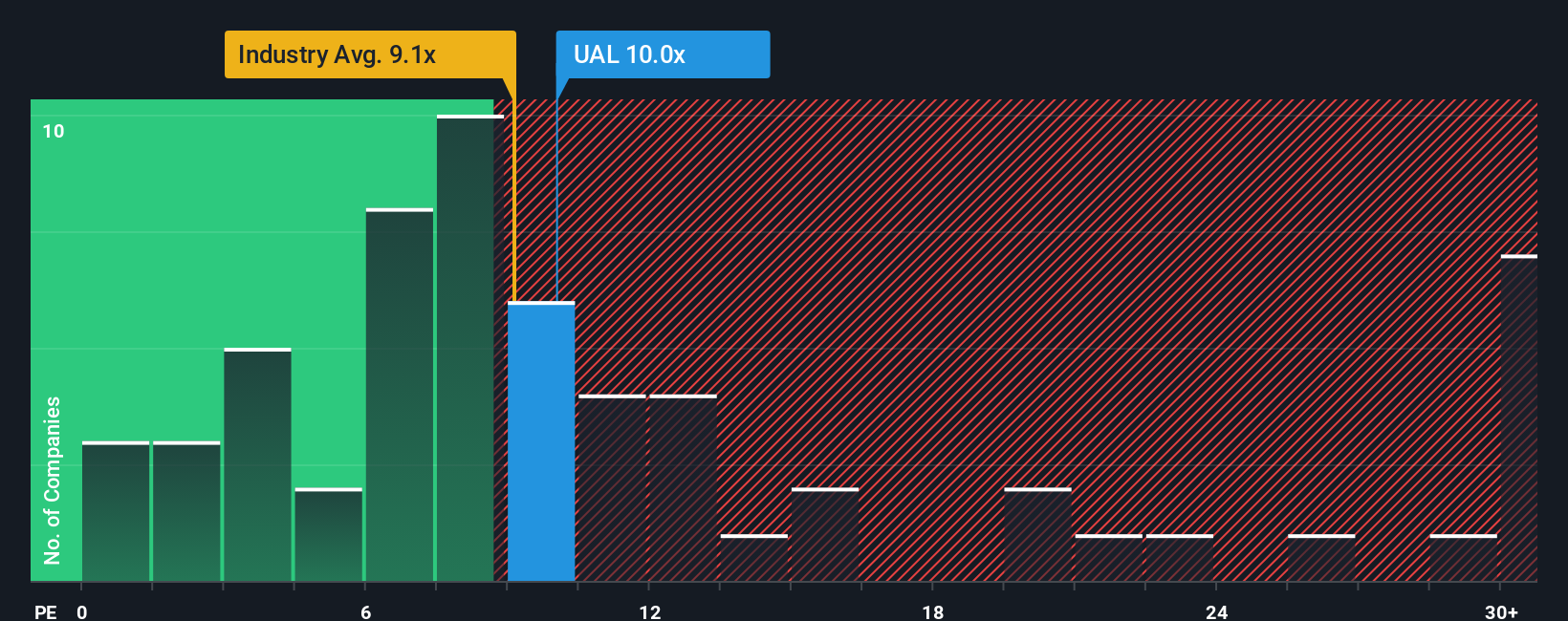

Approach 2: United Airlines Holdings Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like United Airlines Holdings. It offers a quick snapshot of how much investors are willing to pay for each dollar of the company’s earnings. This makes it especially relevant when evaluating established businesses that have a consistent earnings track record.

The PE ratio is not just a number. It is shaped by investor expectations for future growth and the level of risk associated with those earnings. Companies expected to grow quickly usually justify higher PE ratios, while more volatile or risk-prone companies often trade at lower multiples.

Currently, United Airlines Holdings is trading at a PE ratio of 9.2x. This is almost identical to the average for the Airlines industry, which stands at 9.1x, and well below the broader peer average of 18.0x. While these comparisons are helpful, they do not fully account for company-specific factors such as United’s growth outlook, profit margins, or overall risk profile.

This is where Simply Wall St’s proprietary Fair Ratio comes in. The Fair Ratio for United Airlines Holdings is 13.9x. This figure is built from factors such as projected earnings growth, market cap, industry dynamics, profit margins, and risk. This tailored benchmark helps investors get a clearer, more personalized view of value, rather than relying solely on blunt industry averages or peer numbers.

With United’s current PE ratio (9.2x) sitting noticeably below its Fair Ratio (13.9x), the stock looks undervalued on this measure. This suggests there may be upside for investors seeking value relative to the company’s unique profile.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your United Airlines Holdings Narrative

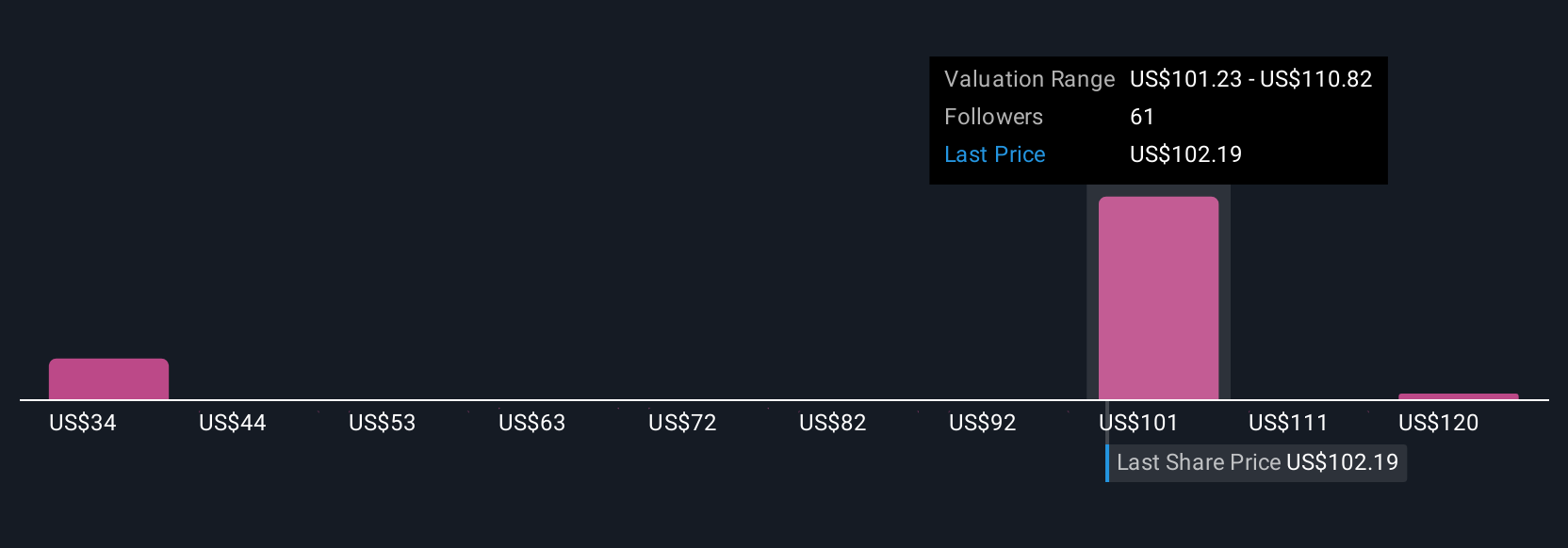

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is more than just numbers; it is your own story or perspective about a company, backed up with your assumptions about fair value, growth, and future profitability. Narratives connect what you believe about a company’s future to a specific financial forecast and then translate that into an actionable fair value.

On Simply Wall St's Community page, used by millions of investors, Narratives make it easy and accessible to create, share, and explore different outlooks for United Airlines Holdings. They help you decide whether to buy or sell by showing how your Fair Value compares to the current Price, giving you the confidence to act while also tracking how your thinking changes over time.

Whenever new events or earnings updates occur, Narratives are updated dynamically, so your analysis always stays relevant. For example, while one investor may construct a Narrative reflecting a bullish fair value of $156, optimistic about United's margin expansion and brand strength, another may take a more cautious view, with a fair value of just $43, focusing on risks like industry pressures or cost challenges.

This approach empowers you to invest based on your own view of United Airlines Holdings and understand exactly what would need to happen in both the business and the stock price for your Narrative to succeed.

Do you think there's more to the story for United Airlines Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal