Gilead Sciences (GILD) Margin Recovery Reinforces Bullish Narrative With 6,336% Earnings Growth

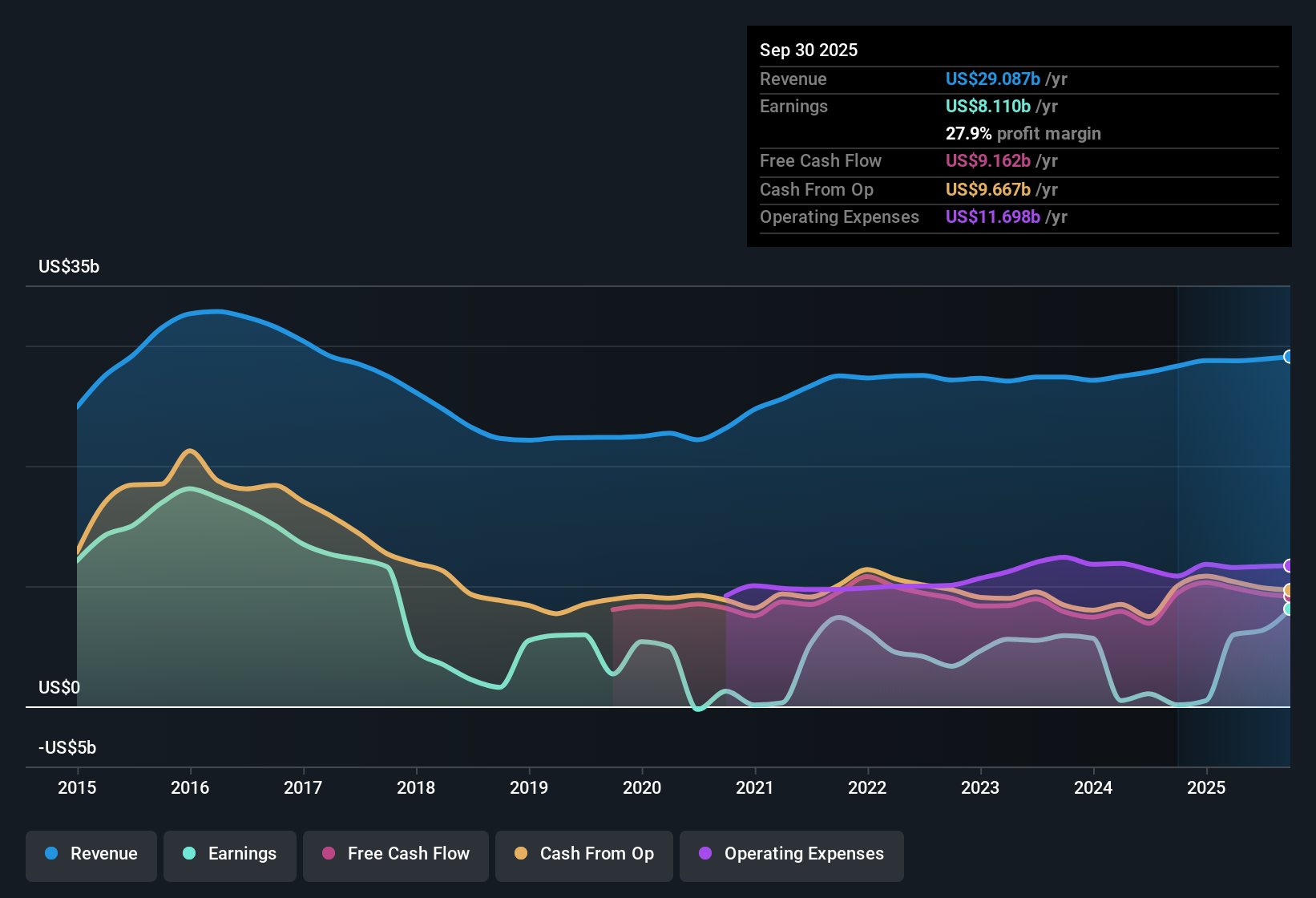

Gilead Sciences (GILD) posted headline-grabbing earnings growth of 6,336.5% year-over-year, far outpacing its 5-year average growth rate of 8.2% per year. Net profit margins recovered sharply to 27.9% from last year’s minimal 0.4%, offering a robust margin story for shareholders. While earnings are projected to grow at 9.1% annually and revenue at 4.5% per year going forward, investors will be weighing this momentum against the broader and faster-growing US market.

See our full analysis for Gilead Sciences.Next, we will put these numbers in the context of prevailing market narratives and see how the data supports or questions the stories investors have been following.

See what the community is saying about Gilead Sciences

DCF Fair Value More Than Doubles Stock Price

- The current share price of $119.79 is trading at a significant discount to the DCF fair value of $276.55. This implies over 130% upside if bullish case assumptions hold true.

- Bullish investors point to the low Price-to-Earnings ratio of 18.3x compared to the peer average of 43.1x as support for further upside, especially given high-quality earnings and a growing dividend.

- Despite concerns about pricing pressures and competition, bulls emphasize Gilead’s strong operating margin (27.9%) and expanding pipeline. They argue these factors can help close the gap between price and fair value.

- Robust cash flow, upcoming product launches, and defensive market positioning further strengthen the bullish thesis that the market is undervaluing Gilead’s long-term potential.

Margin Turnaround: 0.4% to 27.9% in a Year

- Net profit margin rose to 27.9%, up dramatically from last year’s slim 0.4%. This turnaround goes far beyond short-term volatility and reflects underlying business strength.

- Analysts’ consensus view highlights that disciplined expense management and new product launches are boosting gross and operating margins, supporting sustainable EBIT growth and enabling share buybacks.

- Ongoing pipeline expansion, the launch of premium-priced therapies, and continued revenue diversity are expected to drive multi-year improvement in Gilead’s margin profile even though reliance on the HIV portfolio persists.

- Strong free cash flow generation enables the company to maintain shareholder-friendly returns. This is central to the consensus narrative on resilience and capital efficiency.

Revenue Growth Still Trails Industry Pace

- Annual growth forecasts call for Gilead’s revenue to rise by 4.5%, which is slower than the broader US market’s expected pace and signals relative underperformance despite improvement in profit margins.

- According to the analysts' consensus narrative, heavy reliance on HIV drugs along with looming patent expiries and tougher regulatory environments pose key risks to sustained top-line momentum.

- While recent launches and product mix upgrades are improving the outlook, execution risks around diversification, market access, and competitive intensity could limit revenue acceleration in coming years.

- Consensus expectations indicate that Gilead’s pricing power may be moderated by policy changes and competition, fueling debate about long-term revenue resilience versus near-term margin gains.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Gilead Sciences on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own interpretation of the figures? Take just a few minutes to shape your perspective and build your unique view. Do it your way

A great starting point for your Gilead Sciences research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Gilead’s muted revenue growth and reliance on a narrow drug portfolio highlight concerns about maintaining consistent expansion in the face of competitive and regulatory pressures.

If dependable results are your priority, use stable growth stocks screener (2103 results) to track companies achieving steady revenue and profit growth regardless of industry ups and downs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal