Is Mastercard’s Valuation Justified Amidst Fintech Partnership Headlines?

- Ever wondered if Mastercard’s share price really reflects its true value, or if there’s an opportunity everyone else is missing? Let’s begin to unpack what’s driving that curiosity.

- The stock hasn’t been immune to some swings lately, with a dip of 3.8% over the past week and month, but those longer-term returns still stack up nicely. The stock is up 5.7% year-to-date and 9.3% over the last year.

- Recent headlines have focused on the evolving payments landscape, regulatory updates, and Mastercard’s ongoing partnerships with fintech innovators. All of these factors add important context to why some investors may see a changing risk or growth narrative. These developments help explain why the market has moved and set the stage for digging into what’s really priced in.

- For those who love numbers, Mastercard currently scores 1 out of 6 on our undervaluation checks. We’ll break down exactly what that means with different valuation methods and introduce a better way to assess value, so stick around for that at the end.

Mastercard scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Mastercard Excess Returns Analysis

The Excess Returns valuation approach helps investors understand whether a company's returns on invested capital are consistently higher than its cost of capital. In Mastercard’s case, this model focuses on how much value the company is creating for shareholders beyond the base return required by investors.

According to the latest data, Mastercard’s Book Value stands at $8.78 per share, while its Stable Earnings Per Share (EPS), forecasted by 12 analysts as a weighted average, is $28.55 per share. The company’s Cost of Equity is $1.05 per share, implying it only needs to generate this amount in returns to meet investor expectations. However, Mastercard is producing a significant Excess Return of $27.50 per share, with an impressive Average Return on Equity of 201.16%. The Stable Book Value projected by eight analysts is $14.19 per share, reinforcing Mastercard’s robust equity foundation over time.

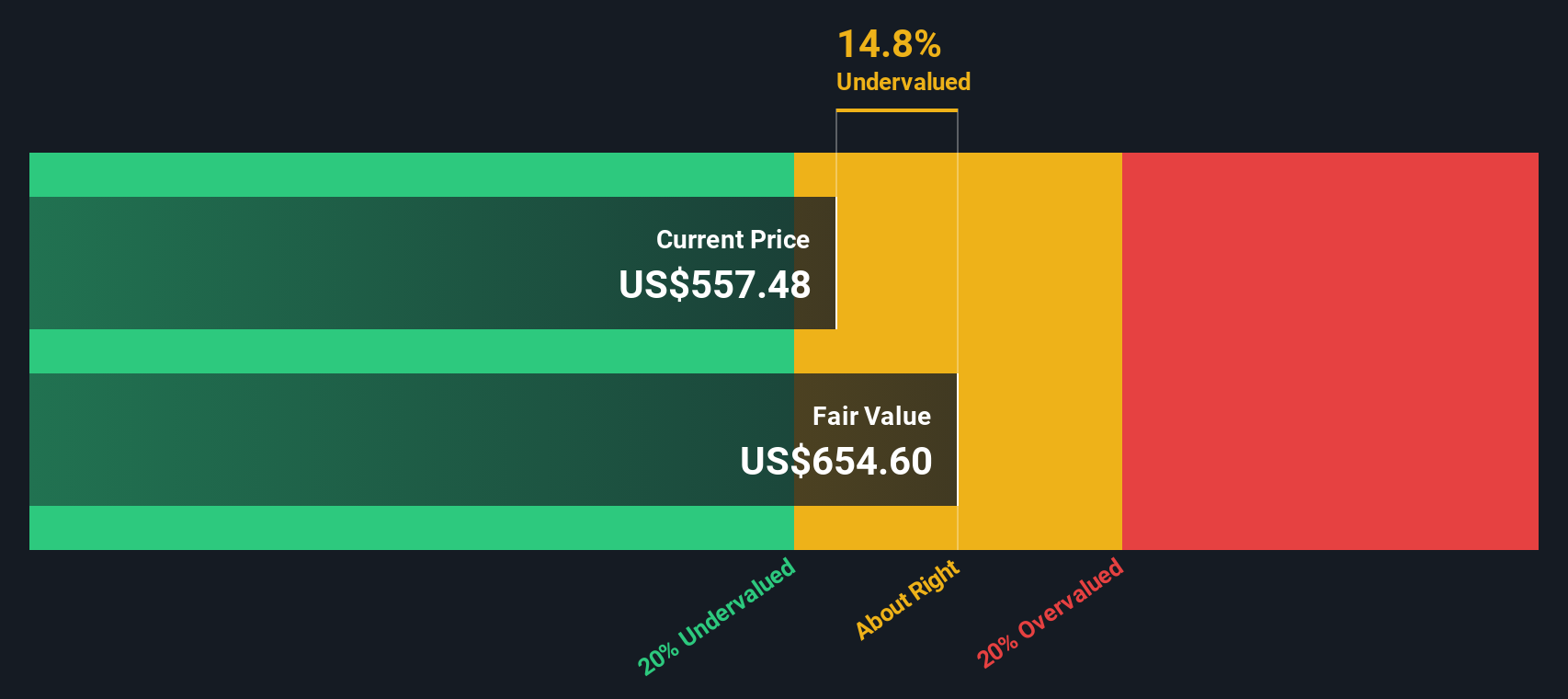

Based on these calculations, Simply Wall St’s Excess Returns Model estimates Mastercard’s intrinsic value at $646.14 per share. Given the model’s implied discount, Mastercard appears to be 14.6% undervalued relative to its current share price. This indicates the market might be underestimating Mastercard’s strong value-creation capabilities and durable growth outlook.

Result: UNDERVALUED

Our Excess Returns analysis suggests Mastercard is undervalued by 14.6%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Approach 2: Mastercard Price vs Earnings

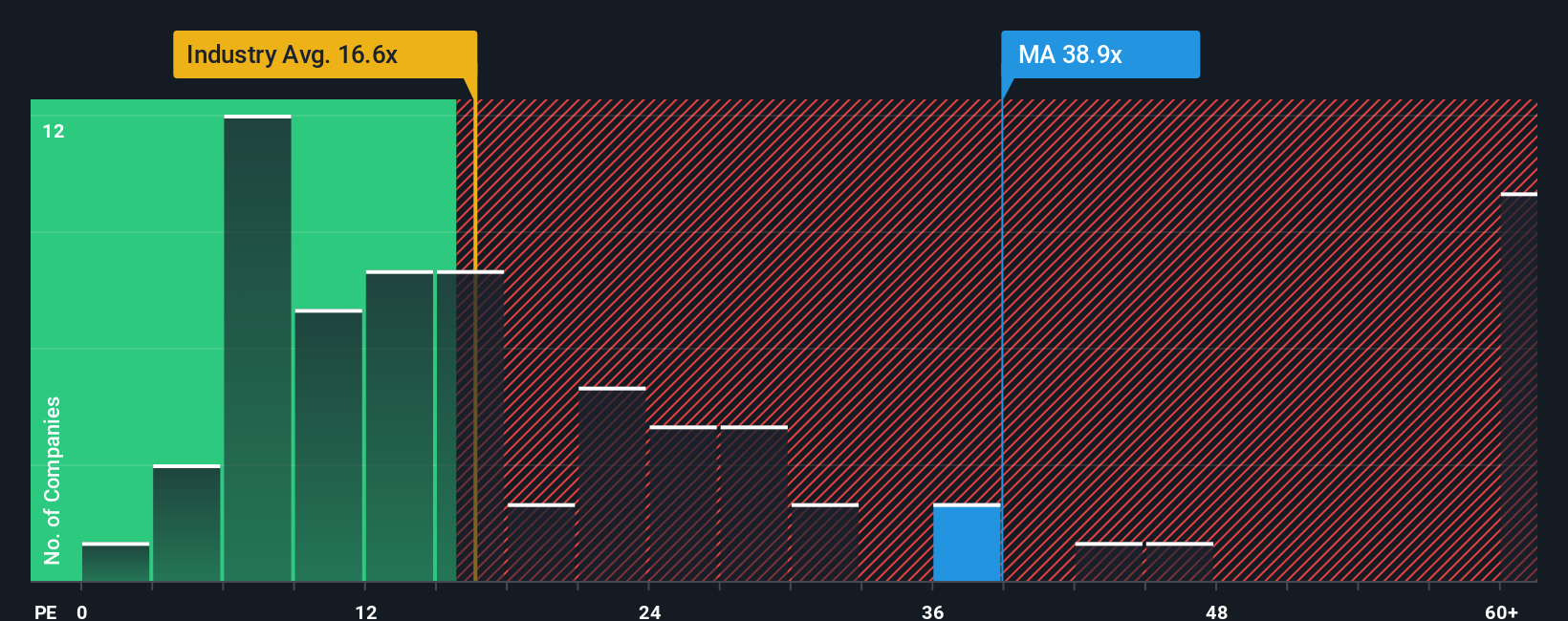

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Mastercard because it directly relates a company’s share price to its net earnings. This makes it a useful gauge for investors seeking to understand how much they are paying for each dollar of company profit. Importantly, companies with higher growth prospects and lower risk usually deserve a higher PE ratio, while those facing more uncertainty or slower growth often trade at lower PEs.

Mastercard’s current PE ratio stands at 34.8x, which is noticeably higher than the Diversified Financial industry average of 15.1x and above the peer group average of 17.8x. At first glance, this premium suggests that the market has elevated growth or quality expectations for Mastercard compared to its counterparts.

However, Simply Wall St's “Fair Ratio” estimate for Mastercard is 22.8x. Unlike a straightforward peer or industry comparison, this Fair Ratio adjusts for Mastercard’s unique blend of growth rates, industry context, profitability, company size, and risk profile. As a result, the Fair Ratio offers a more tailored benchmark that reflects what a rational investor might be willing to pay for these specific characteristics, rather than a generic sector average.

With Mastercard’s market multiple (34.8x) sitting well above the Fair Ratio (22.8x), the stock appears to be overvalued on this metric, even accounting for its strengths.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mastercard Narrative

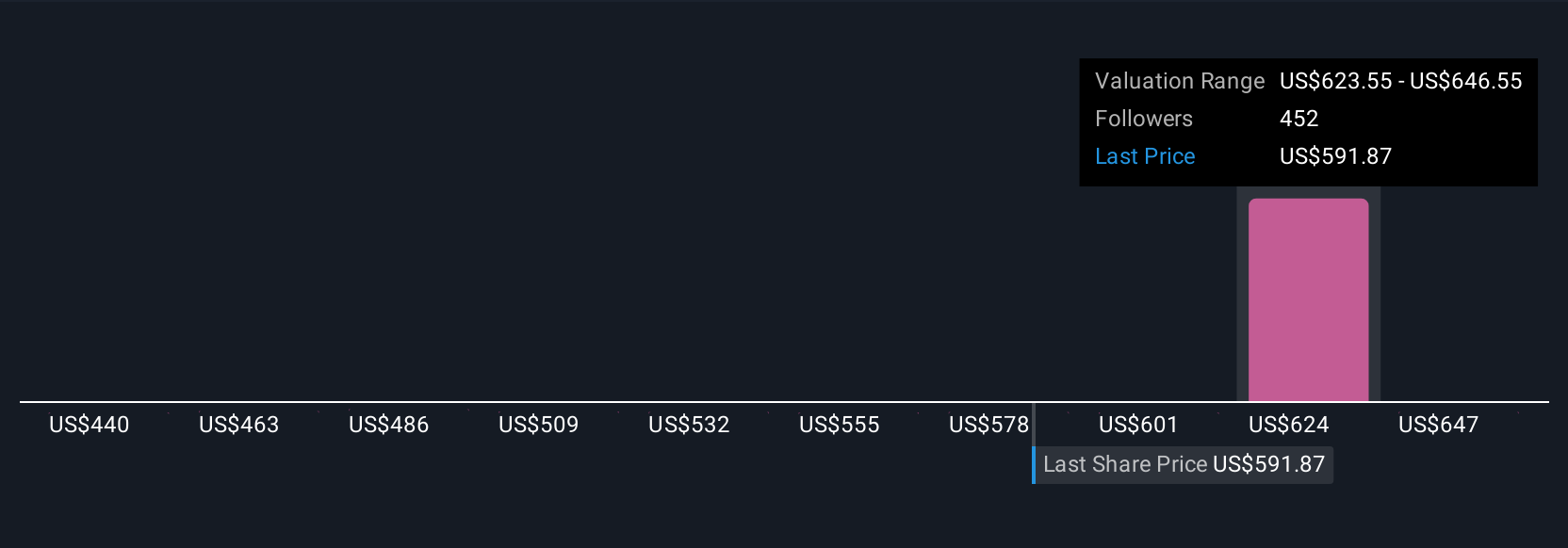

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company, bringing together your perspective on Mastercard's future, including what you think its revenues, margins, and earnings will be, and connecting that to a fair value.

Unlike traditional models that rely solely on static numbers, Narratives let you combine your outlook with real financial forecasts, so you can see how your story translates into Mastercard’s estimated value. Available on Simply Wall St’s Community page, Narratives make it easy for anyone, whether you’re a new investor or a seasoned pro, to build and compare views alongside millions of other users.

Narratives help you make smarter buy or sell decisions by revealing when your Fair Value diverges from the current Price, and they automatically update whenever new data or news impacts the business. For example, on Mastercard, some investors believe in long-term digital growth and set a bullish price target as high as $690, while others cite regulatory risks and peg the fair value closer to $520, showing how different views and fresh information shape every investment decision.

Do you think there's more to the story for Mastercard? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal