Harmonic (HLIT): Is the Current Valuation Justified After a 28% Share Price Rebound?

Harmonic (HLIT) has quietly moved higher over the past month, showing more than 28% growth. Investors might be examining whether the stock's current price truly reflects its longer-term value as business results continue to evolve.

See our latest analysis for Harmonic.

Momentum seems to be building for Harmonic, with a strong 90-day share price return of 28.1% helping to offset earlier losses and signal renewed investor interest. While the year-to-date share price return remains in negative territory, the shift in sentiment could reflect optimism about growth potential or a rethinking of risks. Over the past five years, investors who held on saw a total shareholder return of 73.1%, even as the one-year total return is slightly negative.

If you’re looking to discover what else is gaining traction in tech, now is the perfect moment to explore See the full list for free.

With shares rebounding and fundamentals showing signs of improvement, the big question now is whether Harmonic is truly undervalued as some metrics suggest, or if the market is already factoring in those brighter prospects. Is there still a real buying opportunity, or is future growth fully priced in?

Most Popular Narrative: Fairly Valued

Harmonic's latest close of $10.70 sits just above what the most followed narrative considers fair value, suggesting the company is trading closely in line with forward-looking expectations. This balanced pricing sets the stage for an in-depth look at the factors behind consensus valuation.

Accelerating global demand for high-speed broadband and the ongoing transformation to next-generation virtualized broadband networks (including Fiber-to-the-Home and Unified DOCSIS 4.0) are driving a multi-year upgrade cycle among operators. Harmonic's leadership and recent customer wins in these areas signal a strong pipeline and are likely to fuel significant future revenue growth as operators ramp deployments in 2026 and beyond.

Wonder why the market is sticking so closely to this valuation? The real story lies in bold broadband expansion assumptions, an industry shake-up in network technology, and possible future margin shifts that analysts are quietly baking into their math. Find out which catalyst moves the needle most on Harmonic's fair value.

Result: Fair Value of $10.50 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued reliance on a few major clients and rapid shifts in broadband technology could still disrupt Harmonic's growth expectations going forward.

Find out about the key risks to this Harmonic narrative.

Another View: Multiples Tell a Bullish Story

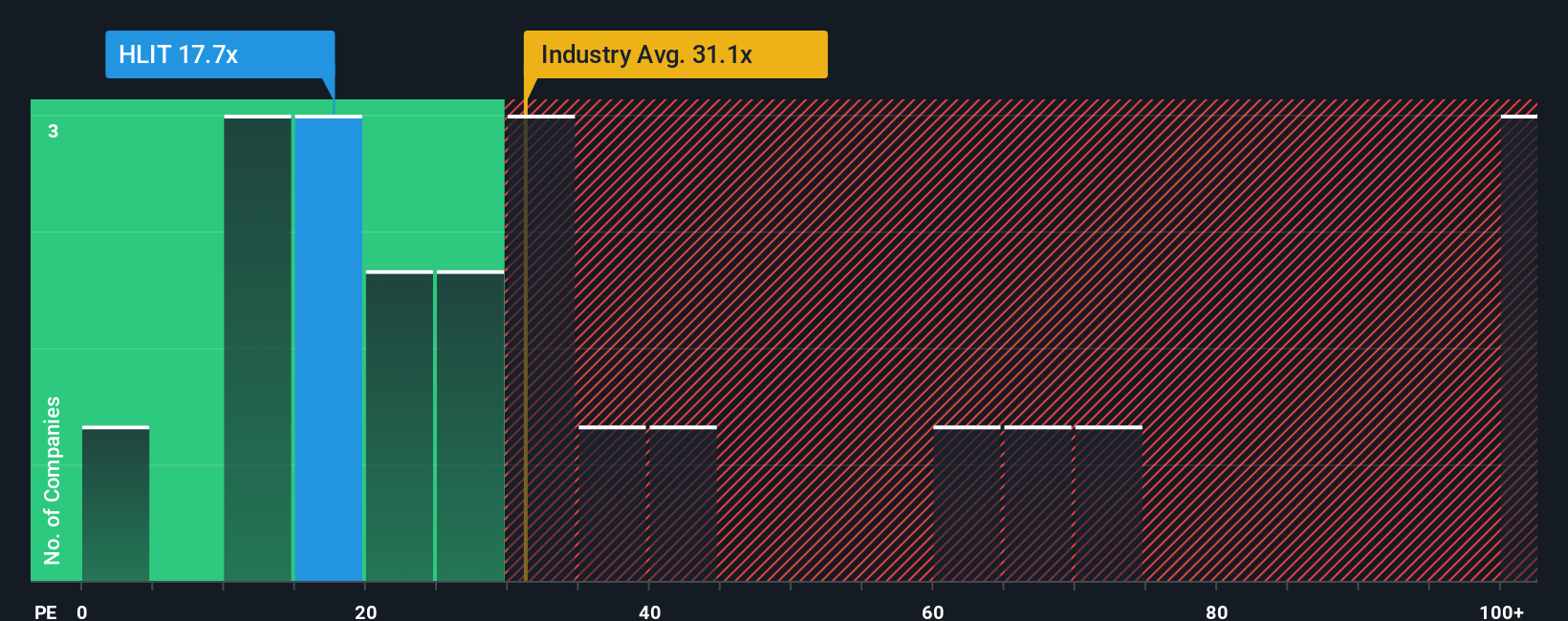

Looking at valuation through the lens of earnings ratios, Harmonic currently trades at 17.7 times earnings. That's considerably cheaper than both its industry peers, who average 33.5 times, and even its sector's fair ratio of 22.9 times. This gap suggests markets may be underestimating future upside, or perhaps pricing in more risk than optimists expect. Will the discount hold as business performance evolves?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Harmonic Narrative

If you see things differently or want to dig deeper into Harmonic's numbers yourself, you can build your own perspective in just a few minutes, and Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Harmonic.

Looking for More Investment Ideas?

Uncover your next big move by using the Simply Wall St Screener. Smart investors are already spotting trends where others aren't even looking. Miss out on these fresh opportunities and you might regret it!

- Unlock truly undervalued companies and position yourself ahead of the curve by starting with these 832 undervalued stocks based on cash flows.

- Experience the surge in artificial intelligence and find trailblazing stocks through these 26 AI penny stocks before they become mainstream picks.

- Boost your income strategy with regular returns by exploring these 22 dividend stocks with yields > 3% that offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal