Moody’s (MCO): Evaluating Valuation After Record Q3 Growth in Credit Ratings and Analytics

Moody's (MCO) shares are in focus after the company announced third quarter earnings, with results supported by growth in its credit ratings and analytics segments. Management pointed to a wave of debt issuance, which has fueled new financial milestones.

See our latest analysis for Moody's.

Backed by stronger-than-expected earnings and an active share buyback program, Moody's shares have shown steady resilience, with a latest close at $480.3. Recent dividend affirmations and margin expansion have kept investor interest high. The stock’s one-year total shareholder return of 6.03% underscores a longer-term trend of solid value creation, and a remarkable 90% total return over three years hints that momentum may be building further.

If you’re looking for the next standout, this could be a perfect opportunity to broaden your search and discover fast growing stocks with high insider ownership

Yet with shares trading near all-time highs and growth clearly on display, the real question is whether Moody’s current price leaves room for further upside or if the market has already accounted for its strong prospects.

Most Popular Narrative: 12% Undervalued

Compared to Moody’s last close at $480.30, the most widely followed narrative sees further upside, suggesting the fair value could be notably higher. The current valuation rests on bold assumptions for growth, efficiency, and revenue drivers shaping the coming years.

Moody's is experiencing accelerating demand from the rapid evolution and expansion of private credit markets, evidenced by 75% year-over-year growth in private credit revenues, 25% of first-time mandates coming from private credit, and ongoing issuer/investor demand for independent risk assessment. This strongly supports future revenue growth and earnings resilience as private credit's share in global financing expands.

Want to see what’s fueling this ambitious valuation? One key metric stands out, mixing recurring income with a margin profile that redefines industry norms. Find out which financial levers analysts believe will drive Moody’s to new highs. Explore the full story behind these projections.

Result: Fair Value of $545.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased regulatory scrutiny and mounting competition from new AI-driven rivals could challenge Moody's pricing power and future margin expansion.

Find out about the key risks to this Moody's narrative.

Another View: Multiples Tell a Different Story

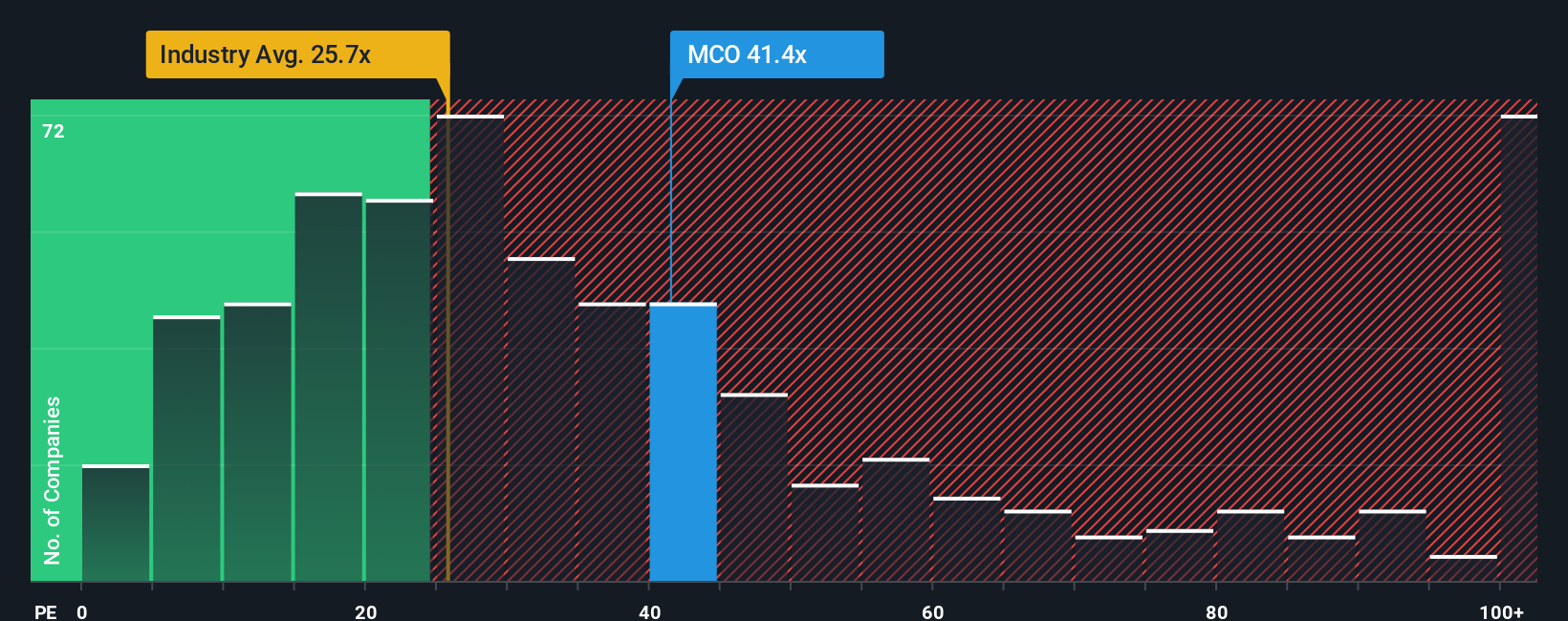

While many expect further upside, a different lens suggests Moody’s may be richly valued. Its current price-to-earnings ratio stands at 38.2x, noticeably higher than industry peers at 25.6x and far above the fair ratio of 19.6x. This signals premium pricing. Does this premium reflect true potential, or is the risk of a rerating being overlooked?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Moody's Narrative

If these takes don’t match your perspective, or you prefer getting hands-on with the numbers, you can shape your own take in just minutes: Do it your way

A great starting point for your Moody's research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more smart investment ideas?

Don’t let your next big winner slip away. Expand your opportunities with unique stock picks handpicked to match your strategy. Find potential standouts before the crowd.

- Tap into untapped potential by jumping on these 3584 penny stocks with strong financials that offer strong financials and momentum for growth.

- Unlock higher income possibilities by selecting from these 22 dividend stocks with yields > 3% featuring steady yields above 3% to boost your portfolio’s cash flow.

- Claim your stake in the future of artificial intelligence with these 26 AI penny stocks and get ahead of the next wave of innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal