Standard Motor Products (SMP) Margin Miss Challenges Bullish Narratives Despite Earnings Turnaround

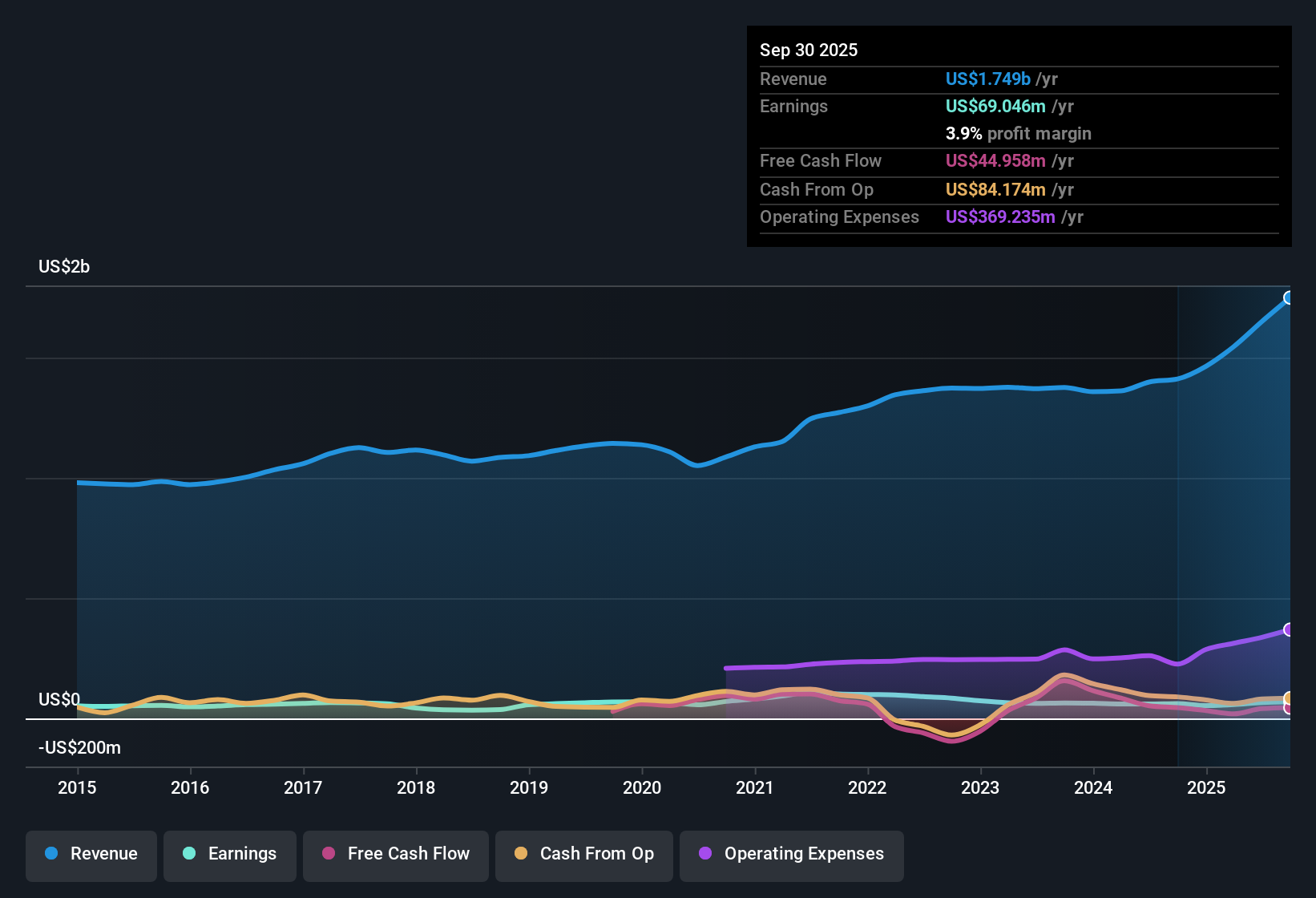

Standard Motor Products (SMP) posted a 9.8% increase in earnings over the past year, a sharp reversal from its five-year trend of an average annual decline of 11.7%. Despite this upturn, net profit margins slipped to 4% from 4.3% a year earlier, and Wall Street is now bracing for a 25.4% per year decline in earnings over the next three years, even as revenue is projected to grow 6.3% annually, which lags behind the broader US market’s 10.3% pace. With shares trading at $37.13, well above an estimated fair value of $23.76 but boasting a relatively low price-to-earnings ratio of 12.4x, investors are weighing solid recent gains against signs of pressure on both margins and future profits.

See our full analysis for Standard Motor Products.The real test, though, is how these headline numbers compare to the prevailing narratives in the market. Some may be on the money, while others could be in for a shake-up.

See what the community is saying about Standard Motor Products

Margins Expected to Shrink to 2.4%

- Analysts project profit margins will drop from the current 4.0% to just 2.4% in the next three years, meaning that for every $100 in sales, only $2.40 may become profit. This signals increased cost pressure or difficulty passing costs along to customers.

- The analysts' consensus view points out that automation investments and supply chain localization, including a new Kansas distribution center, could eventually help margins recover. However, ongoing tariff headwinds and new operational expenses are expected to outweigh these efficiencies in the short term.

- Management guidance also notes millions in higher operating costs and net higher tariffs, which supports the view that net margins are at risk of falling further before any long-term improvements materialize.

- Critics highlight how the company's margin pressure is compounded by heavy exposure to legacy markets and the slow transition to higher-growth EV or ADAS segments, potentially leaving profits exposed if end markets decline or costs continue to rise.

- With profit margins squeezed to nearly half their historic level, the analysts' consensus still sees margin resilience as possible long-term. However, the current trend keeps risks front and center.

📊 Read the full Standard Motor Products Consensus Narrative.

Organic Growth Trails Acquisition Gains

- Organic sales from legacy business are growing at just 3.5 to 4%, notably lagging the company’s total forecast revenue growth of 6.3% per year. This means more than half the expected top-line progress hinges on recent acquisitions rather than the core business.

- According to the analysts' consensus narrative, major acquisition synergies, such as from the Nissens deal, are billed as top drivers of near-term revenue and operational efficiency. However, if these integration wins fade, Standard Motor Products could struggle to sustain its revenue momentum.

- Growing exposure to advanced vehicle categories like engine efficiency and emissions systems offers a path to diversify growth beyond legacy markets if execution succeeds.

- Still, if organic growth remains muted and the slow pivot into EV or ADAS markets continues, the business may see persistent dependence on one-off deals or be vulnerable to cyclical declines in acquired segments.

Valuation: Peer Discount vs. Fair Value Gap

- Despite a low price-to-earnings ratio of 12.4x, well below both the peer average of 23.1x and the US auto components industry at 18.1x, shares currently trade at $37.13. This is still over 55% higher than the company’s DCF fair value estimate of $23.76 and about 20% below the analyst price target of $46.33.

- The analysts' consensus highlights that investors must weigh the apparent bargain against sector headwinds. The low P/E ratio signals a value opportunity, but profits and revenues are both expected to contract, so upside relies on believing in efficiency gains and a long-term market turnaround.

- If margin pressures ease and revenue diversifies, Standard Motor Products could close the gap toward the analyst target. However, if declines accelerate, the current premium over fair value looks risky even at a discount to peers.

- Consensus calls attention to this tension, whether investors see the valuation as a discounted entry point or as a sign that the market is already pricing in future challenges.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Standard Motor Products on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the numbers? It only takes a few moments to shape your take into a personal narrative. Do it your way

A great starting point for your Standard Motor Products research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Standard Motor Products faces shrinking profit margins, muted organic growth, and the risk of underperforming its peers if cost pressures persist or revenue stumbles.

If you’re seeking stocks with more upside and less valuation risk, use our these 832 undervalued stocks based on cash flows to spot companies trading at compelling prices relative to their fundamentals right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal