How Diebold Nixdorf's (DBD) Global ATM Software Rollout with Bank AlJazira Reshapes Its Investment Story

- Diebold Nixdorf recently announced that Bank AlJazira has become the first bank globally to implement its VCP-Lite 7 software across more than 400 DN Series ATMs in Saudi Arabia, supporting multi-language features, NFC transactions, and the latest regulatory standards.

- This deployment highlights Diebold Nixdorf’s ability to tailor advanced self-service banking solutions for emerging markets, reflecting the company’s technological edge and successful collaborations with regional partners like Alhamrani Universal.

- We'll explore how this pioneering ATM software deployment with Bank AlJazira could influence Diebold Nixdorf's investment narrative and software-driven growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Diebold Nixdorf Investment Narrative Recap

To be a shareholder in Diebold Nixdorf, you need to believe in the company's ability to shift from its traditional hardware focus to a recurring, high-margin software and services model, even as cash usage gradually declines. The Bank AlJazira contract validates Diebold Nixdorf’s competitive positioning in global ATM software deployment, but this win does not yet address the most pressing short-term issue: execution risk in accelerating profitable software-driven growth while managing margin pressures tied to the business transformation. The risk of persistent hardware commoditization and the challenge to scale recurring service contracts remain central near-term hurdles, largely unaffected by this news.

A related recent development is Diebold Nixdorf's announcement on September 3 regarding Eurasian Bank's adoption of VCP-Lite 7, further evidencing initial customer traction for its next-generation ATM software platform. These announcements show progress in rolling out software solutions, which is closely tied to the company's biggest catalyst: the opportunity to drive higher-margin growth as more clients adopt its software, although significant execution risk persists as this transition is in its early stages.

However, while these deployments reflect important momentum, investors should remain tuned for signs of...

Read the full narrative on Diebold Nixdorf (it's free!)

Diebold Nixdorf's narrative projects $4.2 billion revenue and $312.7 million earnings by 2028. This requires 4.3% yearly revenue growth and a $325.6 million increase in earnings from current earnings of -$12.9 million.

Uncover how Diebold Nixdorf's forecasts yield a $75.67 fair value, a 28% upside to its current price.

Exploring Other Perspectives

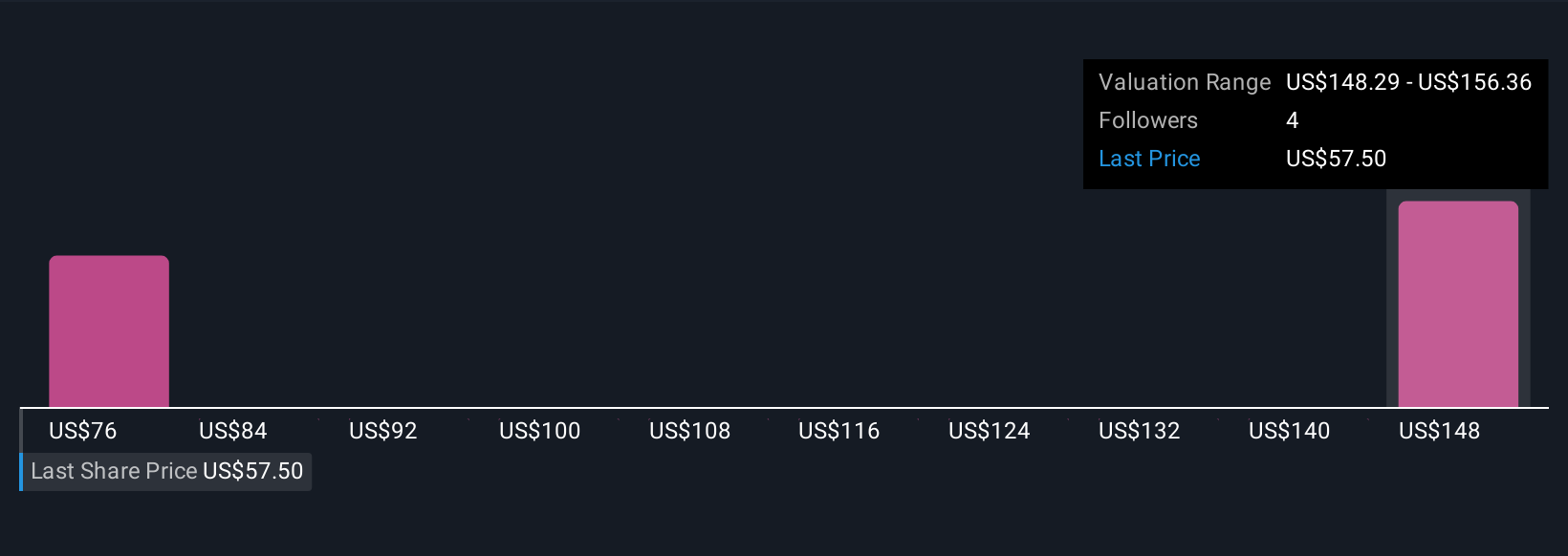

Simply Wall St Community members estimate Diebold Nixdorf’s fair value between US$75.67 and US$155.07, across two unique perspectives. Yet, with pricing power risks growing as digital alternatives pressure hardware margins, it pays to explore these varied viewpoints.

Explore 2 other fair value estimates on Diebold Nixdorf - why the stock might be worth over 2x more than the current price!

Build Your Own Diebold Nixdorf Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Diebold Nixdorf research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Diebold Nixdorf research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Diebold Nixdorf's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal