The Bull Case For ServiceNow (NOW) Could Change Following Strong Q3 Results and AI-Driven Partnerships

- In the past week, ServiceNow reported strong third-quarter results, surpassing analyst expectations with revenue of US$3.41 billion and net income of US$502 million, and announced a five-for-one stock split pending shareholder approval. The company also raised its full-year subscription revenue guidance and announced deeper AI-driven partnerships, highlighting continued demand and business confidence in enterprise workflow automation.

- A key insight is ServiceNow’s acceleration in AI-powered solutions and deepening industry partnerships, positioning it to address global enterprise digital transformation needs across supply chain, data center operations, and security workflows.

- We’ll examine how ServiceNow’s raised forecasts and focus on AI partnerships may influence the company's investment narrative and growth outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

ServiceNow Investment Narrative Recap

To be a shareholder in ServiceNow, you need confidence in the company’s ability to capitalize on enterprise demand for AI-powered workflow automation and digital transformation. The recent strong Q3 results and raised subscription revenue guidance reinforce the near-term catalyst of robust AI adoption, while also drawing attention to persistent risks like integration challenges from ongoing acquisitions. Current news does not alter the risk profile meaningfully but does strengthen the conviction behind growth catalysts tied to AI partnerships.

Among recent developments, ServiceNow’s expanded alliance with NVIDIA stands out. The joint launch of Apriel 2.0, an enterprise-focused AI reasoning model, aligns directly with the surging demand for scalable, trusted AI across industries. This type of partnership is highly relevant given how AI innovation remains a key short-term and long-term growth driver for the business.

Yet, investors should pay close attention to potential integration risks, especially given...

Read the full narrative on ServiceNow (it's free!)

ServiceNow's outlook anticipates $20.3 billion in revenue and $3.3 billion in earnings by 2028. Achieving these figures requires 18.9% annual revenue growth and a $1.6 billion earnings increase from the current $1.7 billion.

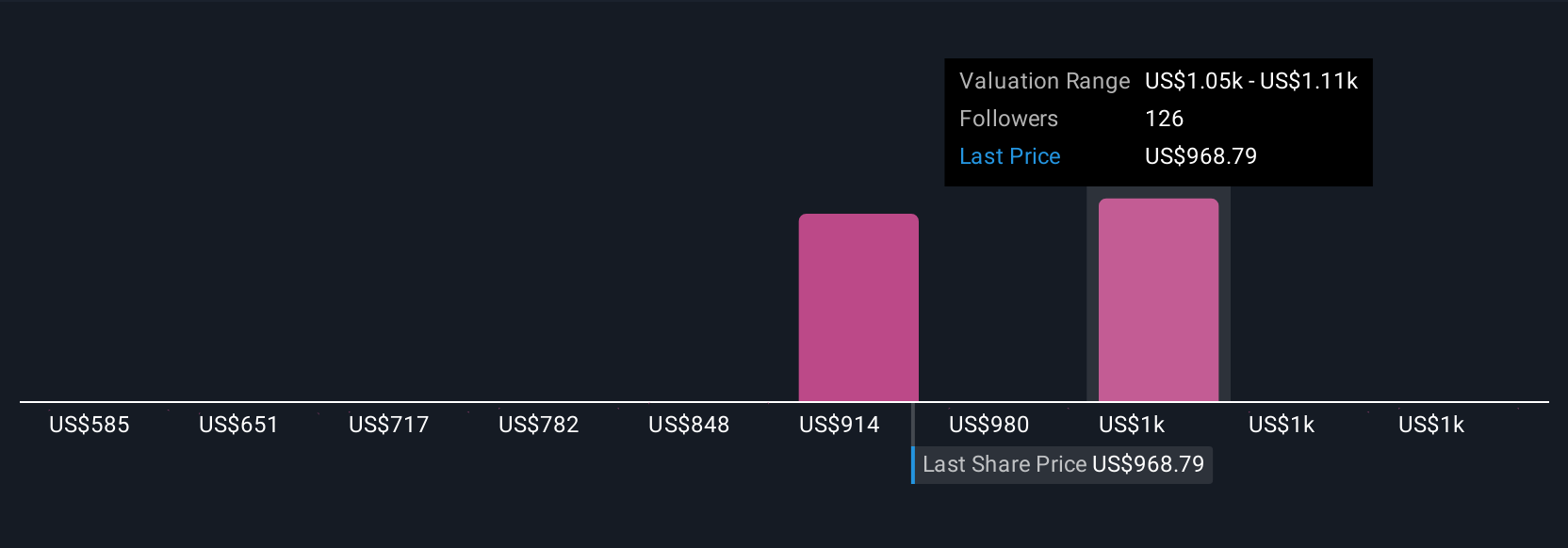

Uncover how ServiceNow's forecasts yield a $1157 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Some analysts are far more optimistic, seeing ServiceNow’s AI advances and strategic alliances as a springboard to potential annual revenues above US$20,300 million by 2028. These bullish forecasts, which assume rising earnings and industry-leading growth, may shift if new developments change expectations, so it’s important to remember that not every investor weighs opportunity and risk the same way.

Explore 16 other fair value estimates on ServiceNow - why the stock might be worth as much as 35% more than the current price!

Build Your Own ServiceNow Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ServiceNow research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ServiceNow research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ServiceNow's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal