Did S&P Global's (SPGI) Raised Guidance and Share Buybacks Just Shift Its Investment Narrative?

- S&P Global reported third-quarter 2025 results showing US$3.89 billion in sales and US$1.18 billion in net income, raising its full-year earnings guidance and completing the latest tranche of its share buyback program.

- The company’s willingness to upgrade its annual outlook underscores management’s confidence as it continues to return capital to shareholders through share repurchases.

- We’ll explore how the raised earnings guidance highlights S&P Global’s evolving investment story and management’s positive business outlook.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is S&P Global's Investment Narrative?

To believe in S&P Global as a shareholder, you need to trust that the company’s essential role in financial markets, data analytics, and ratings will continue to drive demand across cycles, while management’s disciplined approach delivers consistent capital returns. The latest quarterly results and increased 2025 earnings guidance reinforce confidence in S&P Global’s operational execution and its ability to expand profits even in a competitive and slower-growth environment. The buyback program, with over US$1 billion spent this quarter, adds support by reducing share count and returning capital to owners. Short-term, the uplifted guidance helps mitigate concerns about revenue growth that trails broader markets and signals management’s conviction, yet the executive transition and ongoing premium valuation mean risk remains if momentum falters. While recent news strengthens near-term catalysts, the fundamental challenge of justifying a high earnings multiple still lingers. On the other hand, recent executive turnover could introduce uncertainty worth watching.

S&P Global's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

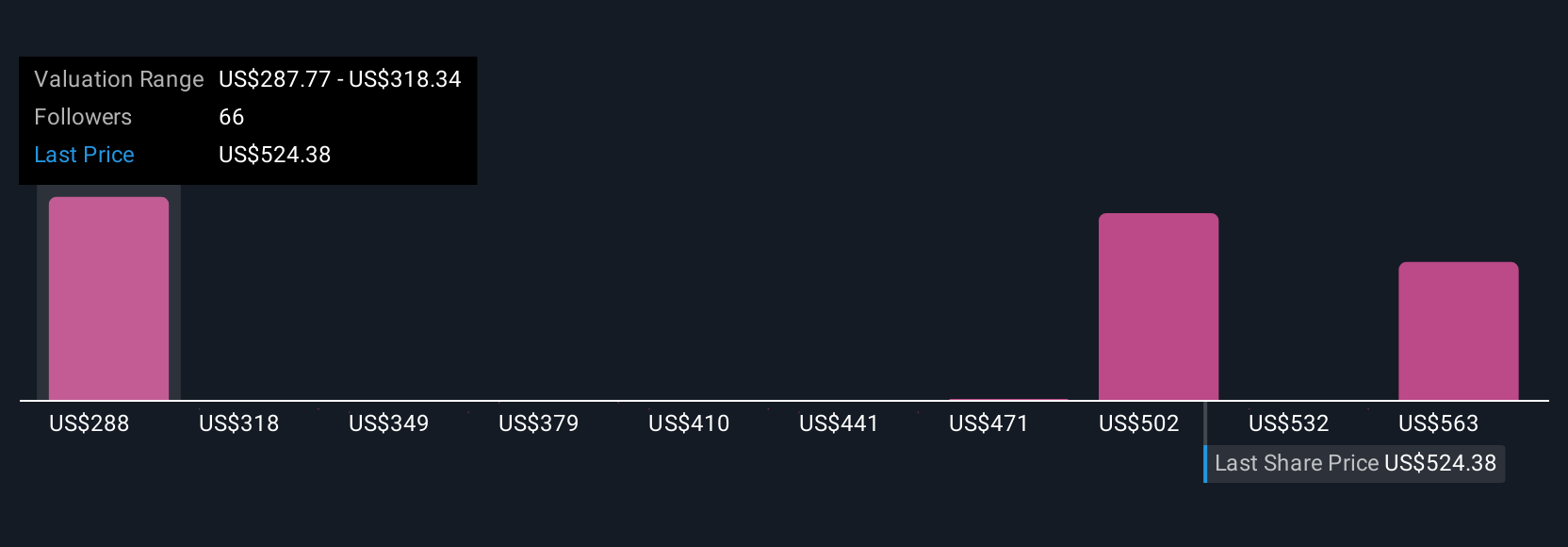

Explore 24 other fair value estimates on S&P Global - why the stock might be worth as much as 29% more than the current price!

Build Your Own S&P Global Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your S&P Global research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free S&P Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate S&P Global's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal