What Do Regulatory Probes and Price Drops Mean for Equifax Shares in 2025?

- Ever wondered whether now might be the right time to buy, hold, or avoid Equifax? Let's dig into what the numbers and recent events reveal about its true value.

- Equifax's shares have experienced significant fluctuations recently. The stock dropped 9.7% this week and is down 16.8% over the last month, with a year-to-date slide of 15.9%. Over the past year, the stock is off 19.6%. Looking further back, there have been cumulative gains of 32.2% over three years and 45.8% over five years.

- Market sentiment shifted recently after news of new regulatory investigations and data privacy initiatives affecting credit reporting agencies. Discussions around tighter oversight have created some near-term volatility and prompted investors to pay closer attention to strong compliance and innovation in this sector.

- On our valuation checks for Equifax, the company scores 3 out of 6 for being undervalued. We’ll look at what that means using a few traditional approaches, but stick around because we will also explore a smarter way to assess true value by the end of this article.

Find out why Equifax's -19.6% return over the last year is lagging behind its peers.

Approach 1: Equifax Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. The goal is to determine what the company is really worth, based on how much cash it’s expected to generate in years to come.

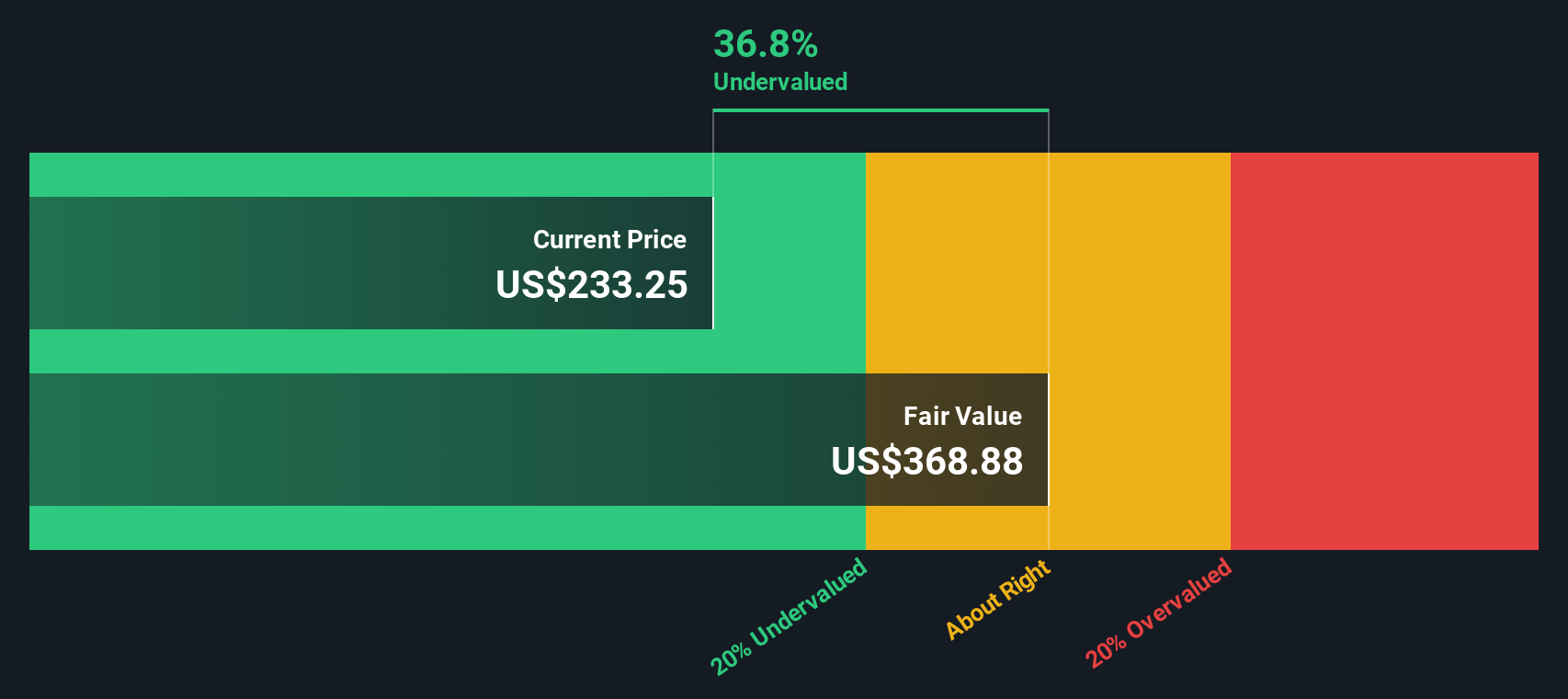

For Equifax, the current Free Cash Flow stands at $891.95 Million. Analysts project that by 2029, annual Free Cash Flow could reach $1.81 Billion. The DCF model uses direct analyst estimates for the first five years and then extrapolates further growth using conservative rates beyond that point.

Based on these projections, the DCF approach values Equifax at $282.67 per share, which is 25.3% higher than the current market price. This means that, according to the cash flows forecasted and discounted appropriately, the stock is trading at a notable discount to its estimated intrinsic value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Equifax is undervalued by 25.3%. Track this in your watchlist or portfolio, or discover 832 more undervalued stocks based on cash flows.

Approach 2: Equifax Price vs Earnings (PE Ratio)

For profitable companies like Equifax, the Price-to-Earnings (PE) ratio is a widely accepted metric because it ties the share price directly to the company’s earnings power. It tells investors how much they are paying for each dollar of the company’s annual earnings.

When judging whether a PE ratio is high or low, it is crucial to factor in the company’s expected earnings growth and the perceived risks facing the business. Faster-growing or lower-risk companies typically command higher PE ratios, while slower growth or increased risk pushes the fair multiple lower.

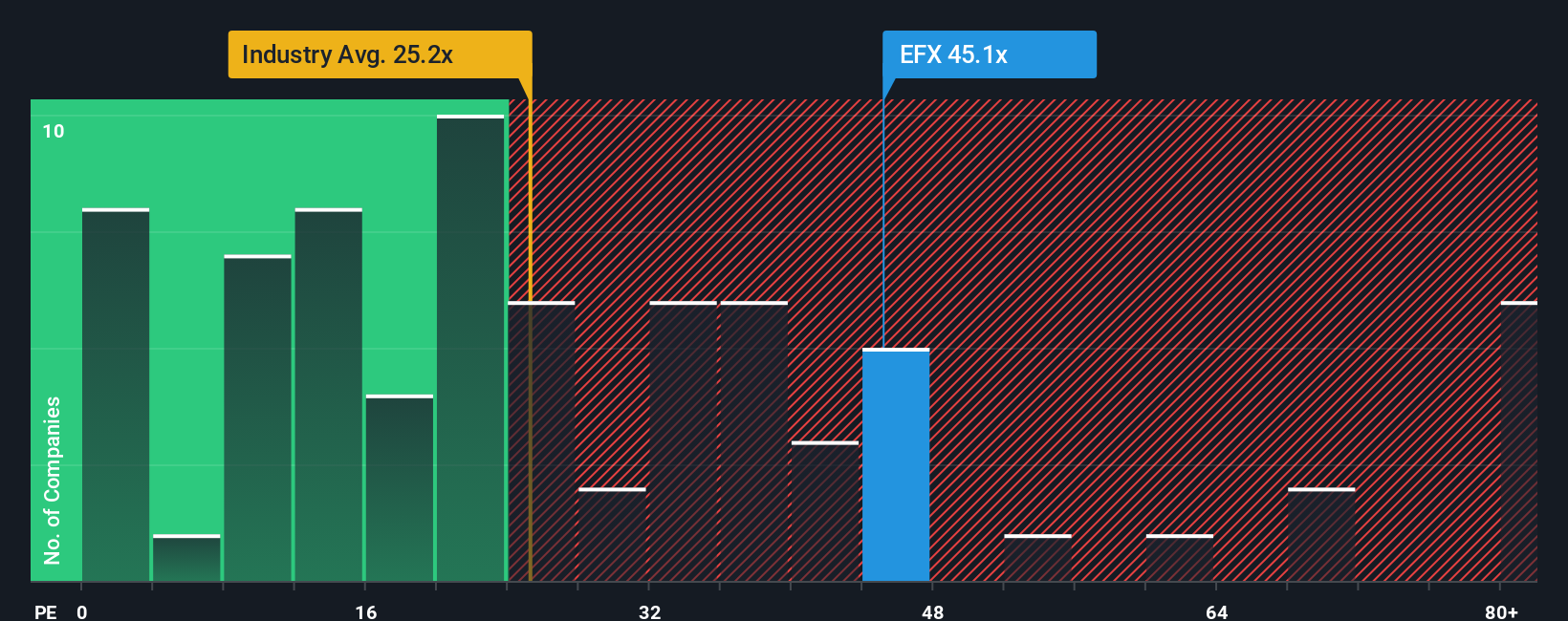

Equifax currently trades at a PE ratio of 39.2x. This stands noticeably above the Professional Services industry average of 25.4x and also higher than its peer average of 34.0x. On the surface, this suggests the stock is priced at a premium compared to both its sector and similar companies.

Simply Wall St introduces a proprietary “Fair Ratio” to move beyond broad comparisons. This tailored benchmark for Equifax is 35.0x, reflecting a blend of factors like its expected earnings growth, sector trends, profit margins, company size, and risk profile. The Fair Ratio is a more nuanced benchmark than the industry or peer averages because it is tailored to Equifax’s specific fundamentals and outlook, giving a clearer signal on whether the current price makes sense.

With Equifax’s actual PE ratio just a bit higher than its Fair Ratio (39.2x versus 35.0x), the difference indicates that the stock is slightly overvalued at current prices, though not excessively so.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Equifax Narrative

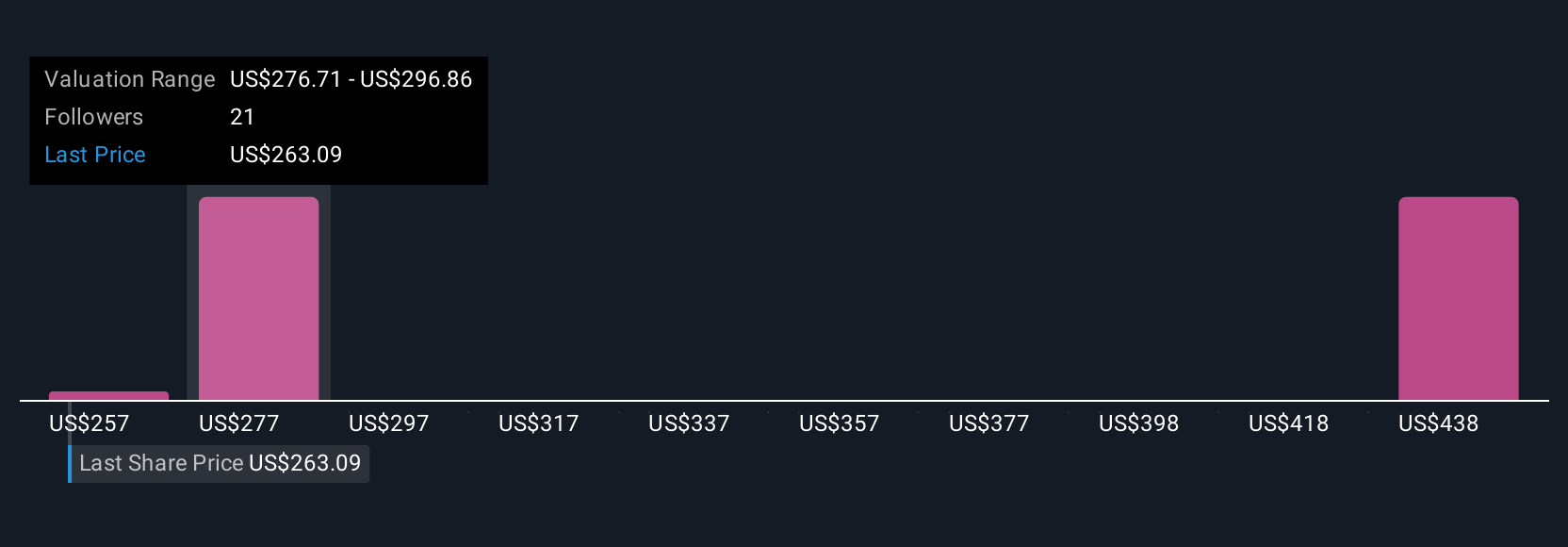

Earlier we mentioned there is a smarter way to understand valuation, so let us introduce Narratives. This is a dynamic tool on Simply Wall St’s Community page that allows investors to bring their perspective to the numbers, weaving a company’s story with its financial forecasts to create a tailored fair value.

A Narrative is more than just a forecast; it lets you apply your own views about Equifax’s future revenue, margins, and risk by connecting the company’s story, whether that includes new products and global expansion or regulatory challenges, directly to your financial estimates and fair value calculation.

This approach gives each investor the power to explain, stress-test, and evolve their reasoning. It makes it easy to decide when the price is right to buy, hold, or sell, all by comparing your own Fair Value to the latest market price.

Narratives are kept up to date automatically whenever major news, earnings, or industry trends emerge, so your investment decisions always reflect the most current information.

For example, while some Equifax investors emphasize bullish factors like expanding international operations and data-driven product launches and assign a fair value as high as $300, others worry about rising competition and regulatory risk and set a fair value closer to $240. Your Narrative helps you cut through the noise and follow the outlook you trust.

Do you think there's more to the story for Equifax? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal