A Fresh Look at PAR Technology’s Valuation Following New Krystal Restaurants Deal and Enterprise Growth Momentum

PAR Technology (PAR) just landed a new deal to power Krystal Restaurants’ nationwide loyalty program. This agreement supports Krystal’s expansion plans and further establishes PAR’s role in the quick-serve restaurant tech sector.

See our latest analysis for PAR Technology.

After a tough year marked by a 50% drop in share price year-to-date, momentum for PAR Technology still feels muted despite real progress on marquee client wins and a healthy growth pipeline. Investor updates noted PAR notched record customer wins and a strong deal backlog, tempered by some rollout delays and recalibrated growth targets. However, management remains upbeat on long-term recurring revenue potential. While the 3-year total shareholder return sits at an impressive 42%, recent price declines serve as a reminder that sentiment can shift quickly, even with underlying business momentum building in the background.

If PAR’s pivot to new partnerships has you curious, you might find it worthwhile to explore fast growing stocks with high insider ownership as your next discovery opportunity.

With shares trading far below analyst targets and management’s optimism about future growth, the question now is whether the market is overlooking PAR’s prospects or if expectations for a rebound are already reflected in the price.

Most Popular Narrative: 50.5% Undervalued

PAR Technology’s most popular narrative puts its fair value at $71.33, more than double the last close price of $35.34. This sharp divergence supports a bold case for potential future upside, based on accelerating growth, platform expansion, and operational leverage.

Strong acceleration in cross-sell and multiproduct adoption (bundled POS, back office, payments, digital ordering, and loyalty), with average revenue per user (ARPU) on full-suite deals up to 2x-3x traditional deals, is expected to materially increase net revenue retention and expand gross margins as these contracts flow through the income statement over the next 12-18 months.

Want to know which financial engine is powering this sky-high fair value? The narrative focuses on rapid upselling, industry-leading margins, and aggressive tech adoption. Why do analysts link these catalysts to a valuation usually reserved for sector disruptors? Only the full narrative reveals the numbers and logic that challenge the market’s current view.

Result: Fair Value of $71.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slower than expected rollout of new solutions or reliance on large contracts could threaten PAR Technology’s growth outlook and delay progress toward profitability.

Find out about the key risks to this PAR Technology narrative.

Another View: What Do Market Ratios Reveal?

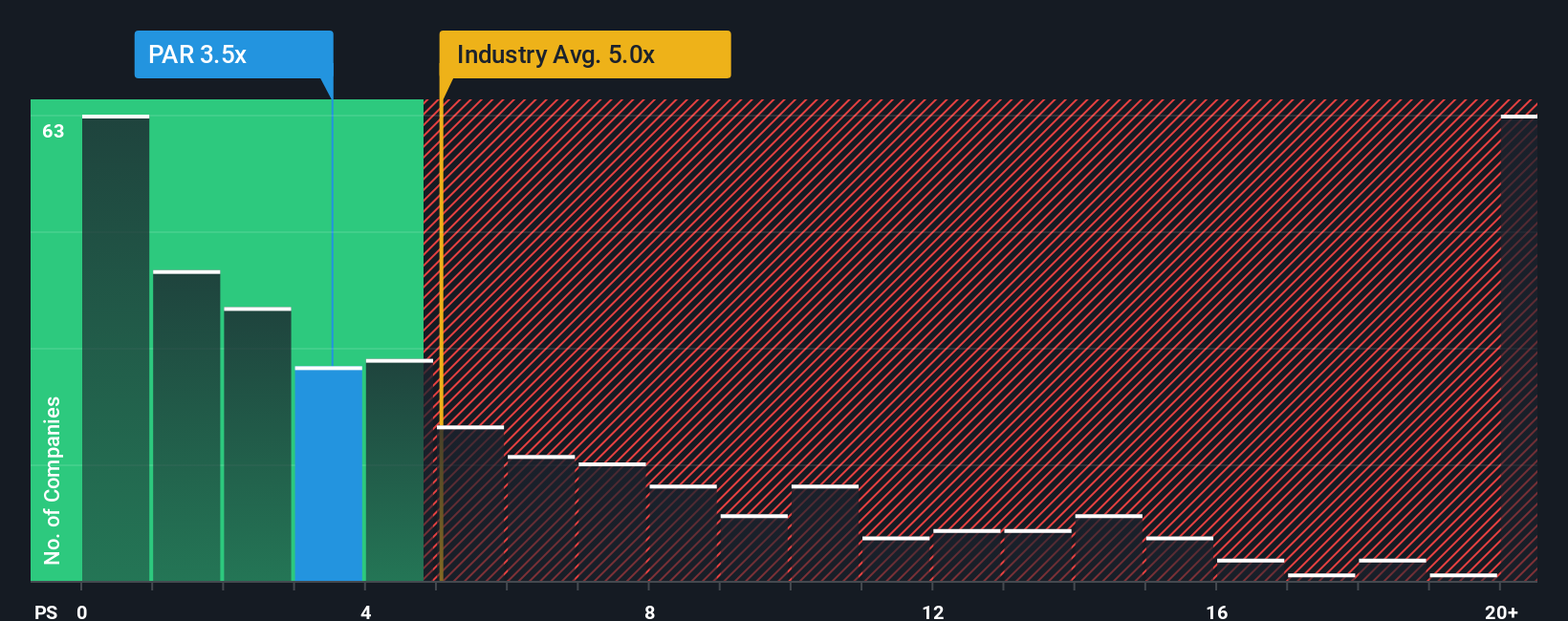

Looking through a different lens, PAR Technology's price-to-sales ratio sits at 3.4x, below the US Software industry average of 5.2x and its peer group’s 4.2x. This suggests relative value. Yet, the current ratio remains above the fair ratio of 2.7x, which hints at some valuation risk if expectations fall short. If the market shifts toward this fair ratio, could today’s discount be less of a sure thing than it appears?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PAR Technology Narrative

Curious to see things differently or keen to dig into your own findings? You can craft your own investment view in just a few minutes. Do it your way

A great starting point for your PAR Technology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Broaden your horizon and get ahead of the market by sizing up unique stocks outside the mainstream. These powerful tools can help you spot opportunities others often miss.

- Capture steady income streams by evaluating market leaders with healthy yields through these 22 dividend stocks with yields > 3%. Find companies supporting growth with strong dividends.

- Ride the AI innovation wave by using these 26 AI penny stocks to access businesses poised to benefit from artificial intelligence breakthroughs and sector momentum.

- Target hidden value opportunities often overlooked. these 832 undervalued stocks based on cash flows uncovers stocks trading below their intrinsic worth based on robust fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal