Bright Horizons (BFAM) Margin Surge Reinforces Profit Quality Narrative Despite Slower Growth Outlook

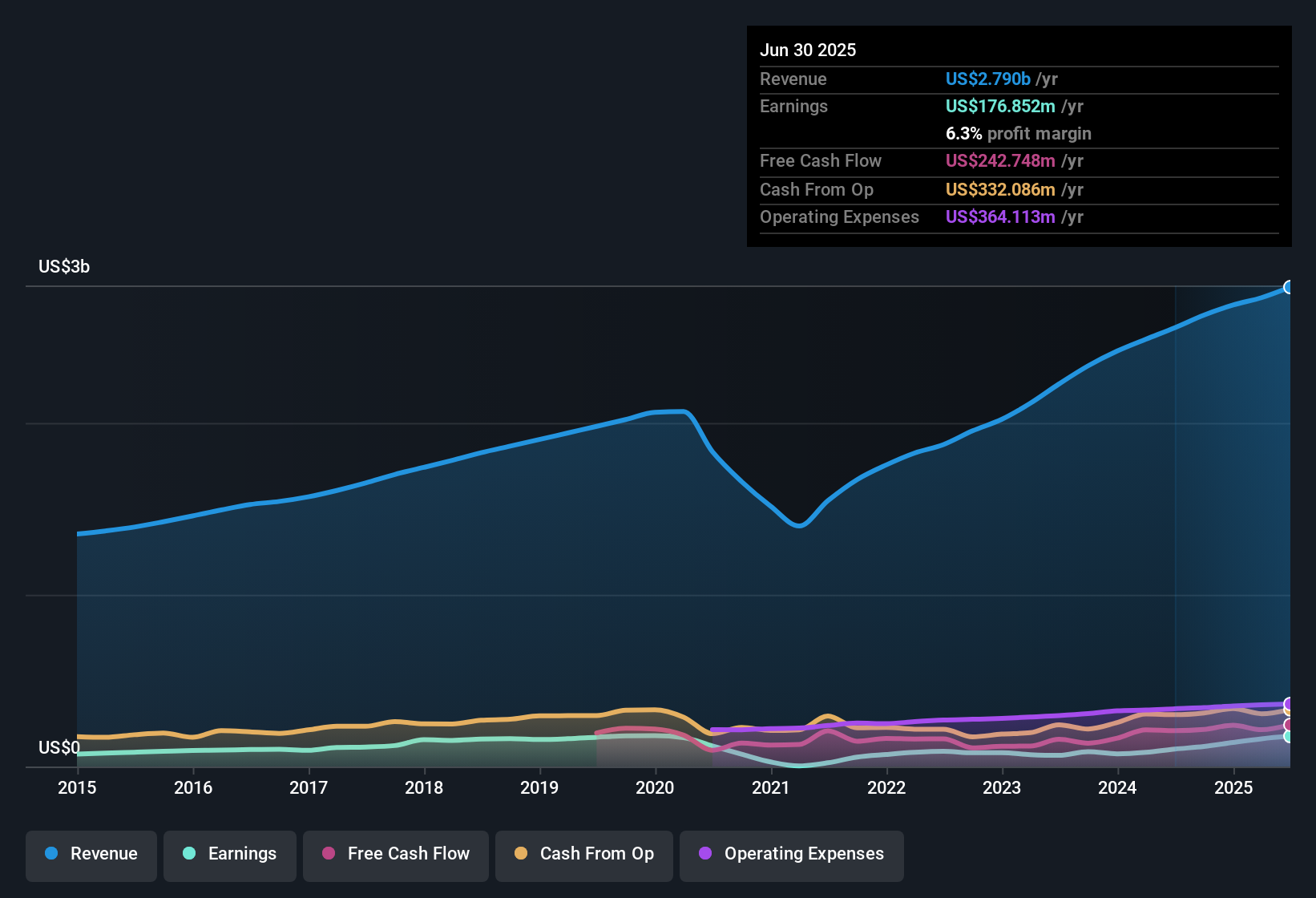

Bright Horizons Family Solutions (BFAM) posted net profit margins of 6.3%, up from last year’s 4%, with earnings surging 74.1% over the past year and averaging 29.3% annual growth over five years. Although revenue and earnings are forecast to continue rising at 6.8% and 13.7% per year, respectively, these growth rates trail the broader US market. Investors are weighing this steady profit momentum and margin improvement against a premium valuation, as the stock trades at 35.1x earnings yet remains below its estimated fair value.

See our full analysis for Bright Horizons Family Solutions.Now, we will set these headline figures against the most widely held narratives about the company to see which themes get confirmed and which may get shaken up.

See what the community is saying about Bright Horizons Family Solutions

Margin Gains Fuel Optimism on Profit Quality

- Net profit margins are projected to improve from the current 6.3% to 9.5% within three years, according to analyst forecasts.

- Analysts' consensus view emphasizes that these margin gains are driven by operational improvements such as streamlined centers and investments in technology, which reinforce the argument for resilient, high-quality earnings despite sector wage pressures and occupancy headwinds.

- Profit margin growth outpaces enrollment recovery and aligns with ongoing cost control efforts, supporting a more optimistic case for long-term profitability.

- At the same time, analysts highlight that persistent labor and enrollment challenges could still limit margin expansion across lower-performing locations, tempering some of the bullish enthusiasm tied to operational gains.

- For a deeper dive into how analysts think Bright Horizons stacks up overall, including margin and growth prospects, see the full consensus breakdown. 📊 Read the full Bright Horizons Family Solutions Consensus Narrative.

Share Decline Offsets Peer Premium

- The price-to-earnings ratio of 35.1x stands well above the US Consumer Services industry average of 18.4x and the peer group average of 13x, yet the stock is trading below its DCF fair value estimate of $165.55, at a current share price of $109.23.

- Analysts' consensus view notes that while the high valuation multiple may deter value-oriented investors, the significant gap between the market price and DCF fair value supports claims of potential upside, provided that future earnings and margin expansion targets are met.

- This narrative is complicated by the fact that future price targets depend on achieving $3.5 billion in revenues and a PE ratio of 28.1x by 2028, meaning any shortfall in growth or margin trends could challenge upside expectations.

- Current trading below both consensus analyst target ($131.56) and DCF fair value serves as a cushion for downside risk, even as absolute multiples remain high versus peers.

Enrollment and Center Mix in the Spotlight

- Recent data show a quarter with eight center closures and only five openings, due to ongoing rationalization and underperforming locations primarily in the US, reflecting operational headwinds.

- Analysts' consensus view acknowledges that, despite overall resilience from employer-sponsored childcare and international expansion, sustained low enrollment growth and net center closures risk constraining revenue and margin expansion.

- Enrollment and occupancy challenges, especially in roughly 10% of centers, have become a key stumbling block for unlocking additional profitability and supporting the bullish narrative for top-line growth.

- Even as labor and wage pressures appear contained for now, analysts stress that a failure to boost enrollment could stall the profit recovery story and future margin expansion.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bright Horizons Family Solutions on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh angle on the data? Share your outlook and craft your own narrative in just a few minutes. Do it your way

A great starting point for your Bright Horizons Family Solutions research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Bright Horizons faces headwinds from enrollment challenges and premium valuation, which could limit upside if growth or margin targets are missed.

If you want companies that may offer stronger value and less reliance on optimistic forecasts, our these 833 undervalued stocks based on cash flows is tailored to spotlight compelling ideas trading below fair value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal