Did FICO's New Mortgage Simulator Access Change the Competitive Equation for Fair Isaac (FICO)?

- In late October, SharperLending Solutions and Credit Interlink announced the integration of the FICO® Score Mortgage Simulator into their platforms, bringing this advanced credit modeling tool directly to mortgage industry professionals and their clients.

- This expansion uniquely positions FICO as the only provider offering a simulator built on its proprietary score algorithm, resulting in greater transparency and more tailored credit insights for homebuyers and lenders.

- We’ll explore how expanding access to the FICO® Score Mortgage Simulator through new partnerships could influence Fair Isaac’s wider investment outlook.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Fair Isaac Investment Narrative Recap

To want to own shares of Fair Isaac today, you need to believe in FICO’s ability to retain dominance in credit decisioning even as alternative scoring models and regulatory changes threaten its core mortgage franchise. The recent integrations of the FICO Score Mortgage Simulator with SharperLending Solutions and Credit Interlink extend FICO’s mortgage presence, but do not materially alter the key near-term catalyst, platform adoption acceleration, or reduce the major risk of regulatory-driven competition from VantageScore.

Among recent announcements, the September 2025 launch of the FICO Foundation Model for Financial Services stands out. By enhancing the accuracy and reliability of FICO’s AI tools, this initiative directly ties into the company’s focus on technology innovation as a growth driver, critical given the ongoing push for more predictive, explainable analytics in financial services.

However, investors should not overlook the continuing risk that regulatory endorsement of alternative scores like VantageScore could erode FICO’s pricing power and market share, particularly if...

Read the full narrative on Fair Isaac (it's free!)

Fair Isaac's outlook projects $2.9 billion in revenue and $1.1 billion in earnings by 2028. This scenario assumes a 14.3% annual revenue growth rate and an increase in earnings of about $467 million from the current $632.6 million.

Uncover how Fair Isaac's forecasts yield a $2017 fair value, a 22% upside to its current price.

Exploring Other Perspectives

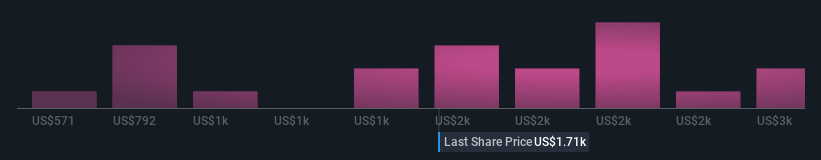

Seventeen individual Simply Wall St Community fair value estimates for Fair Isaac span from US$1,252 to US$2,627.67. With the company’s future shaped by regulatory competition and product adoption, you’ll find sharply contrasting viewpoints worth exploring in the full set of community analyses.

Explore 17 other fair value estimates on Fair Isaac - why the stock might be worth 25% less than the current price!

Build Your Own Fair Isaac Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fair Isaac research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fair Isaac research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fair Isaac's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal