Acuity Brands (AYI): Evaluating Valuation After Strong Buyback Execution and Market-Beating Margins

Acuity (AYI) just wrapped up another phase of its share buyback program, catching the attention of investors who are monitoring capital allocation moves in a challenging market. This update highlights management’s confidence and focus on driving shareholder value.

See our latest analysis for Acuity.

Momentum around Acuity is building, with its 19.8% 90-day share price return standing out against a steady upward trend. Investors have noticed this, particularly as the company’s strong buyback execution and robust gross margins set it apart from peers facing tougher markets. Over the long haul, Acuity’s total shareholder return has been impressive, more than doubling in three years and nearly tripling over five.

If you’re curious about what other companies are capturing attention for growth and insider confidence, now is the time to broaden your search and discover fast growing stocks with high insider ownership

With such strong returns and a disciplined buyback in play, is Acuity still trading at a bargain, or has the market already factored in all of its future growth potential?

Most Popular Narrative: 8.6% Undervalued

The most widely followed narrative sets a fair value for Acuity that stands above its latest closing price, highlighting analyst conviction in further upside. Market performance and rising expectations create a fascinating gap between what has already happened and what could come next.

Acuity's investment in its electronics portfolio, including market-leading lighting controls technology and proprietary drivers, positions it to improve product vitality and enhance productivity, potentially driving revenue growth and improving net margins.

Wondering what is fueling this bullish price target? The core of this narrative is built on ambitious, but not reckless, assumptions about growth and profitability. Find out which specific future trends are driving this premium valuation and why market consensus is willing to pay up for Acuity’s next chapter.

Result: Fair Value of $399.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost inflation and uncertain demand trends could undermine Acuity’s margin expansion, which may challenge the bullish outlook outlined by analysts.

Find out about the key risks to this Acuity narrative.

Another View: Market Ratios Raise Questions

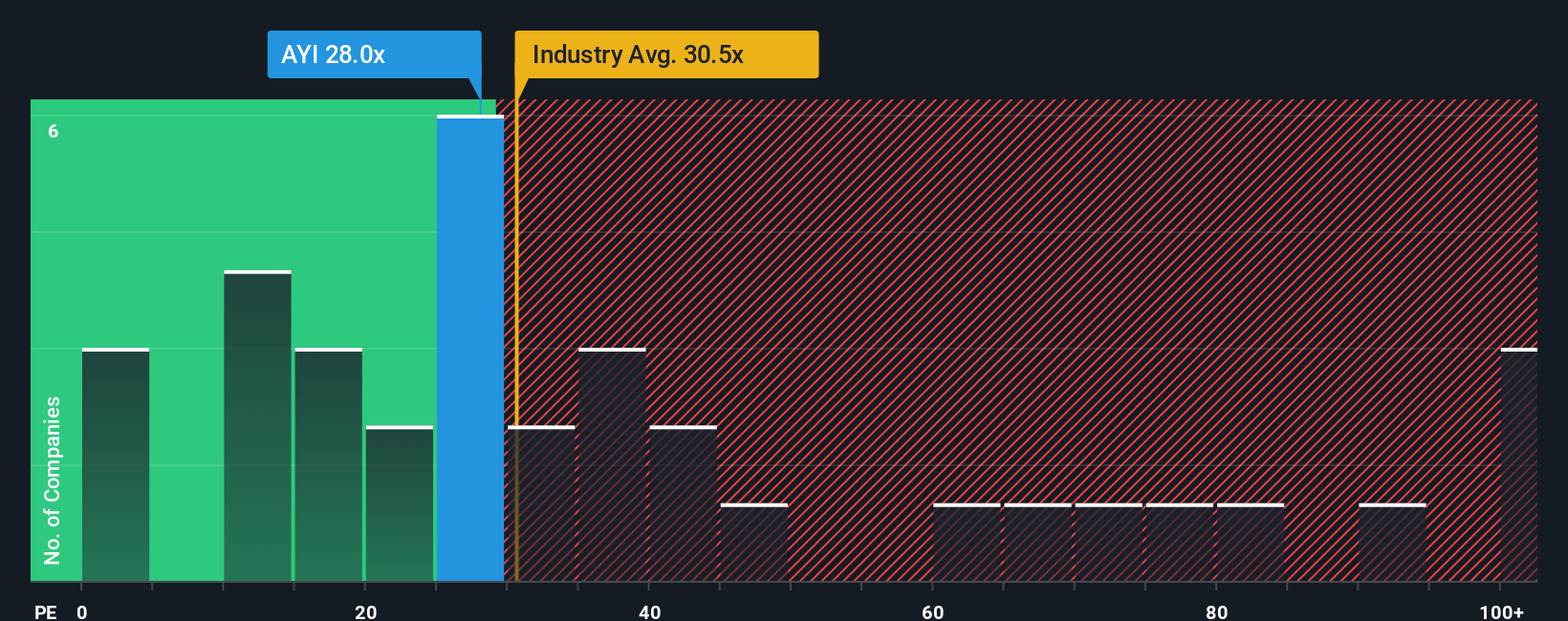

While analysts see Acuity as undervalued, our analysis of price-to-earnings ratios paints a murkier picture. Acuity’s P/E is 28.2x, which is notably lower than its peer group average of 41.5x and also below the industry average of 31.4x. However, it is still above the estimated fair ratio of 24.7x, suggesting limited upside unless earnings growth picks up or the market re-rates.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Acuity for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 833 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Acuity Narrative

If you’re curious to dig into the numbers yourself or have a different perspective, it’s quick and easy to build and share your own view. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Acuity.

Looking for More High-Potential Opportunities?

Don’t limit yourself to just one story. The market is full of breakthrough opportunities. Start building a smarter portfolio today with ideas others might miss.

- Capitalize on cash flow bargains by checking out these 833 undervalued stocks based on cash flows making major moves in today’s market.

- Target tomorrow’s medical trailblazers and see why these 33 healthcare AI stocks could change your view on healthcare innovation.

- Tap into big returns and growth opportunities as you review these 3580 penny stocks with strong financials gaining traction among savvy investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal