J&J’s IMAAVY™ Head-to-Head Study Might Change the Case for Investing in JNJ

- Johnson & Johnson recently announced plans to launch the first head-to-head study comparing its FcRn blocker IMAAVY™ with other agents in generalized myasthenia gravis, supported by positive long-term data from the Vibrance-MG extension study in pediatric patients.

- This development highlights IMAAVY™ as the only FcRn blocker currently approved for both adult and pediatric gMG patients aged 12 and older with specific antibody positivity, emphasizing its differentiated clinical value in the market.

- We'll examine how the initiation of a head-to-head clinical trial for IMAAVY™ could impact Johnson & Johnson's investment narrative and growth outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Johnson & Johnson Investment Narrative Recap

Shareholders in Johnson & Johnson need to believe in the ongoing strength of its innovative medicine pipeline and the company's ability to offset headwinds from biosimilar competition for STELARA. The recent IMAAVY™ head-to-head study announcement is interesting, but the most important short-term catalyst remains the ability to drive revenue growth and defend margins as top products face patent expiries; this news does not materially shift that outlook. The biggest risk is still adverse litigation developments, especially regarding talc-related cases, which could impact financial stability and cash flow.

Of the recent announcements, the new long-term data for IMAAVY™ in pediatric gMG patients stands out, supporting Johnson & Johnson’s effort to strengthen its innovative medicine segment and sustain revenue growth. This aligns closely with the catalyst of expanding next-generation therapies, though the impact on near-term earnings remains relatively limited compared to broader portfolio risks. In contrast, investors should be aware of the ongoing litigation risk that still looms large for ...

Read the full narrative on Johnson & Johnson (it's free!)

Johnson & Johnson's outlook forecasts $104.1 billion in revenue and $22.9 billion in earnings by 2028. This assumes an annual revenue growth rate of 4.7% and a small earnings increase of $0.2 billion from the current $22.7 billion.

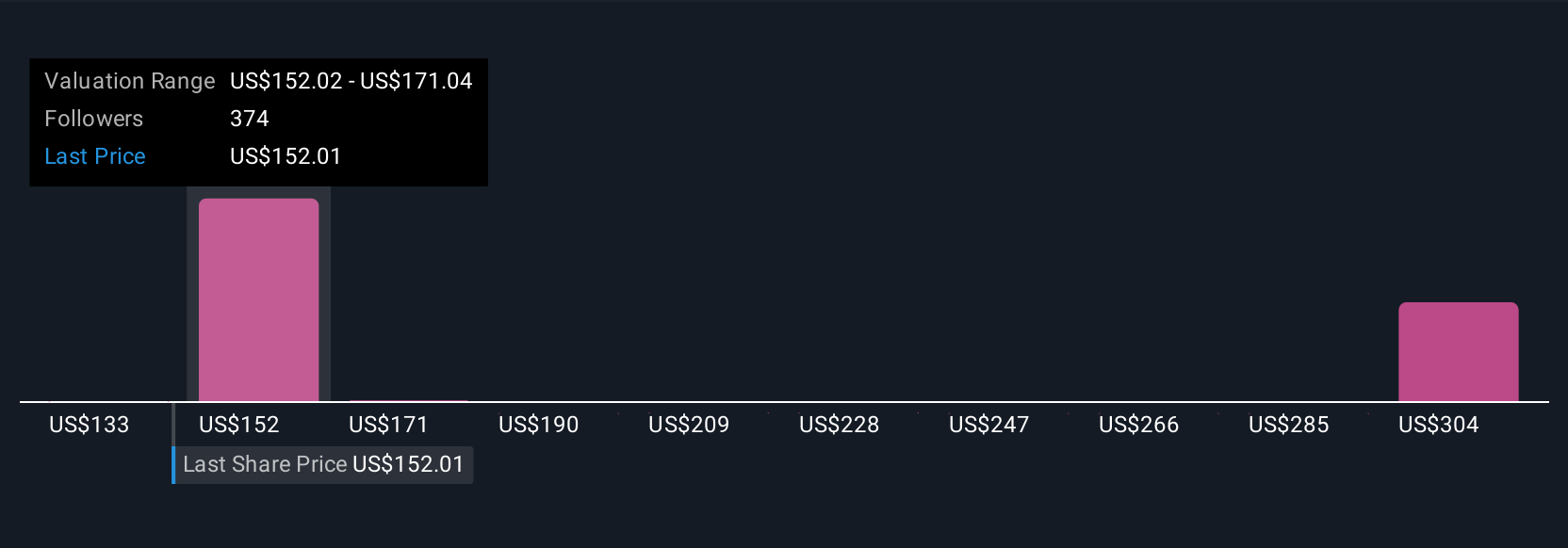

Uncover how Johnson & Johnson's forecasts yield a $198.03 fair value, a 5% upside to its current price.

Exploring Other Perspectives

With 21 fair value estimates from the Simply Wall St Community ranging from US$143.62 to US$432.38, opinions on Johnson & Johnson’s worth are wide. While many analysis highlight pipeline innovation as a key driver ahead, the risk of major legal liabilities is never far from discussion, explore why this matters across different viewpoints.

Explore 21 other fair value estimates on Johnson & Johnson - why the stock might be worth 24% less than the current price!

Build Your Own Johnson & Johnson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Johnson & Johnson research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Johnson & Johnson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Johnson & Johnson's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal