EnerSys (ENS): Evaluating Valuation as Lower Sales and Margin Pressures Raise Outlook Concerns

Recent commentary points out that EnerSys (NYSE:ENS) is seeing lower unit sales and facing pressure on its free cash flow margin. These developments are prompting investors to scrutinize the company’s future growth prospects and potential shareholder returns.

See our latest analysis for EnerSys.

Despite the supply headwinds and tighter free cash flow margins making headlines this quarter, EnerSys shares have been on a tear, with a 9.7% 1-month share price return and an impressive 41% jump over the last three months. The company’s strong price momentum stands out, and its 1-year total shareholder return of 31% continues a robust trend stretching back several years.

If these moves have you looking for your next investing angle, consider this an opportunity to discover fast growing stocks with high insider ownership.

The real question now is whether EnerSys shares are still trading below their true value, or if the market’s recent optimism has already captured all the future growth investors can expect. Could this be a genuine buying opportunity, or is everything priced in?

Most Popular Narrative: 5% Overvalued

EnerSys is now trading above the most popular fair value estimate of $120.00, with its last close reaching $126.16. It is a sharp move that puts the spotlight on a valuation debate: has bullish sentiment pushed shares beyond their justified price, or is there more upside still to uncover?

Ongoing recovery in U.S. communications and robust growth in Data Center deployments, both driven by upgrades to broadband and expansion of digital infrastructure, are expected to fuel accelerating demand for EnerSys' energy storage solutions, supporting multi-year revenue growth. Major cost-reduction initiatives, including a strategic realignment and transition to Centers of Excellence (CoEs), are expected to generate $80 million in annualized savings starting in fiscal 2026, structurally expanding net and operating margins.

Curious how such an outlook justifies the current valuation? The narrative hinges on game-changing margin improvements and structural efficiency gains. But what financial scenarios lie beneath the surface? Dive into the full narrative to see which future business shifts and profit assumptions determined this price target; there may be a surprise in the details.

Result: Fair Value of $120.00 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade policy uncertainties or further delays in EnerSys’s lithium initiatives could undermine the current bullish outlook and put pressure on future margins.

Find out about the key risks to this EnerSys narrative.

Another View: What Does the Market Multiple Say?

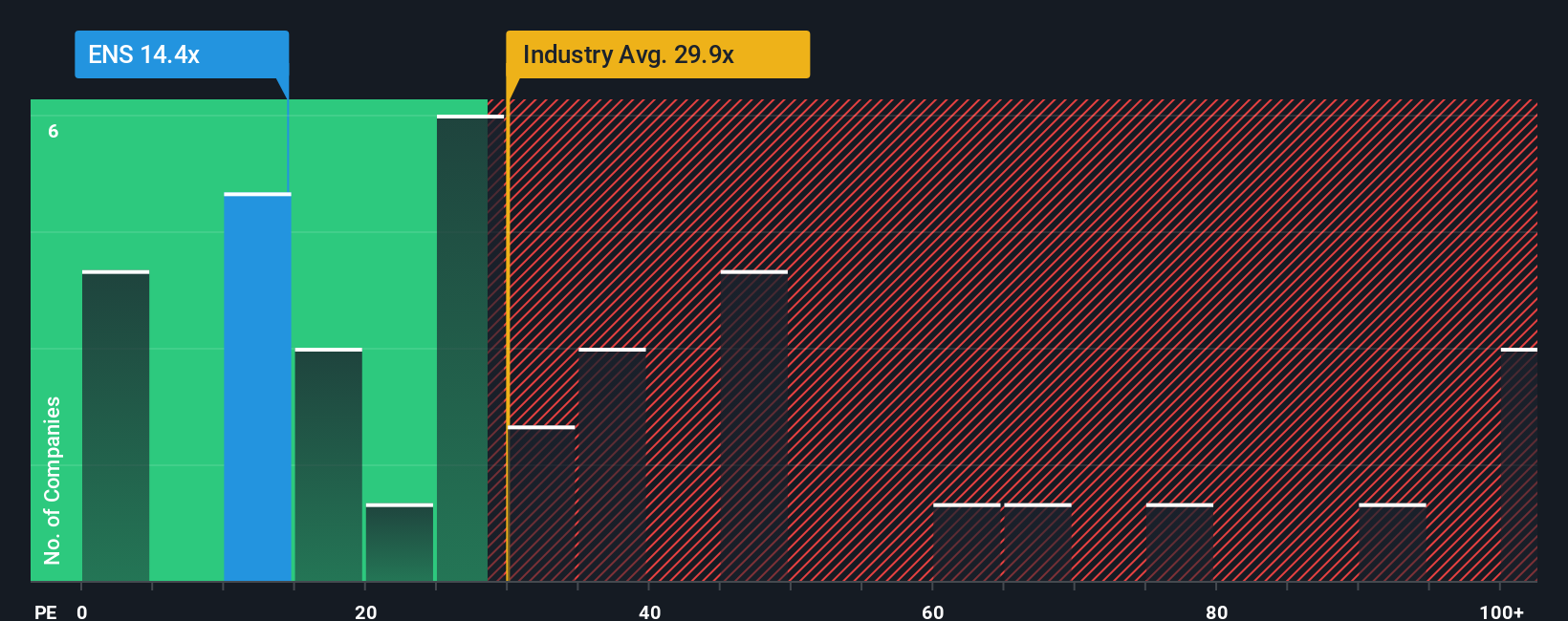

Our second lens uses the company’s price-to-earnings ratio. At 13.4x, EnerSys is valued well below the US Electrical industry average of 29.4x and its peer average of 35.3x. It also stands beneath the implied fair ratio of 21.2x. This could signal further opportunity, or a reason for caution if the gap never closes. Which side of this divide are you on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EnerSys Narrative

If you have a different take, or want to dig into the numbers on your own terms, consider crafting your own perspective in just a few minutes with Do it your way.

A great starting point for your EnerSys research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for Your Next Winning Idea?

Stay a step ahead by tapping into new trends and unique sectors. Don’t let great opportunities pass you by when smarter investment moves are just a click away.

- Capitalize on breakthroughs in digital health by targeting real growth potential with these 34 healthcare AI stocks.

- Catch the next wave of market outperformance and zero in on bargains with strong earnings upside through these 834 undervalued stocks based on cash flows.

- Boost your passive income strategy and find high-yield contenders with these 24 dividend stocks with yields > 3% offering attractive dividend returns above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal