Broadridge's Push Into Tokenization Might Change The Case For Investing In Broadridge Financial Solutions (BR)

- On October 21, 2025, Broadridge Financial Solutions presented at its Annual Meeting in Washington D.C., where CEO Timothy C. Gokey addressed advancements in digital financial services.

- Recent Broadridge research highlights that tokenization is moving quickly from theory to application, with the company emerging as a key enabler of tokenized trading solutions for institutional clients.

- We'll explore how Broadridge's leadership in tokenization technology could shape its long-term outlook within financial services.

Find companies with promising cash flow potential yet trading below their fair value.

Broadridge Financial Solutions Investment Narrative Recap

To have confidence as a Broadridge shareholder, one needs to believe in the company's ability to lead the digitization and modernization of financial services, especially as institutions shift to tokenized assets. The recent focus on tokenization and the company's early mover status in this space provide reassurance about its strategic direction, but the largest near-term risk, declining event-driven revenue expected in fiscal 2026, remains unaddressed by these announcements and is not materially changed by this news. Among major announcements, Broadridge's latest partnership with WealthFeed to boost AI-enabled marketing solutions for advisors demonstrates the company’s continued investment in digital transformation. This move is aligned with one of Broadridge’s most important catalysts: accelerating demand for digitized and automated financial services, which could help drive recurring revenue growth and offset some revenue volatility in other segments. In contrast, investors should be aware of the prominent risk that as event-driven revenues normalize after a record year, earnings may face short-term headwinds if...

Read the full narrative on Broadridge Financial Solutions (it's free!)

Broadridge Financial Solutions' narrative projects $8.0 billion in revenue and $1.1 billion in earnings by 2028. This requires 5.3% yearly revenue growth and a $260 million increase in earnings from the current $839.5 million.

Uncover how Broadridge Financial Solutions' forecasts yield a $279.12 fair value, a 26% upside to its current price.

Exploring Other Perspectives

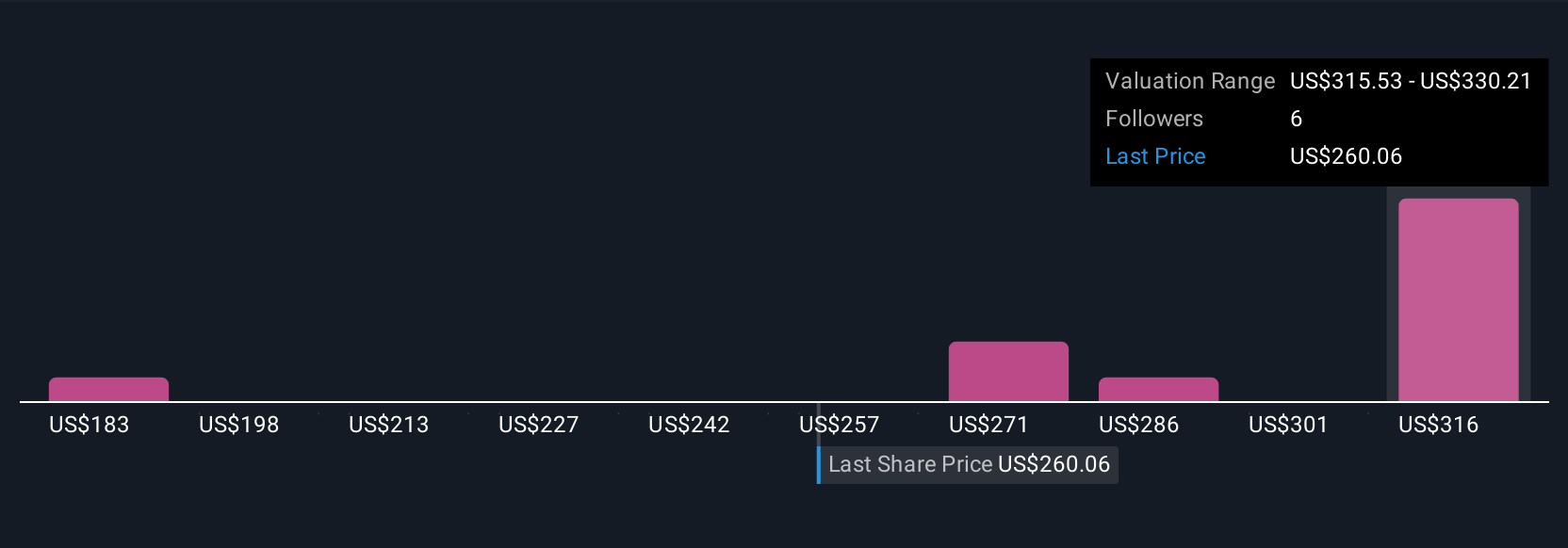

Simply Wall St Community members estimate Broadridge’s fair value from US$279.13 to US$330.13 across three independent views. While the digitization catalyst is positive, the wide range of opinions shows just how differently you might assess the company’s earnings resilience.

Explore 3 other fair value estimates on Broadridge Financial Solutions - why the stock might be worth as much as 49% more than the current price!

Build Your Own Broadridge Financial Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Broadridge Financial Solutions research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Broadridge Financial Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Broadridge Financial Solutions' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal