Earnings Preview: Comstock Resources

Comstock Resources (NYSE:CRK) is set to give its latest quarterly earnings report on Monday, 2025-11-03. Here's what investors need to know before the announcement.

Analysts estimate that Comstock Resources will report an earnings per share (EPS) of $0.05.

Comstock Resources bulls will hope to hear the company announce they've not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

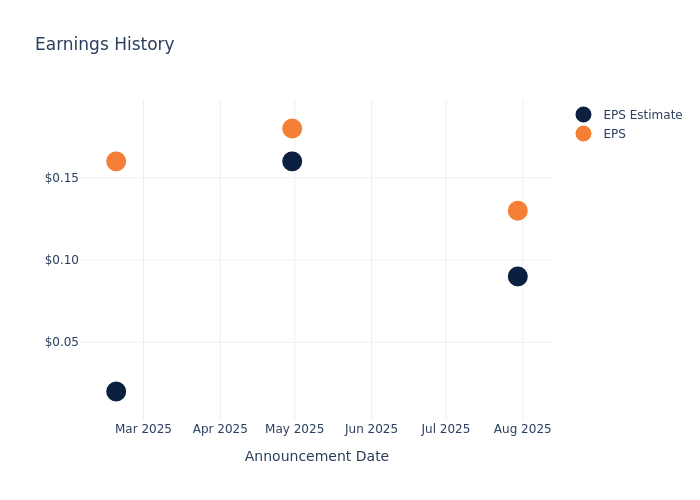

Overview of Past Earnings

Last quarter the company beat EPS by $0.04, which was followed by a 14.05% drop in the share price the next day.

Here's a look at Comstock Resources's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.09 | 0.16 | 0.02 | -0.16 |

| EPS Actual | 0.13 | 0.18 | 0.16 | -0.17 |

| Price Change % | -14.00 | 3.00 | 10.00 | -7.00 |

Tracking Comstock Resources's Stock Performance

Shares of Comstock Resources were trading at $18.38 as of October 30. Over the last 52-week period, shares are up 58.76%. Given that these returns are generally positive, long-term shareholders should be satisfied going into this earnings release.

Insights Shared by Analysts on Comstock Resources

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on Comstock Resources.

Comstock Resources has received a total of 8 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $16.62, the consensus suggests a potential 9.58% downside.

Analyzing Analyst Ratings Among Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Chord Energy, Matador Resources and Viper Energy, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Analysts currently favor an Outperform trajectory for Chord Energy, with an average 1-year price target of $137.47, suggesting a potential 647.93% upside.

- Analysts currently favor an Outperform trajectory for Matador Resources, with an average 1-year price target of $60.43, suggesting a potential 228.78% upside.

- Analysts currently favor an Outperform trajectory for Viper Energy, with an average 1-year price target of $52.67, suggesting a potential 186.56% upside.

Snapshot: Peer Analysis

The peer analysis summary presents essential metrics for Chord Energy, Matador Resources and Viper Energy, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Comstock Resources | Neutral | 90.52% | $101.75M | 5.72% |

| Chord Energy | Outperform | -6.36% | $171.79M | -4.64% |

| Matador Resources | Outperform | 6.39% | $321.02M | 3.24% |

| Viper Energy | Outperform | 37.50% | $152M | 1.21% |

Key Takeaway:

Comstock Resources ranks at the bottom for Revenue Growth and Gross Profit, while it is in the middle for Return on Equity.

All You Need to Know About Comstock Resources

Comstock Resources Inc is an independent natural gas producer operating in the Haynesville shale, a natural gas basin located in North Louisiana and East Texas with superior economics given its geographical proximity to the Gulf Coast natural gas markets. The Company operates in one business segment, the exploration and production of North American natural gas and oil. It is engaged in the acquisition, development, production, and exploration of oil and natural gas. Its oil and gas operations are concentrated in Louisiana and Texas.

Key Indicators: Comstock Resources's Financial Health

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Comstock Resources's remarkable performance in 3 months is evident. As of 30 June, 2025, the company achieved an impressive revenue growth rate of 90.52%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Energy sector.

Net Margin: Comstock Resources's net margin excels beyond industry benchmarks, reaching 26.55%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Comstock Resources's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 5.72% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Comstock Resources's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 1.88%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: With a high debt-to-equity ratio of 1.39, Comstock Resources faces challenges in effectively managing its debt levels, indicating potential financial strain.

To track all earnings releases for Comstock Resources visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal