Xerox (XRX): Losses Deepen 52.7% Annually, Undervalued Shares Test Bullish Turnaround Narratives

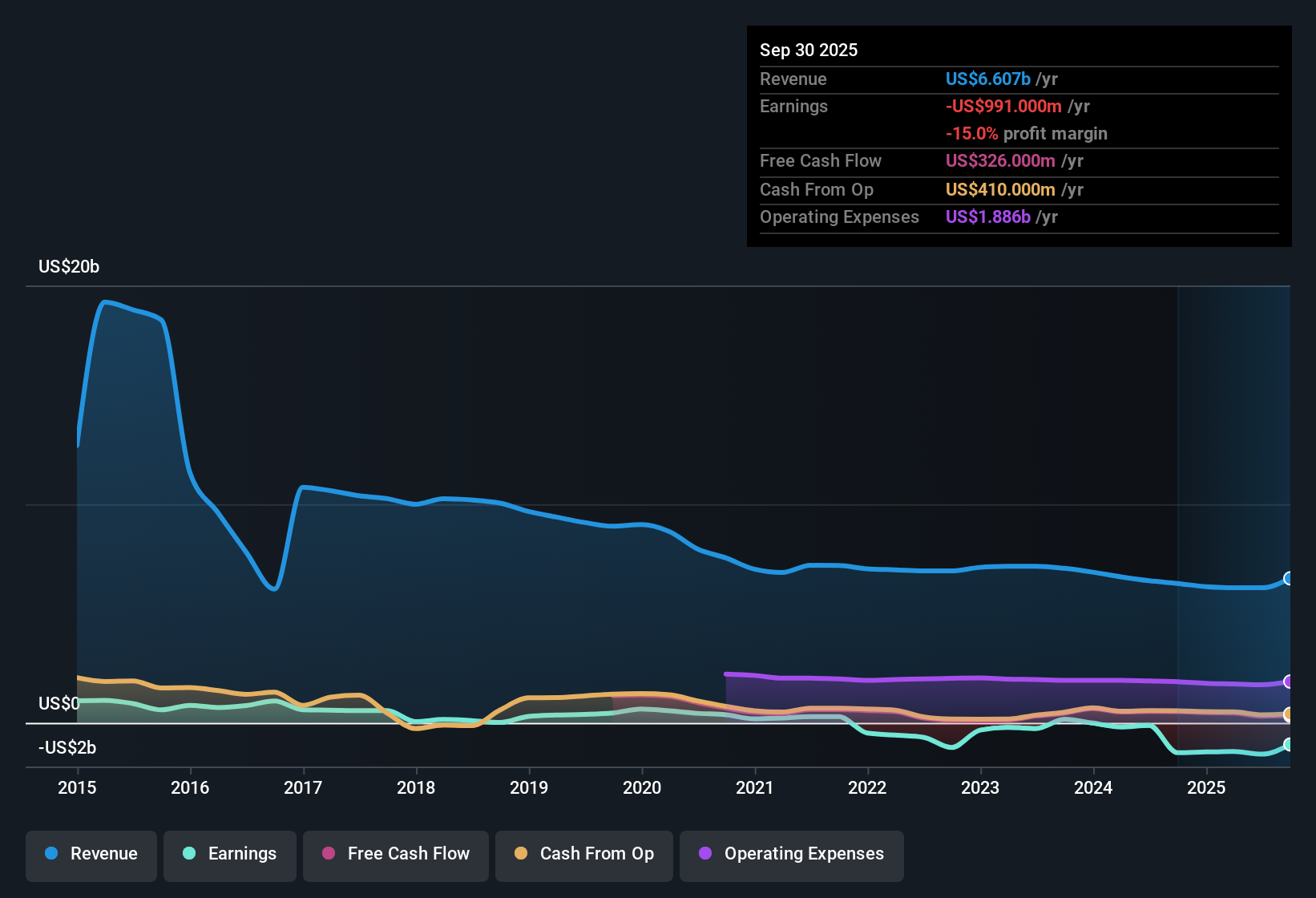

Xerox Holdings (XRX) continues to face profitability challenges, with net losses deepening at an annual rate of 52.7% over the past five years. While revenue is projected to grow at 6.2% per year, this pace lags well behind the broader US market’s expected 10.3% annual growth. Despite a muted performance on margins and ongoing negative earnings, some investors will note that the company trades at a Price-To-Sales Ratio of just 0.1x, significantly below peer and industry averages. This raises the question of whether value now outweighs risk.

See our full analysis for Xerox Holdings.Next up, let’s see how these latest numbers compare against the narratives that drive discussions among investors and analysts. Reviewing the facts alongside current stories may help clarify where they converge or diverge.

See what the community is saying about Xerox Holdings

Margin Recovery Hinges on Reinvestment

- Profit margins remain under pressure, sitting at -21.2% today, with analysts projecting a dramatic turnaround to 31.8% within just three years, assuming cost-saving and reinvention efforts deliver as planned.

- According to analysts' consensus view, reinvention initiatives targeting more than 100 cost reduction and efficiency projects are set to boost free cash flow and operating income. However,

- these gains depend on executing a complex shift to a business unit-led model and the successful integration of new acquisitions;

- organizational disruption and execution risks may slow improvements, especially as recent revenue declines show that structural changes take time to flow through to the bottom line.

Analysts watching Xerox’s reinvention want to see if the company can pull off those projected margin gains. See exactly what’s at stake in the full Consensus Narrative. 📊 Read the full Xerox Holdings Consensus Narrative.

Acquisitions and Revenue Diversification

- The company is banking on strategic acquisitions such as ITsavvy and Lexmark to stabilize revenue streams and improve operating income margins by broadening market reach beyond legacy hardware.

- Consensus narrative notes the new operating model and expanded product mix could help reverse market share losses and sales declines. However,

- bears argue integration risks may be substantial, and failure to realize projected cost synergies would keep margins and cash flows weak;

- early signs from a 9.7% annual revenue decline in 2024 suggest that market challenges persist, so investors should weigh short-term pain against the long-term upside of diversification.

Valuation Remains Well Below Peers

- With a Price-To-Sales Ratio of 0.1x, Xerox trades at a steep discount to its peer group at 0.9x and the US tech industry at 2.1x, while the current share price of $3.09 sits far below both the $4.50 analyst price target and DCF fair value of $17.30.

- Consensus narrative emphasizes that while the steep valuation discount could attract investors seeking turnaround stories,

- these multiples look attractive only if ongoing restructuring sparks the expected recovery in revenue and profitability as forecasted, not just a temporary pause in deeper declines;

- confidence among analysts is cautious given lingering dividend sustainability concerns and the slow forecasted top-line growth relative to the market.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Xerox Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a fresh take or new angle? Share your perspective now and shape your story in just a few minutes with Do it your way.

A great starting point for your Xerox Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite attempts at turnaround, Xerox’s shrinking margins, slow sales growth, and ongoing losses underline persistent instability in both earnings and cash flow.

If that volatility raises concerns, focus on stable growth stocks screener (2108 results) to spot companies delivering more dependable growth and consistent performance from quarter to quarter.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal