Ulta Beauty (ULTA) Valuation in Focus After Class Action Lawsuit Over 'Clean Ingredient' Marketing

Ulta Beauty (ULTA) is in the spotlight following news of a nationwide class action lawsuit over its Conscious Beauty program. The case centers on claims of misleading 'clean ingredient' marketing and could affect investor sentiment.

See our latest analysis for Ulta Beauty.

The class action headlines arrive just as Ulta Beauty’s share price momentum has cooled, with a 1-month share price return of -6.78% after an energetic rally earlier this year. Yet, the long-term story remains impressive. Shareholders who stuck around for the past year have seen a total return of 38.13%, and those in for five years have nearly tripled their investment, pointing to resilient growth beyond today’s turmoil.

If this shift in sentiment has you curious about other opportunities, it could be the perfect time to see which fast-growing stocks with high insider ownership are catching investor attention. Discover fast growing stocks with high insider ownership

With shares pulling back and analysts still seeing room for upside, the key question is whether Ulta Beauty’s current valuation offers a genuine buying opportunity or if the market has already factored in all of its future growth.

Most Popular Narrative: 11% Undervalued

Compared to Ulta Beauty’s last close at $509.66, the most widely followed market narrative sees room for upside and pegs fair value notably higher. This sets the stage for a deeper look at what’s driving such optimism and how future growth is being positioned beyond recent market jitters.

Ulta Beauty's expansion into the wellness category, with dedicated in-store footprints and over 150 brands, is set to capture a larger share of the rapidly growing self-care and wellness market. This may drive new customer acquisition and top-line revenue growth over the long term. The widening of Ulta's assortment, particularly through exclusive brand launches, key partnerships with in-demand emerging brands, and the rollout of a curated online marketplace, positions the company to attract Gen Z and Millennials, increase basket sizes, and capture higher-margin sales. This could benefit both revenue and gross margins.

Want to know what justifies such a bullish outlook? The secret lies in the bold revenue and profitability roadmap baked into this narrative. It leans on aggressive milestones and long-term customer value. What ambitious financial assumptions are underpinning that price? Dive in to uncover the strategies, growth levers, and numbers that could power Ulta Beauty’s next chapter.

Result: Fair Value of $574.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as rising costs in store operations and intensifying competition in beauty retail could put pressure on Ulta’s growth outlook.

Find out about the key risks to this Ulta Beauty narrative.

Another View: Price-to-Earnings Tells a Different Story

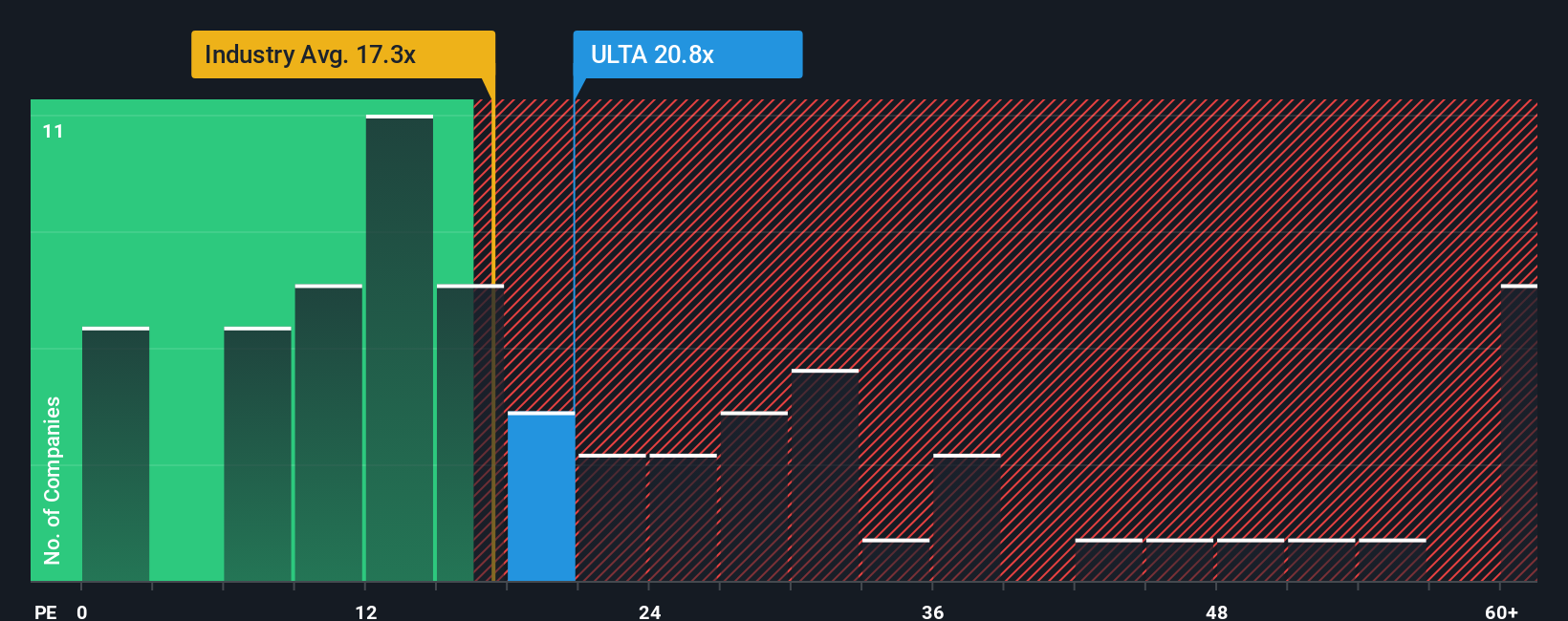

Looking at Ulta Beauty through the lens of its price-to-earnings ratio reveals a more cautious picture. Shares currently trade at 19x earnings, making them pricier than both the US Specialty Retail industry average of 16.6x and the fair ratio of 17.1x. This suggests investors are paying a premium, possibly raising the bar for future returns. Will the market keep rewarding this optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ulta Beauty Narrative

If you have a different perspective or want to chart your own path using the numbers, you can create a full narrative for Ulta Beauty in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Ulta Beauty.

Looking for more investment ideas?

Don’t let your next portfolio winner slip through the cracks. Make your research count by testing fresh strategies and finding unique opportunities right now.

- Catch the wave of innovation by scouting these 26 AI penny stocks bringing artificial intelligence to everyday life, healthcare, and business before everyone else takes notice.

- Maximize your income potential by tapping into these 24 dividend stocks with yields > 3% that consistently deliver impressive yields above 3% for committed investors.

- Get ahead on the next big tech leap with these 28 quantum computing stocks, where pioneers in quantum computing could redefine how we solve problems across finance, science, and cybersecurity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal