Etsy (ETSY) Margin Miss Challenges Optimistic Narratives After $106.8 Million One-Off Loss

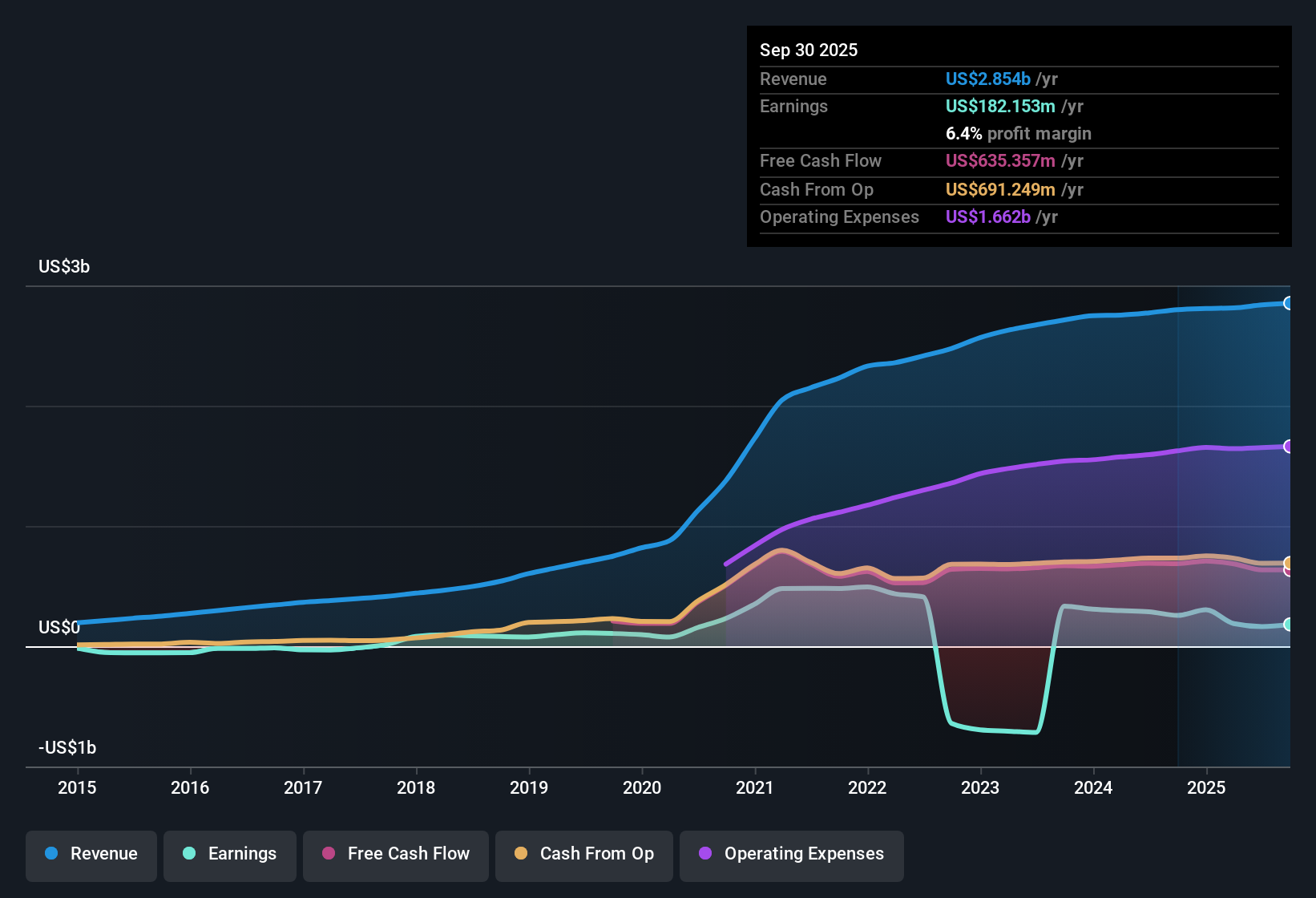

Etsy (ETSY) reported a net profit margin of 6.4%, down from last year’s 9.2%, and disclosed that earnings have declined 9.1% per year over the past five years. The company was hit by a significant one-off loss of $106.8 million for the twelve months to September 30, 2025, but analysts are looking for a turnaround with profit growth forecast at 22.5% per year, which would outpace the projected 15.7% growth for the US market. While revenue is expected to grow more slowly than peers, Etsy’s current valuation and the tension between past declines and future growth projections are keeping investors on alert this season.

See our full analysis for Etsy.Now, let’s see how these headline numbers compare to the most widely circulated narratives. This is where the numbers may either confirm or challenge market expectations.

See what the community is saying about Etsy

Buyer Engagement and GMS Face Headwinds

- Gross merchandise sales (GMS) declined 5.4% year-over-year in Q2 2025, and the trailing 12-month active buyer count dropped 4.6%. This signals that fewer shoppers are transacting and individual buyer spend is down 2.9% versus last year.

- According to the analysts' consensus view, ongoing investment in AI-driven personalization and mobile app engagement is expected to counteract these negative buyer trends.

- Consensus narrative notes that expanding AI personalization and a stronger app footprint could increase buyer retention and frequency, supporting future revenue and margins even as historical transaction volumes and engagement decline.

- Still, the combined impact of lower GMS and declining active buyers remains a challenge for any immediate turnaround, especially as competition for digital shoppers intensifies this year.

Marketing Spend Rises While Margins Are Squeezed

- Marketing expenses climbed 16% year-over-year in Q2 2025, making up 31.5% of revenue. Margin guidance has been revised down to the high-20% EBITDA range from over 30% previously.

- Analysts' consensus view frames this as a potential risk to future profitability if escalating paid social and acquisition costs continue to outpace the incremental returns from new users.

- Higher marketing spend is intended to expand audience reach and boost app downloads. However, consensus narrative highlights that margin flow-through is being compressed as the cost of acquiring each new customer increases.

- If Etsy cannot convert these investments into sustained higher gross merchandise sales, elevated spend will continue to pressure overall profit margins, particularly as competition with larger e-commerce platforms accelerates cost inflation for digital ads and user acquisition.

Valuation Stands Out Despite Peer Premium

- Etsy trades at a Price-to-Earnings of 33.7x, well above the peer average (19.9x) and industry average (21.4x), yet remains below the DCF fair value of $119.31 with the current share price at $61.93.

- Analysts' consensus view sees significant tension in this valuation. The market is paying a growth premium based on future earnings recovery, but only if Etsy’s revenue and margin rebound materializes as projected.

- If earnings grow at the forecast 22.5% per year and profit margins nearly double over the next few years, a price closer to DCF fair value may be justified.

- However, consensus flags that persistent margin pressure and weak buyer trends could make the current premium unsustainable unless management’s strategic pivots deliver visible operational gains soon.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Etsy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something others might have missed? Take just a few minutes to share your take and craft your own narrative. Do it your way.

A great starting point for your Etsy research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

See What Else Is Out There

Persistently declining buyer engagement, compressed profit margins, and pressure to justify a growth premium mean Etsy’s path forward is uncertain.

If stable earnings and steady expansion are your priority, make your search easier by focusing on stable growth stocks screener (2108 results), which highlights companies delivering reliable revenue and profit growth through changing cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal