Rogers (ROG): Projected 161% Annual Earnings Growth Sets Focus on Profit Outlook

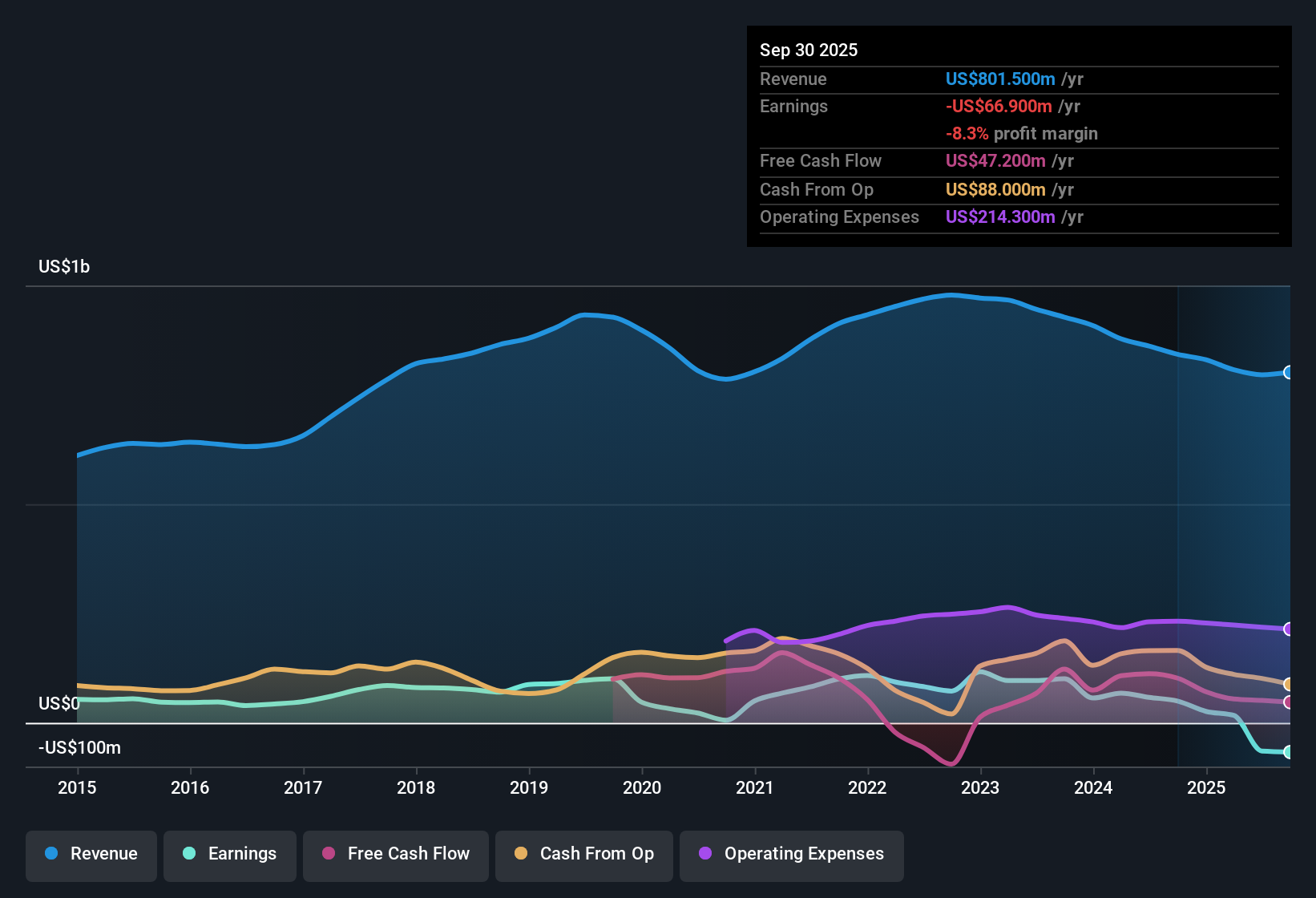

Rogers (ROG) remains unprofitable, with losses deepening at a rate of 24% per year over the past five years. Revenue is forecast to grow by 6.4% annually, which is slower than the US market’s projected 10.3% pace. However, the standout is a forecasted 161.37% annual jump in earnings, which could put the company on a path to profitability within three years. With shares trading at $88.27, investors are focused on the potential for above-average profit growth in the near future, even as the company's valuation sits well above fair value estimates based on discounted cash flow.

See our full analysis for Rogers.Next, we’ll see how these headline numbers stack up against the most followed narratives, highlighting where the latest results reinforce or challenge market expectations.

See what the community is saying about Rogers

Cost Savings Drive Margin Expansion Outlook

- Ongoing cost containment actions are expected to generate at least $13 million in extra annual savings, directly supporting margin improvements for Rogers as early as 2026.

- Analysts' consensus view highlights how shifting manufacturing to lower-cost Asian regions and focusing on organic growth are set to enhance Rogers' financial flexibility, with

- structural margin gains anticipated from geographic manufacturing rebalancing and portfolio optimization,

- expansion in high-value advanced materials expected to offset margin risks from restructuring and competitive pressure.

- Curious how numbers become stories that shape markets? Explore Community Narratives Curious how numbers become stories that shape markets? Explore Community Narratives

Asian Competition Threatens Revenue Stability

- Rogers faces significant competitive headwinds in the electric vehicle power substrate market, particularly from aggressive Asian and Chinese manufacturers, increasing volatility in its core revenue streams.

- Consensus narrative notes that

- customer concentration risk has increased as large Asian power module makers have captured significant market share from Rogers’ traditional client base,

- restructuring actions and recent underutilization of facilities, including curamik Germany, have resulted in net losses and impairment charges in key business segments.

Valuation Sits Far Above DCF Fair Value

- Shares trade at $88.27, placing the stock at a steep premium to its DCF fair value of $15.11. The analyst price target is $92.33, which is only a fractional 0.8% above the market price.

- According to the consensus narrative,

- the company’s price-to-sales multiple (2x) is modest compared to the industry average (2.8x) and peers (2.2x). However, the wide gap to intrinsic value and the limited upside versus the analyst target raise questions about how much optimism is reflected in the price,

- meaningful earnings growth expectations will need to be realized for current valuations to persist, given the thin discount to consensus targets and aggressive price versus fair value metrics.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Rogers on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have an alternative view on the figures? Share your perspective and build your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Rogers.

See What Else Is Out There

Despite optimism about future profitability, Rogers faces ongoing competitive pressure, thin margins, high valuation risk, and recent restructuring losses that are impacting financial stability.

If you’re looking for better value and lower valuation risk, check out these 831 undervalued stocks based on cash flows to discover companies trading well below intrinsic value and consensus targets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal