Why Beneficient (BENF) Shares Soared More Than 46% Overnight?

Beneficient (NASDAQ:BENF) shares jumped 46.54% in after-hours trading on Thursday to $0.82 after the Nasdaq Hearings Panel notified the company that it had regained compliance with two listing requirements, according to a Form 8-K filing.

Check out the current price of BENF stock here.

Compliance Regained On Two Requirements

The Texas-based company received notice on Wednesday that it complied with Nasdaq Listing Rules 5250(c)(1), which requires periodic filings, and Rule 5550(b), which requires listed securities to have a minimum market value of $35 million.

Bid Price Requirement Remains Unmet

Beneficient remains noncompliant with Nasdaq Listing Rule 5550(a)(2), requiring a minimum $1.00 bid price per share.

See Also: Intensity Therapeutics Stock Cools After-Hours Following 395% Surge: What You Should Know

The notice advised that the company must regain compliance within the extension period granted by the Panel.

Reverse Stock Split Under Consideration

Beneficient stated it intends to ask shareholders for approval to split Class A and Class B common stock in reverse.

The fintech believes that the reverse stock split will enable them to meet the bid price requirement during the extension period.

Stock Performance

Beneficient's 52-week trading range is $0.22 to $2.36, with a market capitalization of $62.23 million.

The stock is down 22.44% year to date but has gained 99.43% over the past six months.

Price Action: According to Benzinga Pro data, Beneficient shares fell 10.3% to $0.56.

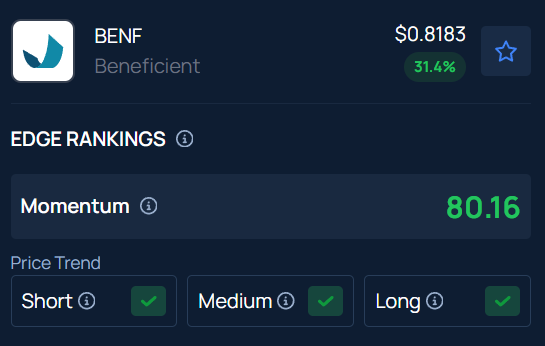

With a strong Momentum in the 80th percentile, Benzinga’s Edge Stock Rankings indicate that BENF has a positive price trend across all time frames. Know how its momentum lines up with other well-known names.

Read Next:

Photo Courtesy: Jose Mario Bertero on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal