Does Jerry Jones’s Backed Gas Discovery Transform the Bull Case for Comstock Resources (CRK)?

- Earlier this week, Comstock Resources was in the spotlight following media coverage of earnings predictions and a reported US$100 billion natural gas resource discovery backed by Dallas Cowboys owner Jerry Jones.

- This highlights not only anticipation around the company’s earnings report but also renewed optimism for its prospects in the natural gas sector due to significant reserve potential.

- With Jerry Jones’s backing and a major natural gas discovery featured in recent headlines, we’ll consider how this could influence Comstock’s investment outlook.

We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Comstock Resources Investment Narrative Recap

For investors to back Comstock Resources, there needs to be confidence in the ongoing value of the Haynesville shale and the company’s ability to unlock new natural gas reserves at scale. The latest news of a US$100 billion natural gas discovery, with high-profile backing from Jerry Jones, may bolster optimism, yet the short-term catalyst remains the company’s upcoming earnings report, while continued production slowdowns and regional market risks remain the biggest threats to stability, these are not materially changed by the new discovery until actual development ramps up.

Among recent announcements, Comstock’s Q2 2025 earnings were notable for a return to profitability, with revenue rising to US$470.26 million and net income at US$124.84 million. The promise of larger reserves could only translate into a stronger business catalyst if sustained production growth follows, especially since the company’s earnings have swung notably in recent quarters, with output from the Haynesville region slightly declining year over year.

However, investors should also be mindful that, in contrast to the excitement around new resource potential, Comstock’s concentrated exposure to Haynesville shale leaves it highly susceptible to fluctuations in regional natural gas prices...

Read the full narrative on Comstock Resources (it's free!)

Comstock Resources' outlook anticipates $2.5 billion in revenue and $733.2 million in earnings by 2028. This is based on projected annual revenue growth of 14.6% and a substantial earnings increase of $805.8 million from current earnings of -$72.6 million.

Uncover how Comstock Resources' forecasts yield a $18.46 fair value, in line with its current price.

Exploring Other Perspectives

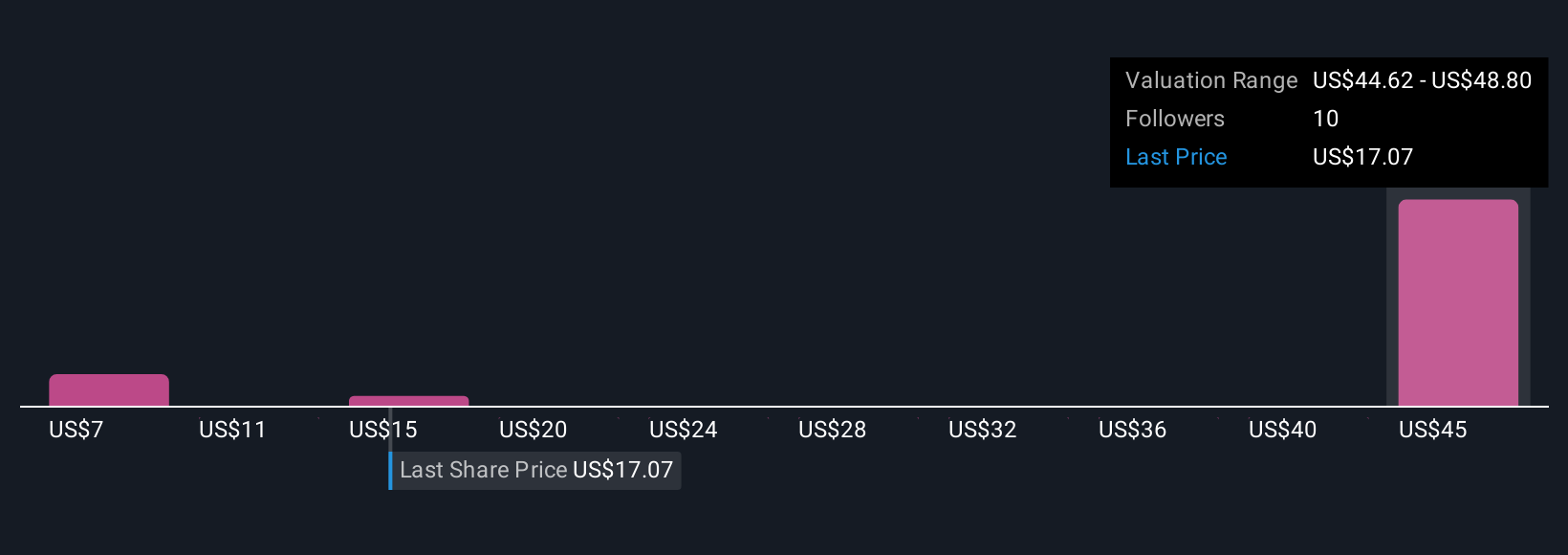

Simply Wall St Community members estimate Comstock Resources' fair value between US$6.97 and US$18.46, reflecting five unique viewpoints. This wide range stands alongside ongoing concerns about the company’s heavy reliance on Haynesville production, which could affect future earnings if market conditions shift; consider how differing assumptions might impact your own analysis.

Explore 5 other fair value estimates on Comstock Resources - why the stock might be worth less than half the current price!

Build Your Own Comstock Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Comstock Resources research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Comstock Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Comstock Resources' overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal