Bandwidth (BAND): Revenue Growth Forecasts and Deep Discount Set Up Q2 Earnings Season

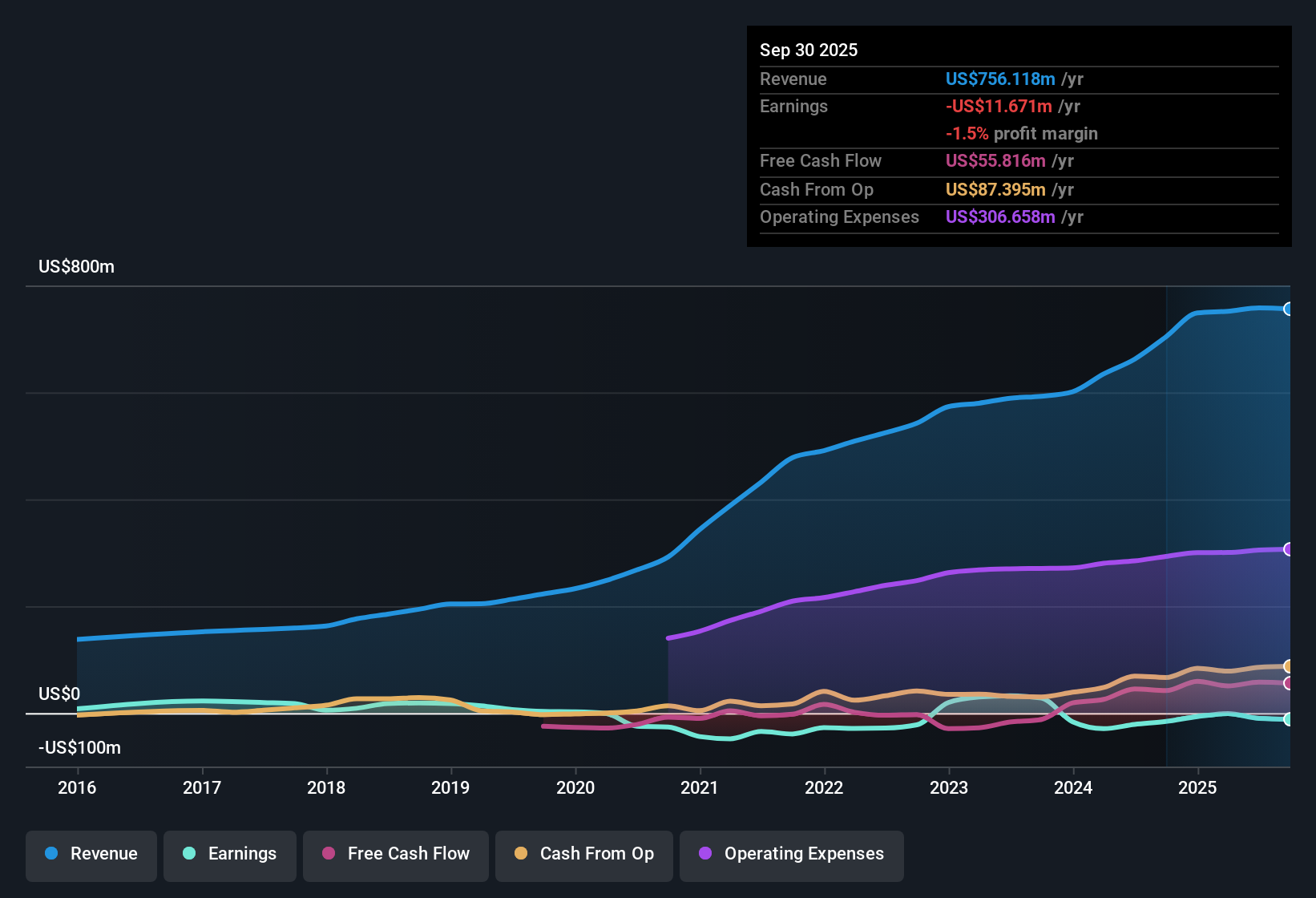

Bandwidth (BAND) remains unprofitable but has managed to narrow its losses by an impressive 31.1% each year over the past five years. With earnings forecast to climb 127.35% per year and the company expected to reach profitability within three years, the outlook is turning notably more optimistic. Revenue is projected to rise 11.7% annually, outpacing the US market average of 10.3%. Investors are paying just 0.6 times sales, a steep discount to peers and the US Telecom industry. The current share price of $16.11 trades well below its $80.11 discounted cash flow fair value. With no major risks in sight and clear reasons for confidence, positive sentiment is likely to build if growth targets are delivered.

See our full analysis for Bandwidth.The next section puts these headline results in the context of the most widely held market narratives for Bandwidth, digging into where the numbers support sentiment and where they might raise questions.

See what the community is saying about Bandwidth

Margin Expansion Drives Profit Outlook

- Analysts expect profit margins to rise from -1.3% today to 1.8% within three years, marking a rare swing into positive territory for a company that has narrowed its annual losses by 31.1% over the past five years.

- Consensus narrative underscores that the shift to positive margins is linked to enterprise customers moving to Bandwidth's Maestro platform and cloud-based solutions.

- Expanded cloud adoption is credited with increasing revenue per call by 3x to 4x in AI-enabled use cases.

- These improvements support analyst beliefs that Bandwidth can secure more long-term, higher-margin contracts as digital transformation accelerates.

Concentrated Customer Base Heightens Forecast Risk

- Bandwidth’s focus on large enterprise clients in regulated sectors means a limited customer base, amplifying the risk that major account churn or contract changes could impact revenue stability and long-term top-line growth.

- Consensus narrative cautions that this dependency could lead to revenue volatility if enterprise adoption of AI solutions slows or major customers renegotiate contracts.

- Analysts note that reliance on Maestro and high-value enterprise clients could leave Bandwidth exposed if market or regulatory shifts occur.

- Continuous investment in R&D and regulatory compliance is necessary to avoid stagnation, but rising costs could tighten free cash flow.

DCF Fair Value and Analyst Targets Signal Discount

- At $16.11, shares trade far below both the DCF fair value estimate of $80.11 and the analyst consensus price target of $21.50, which reinforces the appeal of Bandwidth’s 0.6x price-to-sales ratio compared to the US Telecom industry average of 1.2x and peers at 17x.

- The analysts' consensus view maintains that price appreciation depends on Bandwidth hitting aggressive revenue and earnings milestones, including growing revenues to $987.7 million and delivering $17.8 million in earnings by 2028.

- However, realizing the $21.50 price target would require a future PE of 53.2x, well above the industry average of 15.4x. This may make some investors cautious.

- Bulls see the deep discount as a rare entry point if Bandwidth can deliver on execution, while bears point to execution risk and a high implied earnings multiple.

- For a full picture of where market consensus stands and how sentiment reflects these numbers, get the story in depth with the official narrative. 📊 Read the full Bandwidth Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bandwidth on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you have an alternative take on the figures? Make your viewpoint count and craft a fresh narrative in under three minutes with Do it your way.

A great starting point for your Bandwidth research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Bandwidth’s reliance on a limited number of large enterprise clients brings exposure to customer concentration risk and potential revenue volatility if contract changes occur.

If you want to focus on steadier prospects, turn to stable growth stocks screener (2112 results) and find companies that consistently deliver reliable growth and minimize sudden earnings swings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal