ServiceNow (NOW): Margin Expansion Reinforces Bullish Growth Narrative Despite Premium Valuation

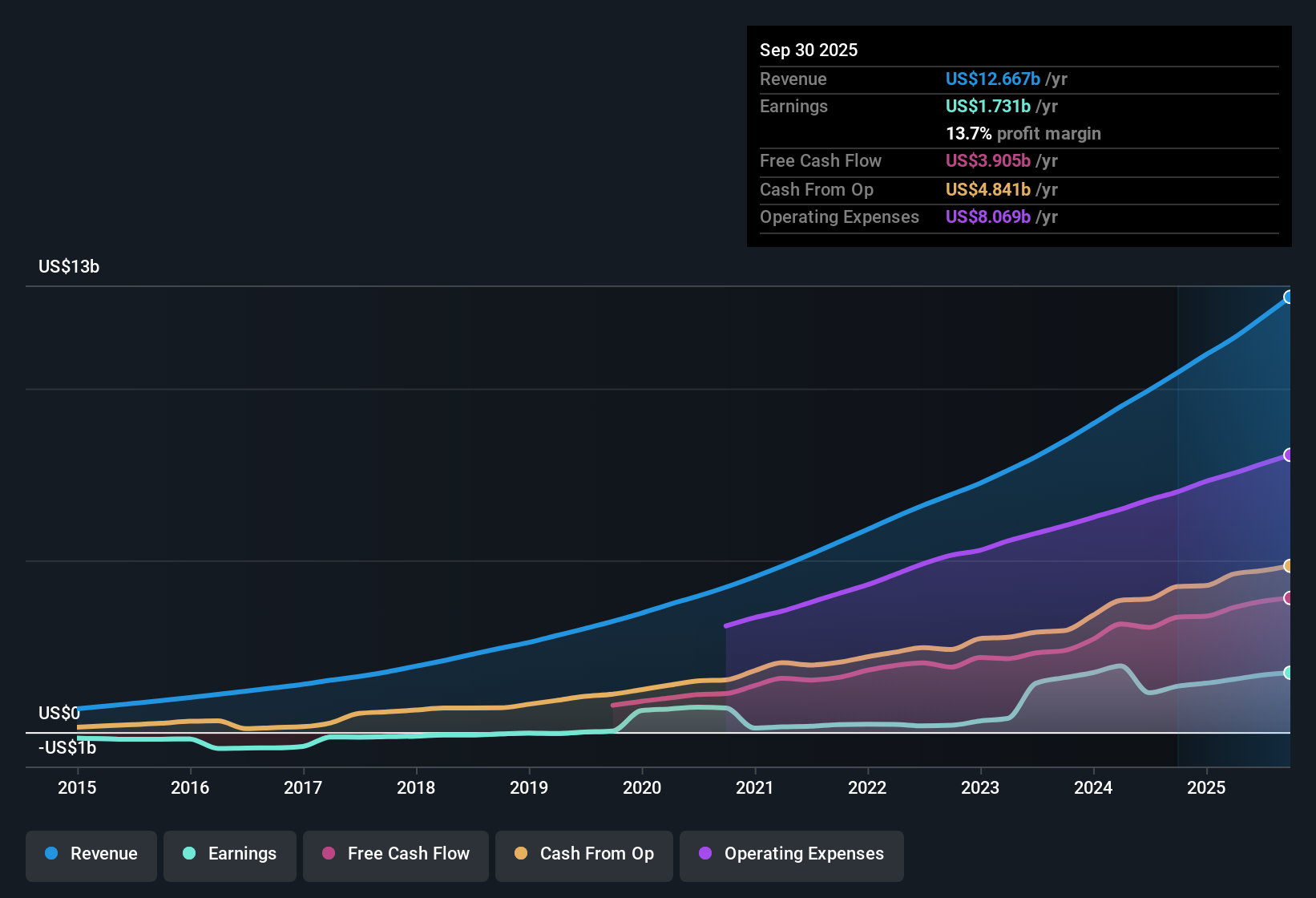

ServiceNow (NOW) reported earnings growth of 41.8% per year over the past five years. Revenue is projected to climb at 15.4% annually, which is notably ahead of the broader US market's 10.3% growth rate. Profitability is also expected to accelerate at 22.1% per year. Recent net profit margins are 13.7%, compared to 12.8% a year ago, signaling improved operational efficiency. Investors are weighing strong earnings and revenue momentum against the company’s premium price-to-earnings ratio of 112.1x, which is well above both industry and peer averages.

See our full analysis for ServiceNow.Next, we will see how these headline numbers stack up against the most widely followed narratives about ServiceNow, highlighting where the data reinforces or contradicts prevailing market expectations.

See what the community is saying about ServiceNow

Free Cash Flow Margin Hits 31.5%

- ServiceNow reported a free cash flow margin of 31.5% in 2024, outpacing typical levels for the broader US software sector and illustrating discipline in converting revenue into cash generation.

- Heavily supporting the bullish narrative, this cash flow strength gives credibility to claims that strategic investments in AI and operational efficiency are yielding tangible financial benefits.

- Bulls point to this margin jump as evidence that heavy investment in AI is not dragging down profitability, despite concerns about rising operating costs.

- The current 13.7% net profit margin, up from 12.8% last year, reinforces the idea that management is not trading away margin for topline growth. This aligns with the bullish view that both profitability and growth can move together in the coming years.

Bulls highlight ServiceNow’s margin expansion as proof its AI-led growth strategy is starting to deliver meaningful operating leverage. 🐂 ServiceNow Bull Case

Hybrid Pricing May Delay Revenue Ramp

- The shift to a hybrid model, blending subscriptions with consumption-based pricing for AI services, introduces risk of delayed revenue recognition and less predictable near-term growth.

- Critics highlight, in line with the bearish narrative, that while long-term opportunity exists, near-term growth visibility can suffer as customers adapt to new pricing structures.

- Bears argue that this transition could impact short-term revenue and earnings, especially if customers are slow to embrace consumption-based models.

- Operating margin pressure could also arise from increased AI investment and ongoing data center spending. This may not immediately translate into higher profits, reinforcing the narrative’s call for caution around margin durability.

Bears say if AI adoption is slower than forecast or margins are squeezed, the market’s premium expectations could be at risk. 🐻 ServiceNow Bear Case

Valuation Remains Well Above Fair Value

- With the stock trading at $934.68 and a price-to-earnings ratio of 112.1x, far above the industry average of 34.8x, ServiceNow’s valuation sits well above both its sector and DCF fair value of $903.71.

- Analysts' consensus view notes that while ServiceNow’s robust growth and margin expansion make a quality case for the premium, the valuation gap highlights tension with more moderate long-term expectations.

- Despite sector-beating profitability, investors are paying a steep multiple for leadership in AI, making continued flawless execution crucial to justify the premium over both peers and its DCF fair value.

- The consensus analyst price target of $1,156.59 suggests upside potential, but that view depends on ServiceNow maintaining both growth and margin improvement trends in an increasingly competitive environment.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for ServiceNow on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the figures? Express your insight and shape your outlook in just a few minutes: Do it your way.

A great starting point for your ServiceNow research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

ServiceNow’s standout growth and margins come with the risk of overvaluation, which makes future returns highly dependent on sustaining exceptional performance at a premium price.

If you’re seeking firms with attractive valuations and upside potential instead, check out these 850 undervalued stocks based on cash flows as a smarter way to uncover strong investment opportunities right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal