Dana (DAN) Turns Profitable, Earnings Growth Outlook Challenges Caution on One-Off Loss

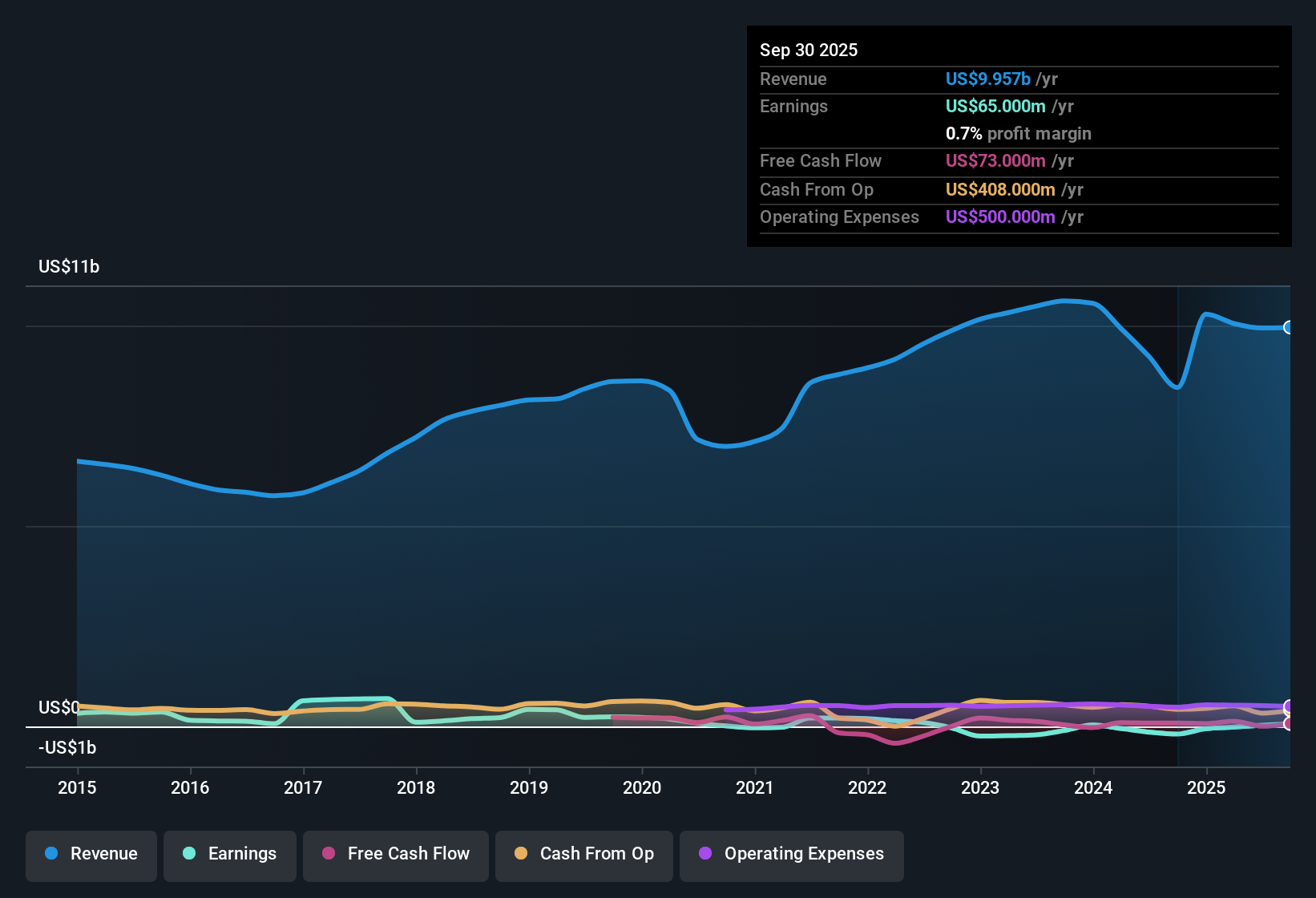

Dana (DAN) has just turned profitable after several years of losses, though a one-off $72 million loss in the latest twelve months clouds the comparison to its five-year average. Over the past five years, the company’s earnings have declined by 27.4% per year. Looking ahead, analysts expect earnings to surge at a robust 44.4% annually even as revenue is projected to fall by 5.8% per year for the next three years. The stock is trading at a price-to-earnings ratio of 39.2x, which is well above industry averages. Despite this valuation, the stock remains below average analyst price targets, reflecting optimism about future profitability but also highlighting caution around earnings quality and revenue trajectory.

See our full analysis for Dana.With the headline numbers out, the next section pits Dana’s latest performance against the most widely accepted investor narratives to see which stories stack up and what might be changing.

See what the community is saying about Dana

Margin Expansion Target: 0.3% to 3.1% in Three Years

- Profit margins are expected to increase from just 0.3% today to 3.1% by 2026, according to analyst projections.

- The analysts' consensus narrative highlights that Dana is pushing for significant margin growth through operational efficiency programs and a $310 million cost savings target. However, substantial margin gains depend on successful execution.

- Consensus narrative notes that much of the "easy" cost cutting has already been realized. Future progress will require deeper operational changes and automation, which comes with added risk and complexity.

- What is surprising is that even with a pessimistic top-line forecast (revenue declining by 5.8% per year), the improved margin goal could still enable robust profit growth if the company delivers on its efficiency agenda.

- Despite ambitious cost targets and an improving margin outlook, increased operational complexity and execution risk may slow desired profitability gains, keeping this long-term target under close investor watch. 📊 Read the full Dana Consensus Narrative.

Revenue Projected to Fall 5.8% Annually

- Analysts are forecasting Dana’s revenue to shrink by 5.8% per year over the next three years, even as earnings are expected to rise.

- The consensus narrative points to Dana’s high dependence on a few key markets and customers, especially in North America, as a structural risk. The narrative warns that revenue and margins remain vulnerable to weaker demand or manufacturing delays among top OEMs.

- Critics highlight the risk that recent sales of the Off-Highway business increase Dana’s exposure to economic swings in core light vehicle and heavy truck markets. This may make revenue more sensitive to cyclical downturns.

- Consensus view also notes that while strategic wins with new electrified vehicle programs may help offset some losses, ongoing supply chain frictions and mixed market recovery could limit top-line stability for several years.

Valuation: Price-to-Earnings 39.2x vs. DCF Fair Value $15.85

- Dana currently trades at a price-to-earnings ratio of 39.2x, which sits well above industry average levels (18.9x) as well as its DCF fair value estimate of $15.85.

- The analysts' consensus narrative suggests that while a premium is being placed on future earnings acceleration and Dana trades below average analyst price targets (current price $20.90, target $25.86), the premium P/E multiple and fair value disconnect reflect ongoing caution about earnings quality and execution on margin growth.

- Consensus narrative underlines that unless Dana reaches the projected $249.2 million in earnings and 3.1% margins by 2028, its current valuation may be difficult to justify compared to both peers and long-term fair value.

- This tension gives investors an incentive to monitor both top-line performance and margin progress closely as 2024 unfolds.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Dana on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these results? It only takes a few minutes to craft your personal view and see how your story compares. Do it your way

A great starting point for your Dana research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Dana’s premium valuation, exposure to shrinking revenue, and reliance on margin recovery draw attention to ongoing uncertainty and execution risk when compared to more stable peers.

If you want more confidence in resilient results, use stable growth stocks screener (2115 results) to uncover companies that consistently deliver reliable revenue and earnings growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal